Thursday, August 3rd, is undoubtedly one of the most important sessions this week – all thanks to Super Thursday, served by Bank of England (BoE) publishing decision on interest rates at 13:00, inflation report, meeting minutes and Q&A session with journalists during the press conference. Nomura analysts have prepared a list of 20 reasons for BoE to hike rates during the next meeting.

5 main categories, 20 reasons for a rate hike

Nomura economists presented a list of twenty arguments grouped into five main categories, which should force the Bank of England to raise rates during the July meeting. This is particularly interesting as the broad consensus is to maintain the current level and no major changes in monetary policy.

Nomura divided her arguments in five groups :

- Economic reconstruction

- Labor market

- Inflation

- Monetary policy

- Problems of fiscal policy

Economic reconstruction

1. On global markets, we are seeing a gradual improvement

2. UK PMI and other indexes show strong fitness

3. Nomura revised up forecasts for business investments

4. The British economy has shown much greater resistance to Brexit than expected

5. Indicators of market gaps show positive values

Labor market

6. The unemployment rate has been at its lowest levels for more than 40 years

7. Other indicators examining the condition of the labor market suggest approaching full employment

8. Labor productivity metrics finally show signs of life

Inflation

9. The BoE maintains its inflation target over 2%

10. Generated national inflation is rising

11. Own central bank inflation forecasts suggest CPI increases

Monetary policy

12. A 25 basis point increase in interest rates is relatively a small move

13. An earlier increase may open the path to a calmer normalization in the future

14. It takes time for monetary policy to translate into a viable economy

15. If Bank of England decided on an August hike, no one can say that he has not warned of such a move lately.

16. Monetary policy conditions are too loose for the current macroeconomic situation

17. MPC has already suggested its proactivity

18. During the BoE meetings, where the inflation report is being published, bank officials show twice as likely to change monetary policy (in 33% of cases)

Problems of fiscal policy

19. Perfect time to grow for consumer loans

20. The MPC should raise rates to match the current market demand and the huge growth rate of credit growth among citizens.

Other large institutions do not agree with Nomura argumentation ?

Although Nomura uses a lot of interesting arguments by trying to make a point about the August rate hike, other big banks do not share this optimism. Consensus indicates that only two of the eight MPC members will vote for a raise and the rates will eventually remain unchanged.

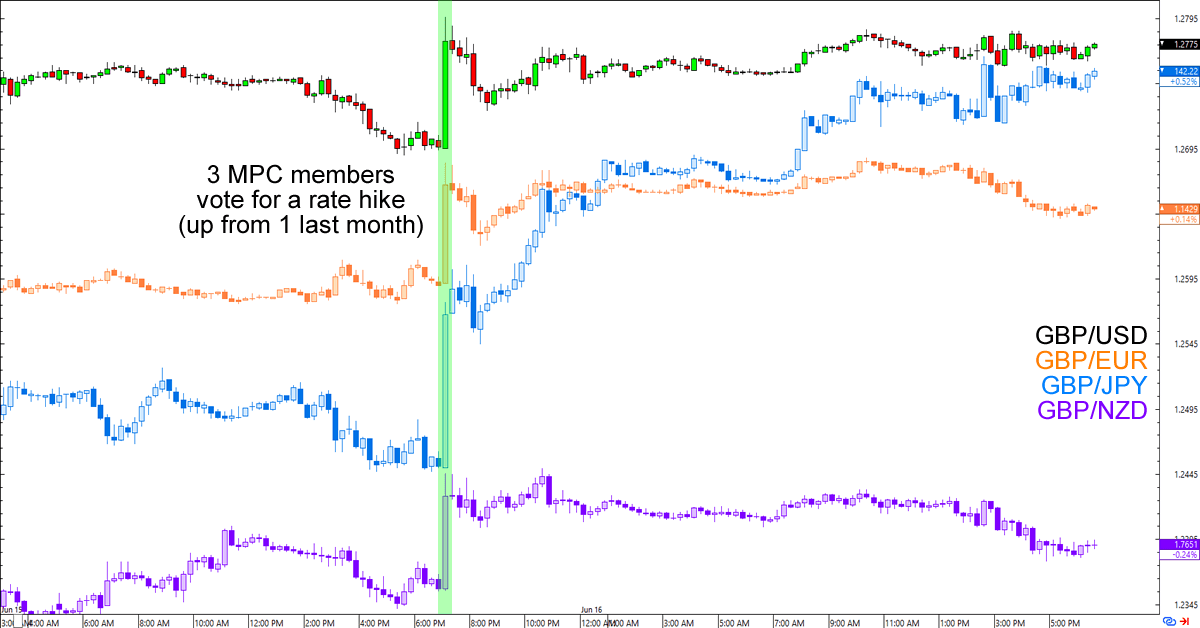

But if BoE were to announce a hike, it could trigger a massive volatility attack in pairs with the GBP . Just remember how the June hawkish change of rhetoric influenced GBP on popular pairs: