Traders are constantly on the lookout for new, improved methods to predict market movements. Most often they are looking to use modern technology. However, one of the more tried and tested indicators, Moving Average still provides well defined information.

Traders are constantly on the lookout for new, improved methods to predict market movements. Most often they are looking to use modern technology. However, one of the more tried and tested indicators, Moving Average still provides well defined information.

Moving average

This is a popular indicator for technical analysis used by many investors.

Unlike candlestick patterns which might be interpreted differently by each trader/investor, or support/resistance levels and trend lines which are determined according to individual preferences, a moving average is characterized by objectivity and transparency of data interpretation. THe only variable is the period which the trader finds the most useful.

Using a simple formula, a moving average might present the current trend in the market and, if properly interpreted, show when the trend will most likely reverse.

Each type of moving average is obtained by calculating the average price from previous periods.

The term “moving” means that a fixed and unchangeable time period is taken into account while the oldest data is disregarded and replaced by the latest.

Example:

If you want to calculate a moving average of closing prices from 8 last days, you need to add closing prices from 8 last days and then, divide the sum by 8.

Similarly in order to calculate a moving average from last 21 hours, you need to add closing prices from last 21 hours and then, divide the sum by 21.

4 8 6 7 9 11 10 15 12 13

(6 + 7 + 9 + 11 + 10 + 15 + 12 + 13) / 8 = 83 / 8 = 10,375

As time moves and a new candle is created, the oldest price (6) is deleted from calculations and the latest one (15) is taken into account:

4 8 6 7 9 11 10 15 12 13 15

(7 + 9 + 11 + 10 + 15 + 12 + 13 + 15) / 8 = 92 / 8 = 11,5

These examples present closing prices. This is the most commonly applied pricing to calculate a moving average. It is worth noting, however, that opening or high or low may also be used.

Using two or more types of averages (e.g. high and low price) simultaneously, we create a channel of averages in the graph which indicates an average range of price fluctuations.

Types of moving averages

Besides the format of price types used when calculating moving averages, we can use various styles of moving average the most common of which are:

- SMA – Simple Moving Average

- EMA – Exponential Moving Average

- SMMA – Smoothed Moving Average

- WMA – Weighted Moving Average

These rely on how the MA is calculated taking different influences into consideration.

The most frequently used averages are: simple moving average (SMA) and exponential moving average (EMA).

SMA – Simple Moving Average

This is the calculation used above where the average is simply calculated totalling the levels from the last X period and dividing by X.

EMA – Exponential Moving Average

An EMA takes note of price moves more quickly since it pays more attention to the most recent prices.

By doing this, it better represents the current condition of the market. It works by not discarding the oldest value but gradually reducing their importance as they get older until they become irrelevant.

In order to demonstrate the difference it is best to imagine the old proverb of the tortoise and the hare

Subscribe to Elliott Waves International to get report for 2017!

SMA is a slow moving average (Tortoise) – it reacts to changing prices more slowly and provides a balanced indicator. Thus, this indicator can prevent false price impressions.

The downside, however, is the fact that a slow indicator may delay your actions and you might miss price changes or notice them too late. A tortoise is slow, like the SMA, so it can skip entering the market at the beginning of a new trend. However, it protects the trader and a SMA will help you to avoid receiving false signals.

EMA is a quick moving average (Hare) – this moving average responds to price changes quickly. It helps to detect and identify the trend rapidly and, as a result, profits will often follow.

A hare is as quick as EMA, so it can help you to catch the beginning of the trend quickly, but it is prone to providing false signals as it does not stop to consider the consequences of every move.

Which is better? EMA or SMA

The question is, which average to choose and work with?

There is no clear answer. As usual it depends on your trading style. The ability to disseminate more signals and verify them using another indicator suggests using an EMA. Wishing to be more considered and using a moving average as confirmation leads the user to favour an SMA.

Application of moving averages

A moving average is an extremely useful tool for technical analysis. Apart from determining the current trend, it may indicate its strength, as well as provide support or resistance, and might signal time to buy or sell.

The first possible use is to insert a moving average in the graph. Its interpretation is very simple. If the graph is above the average and the average is directed upwards, then there is an upward trend, and similarly – if the graph is below the average and the average is directed downwards, then there is a downward trend.

This provides a valuable first attempt at technical analysis and is an easy introduction.

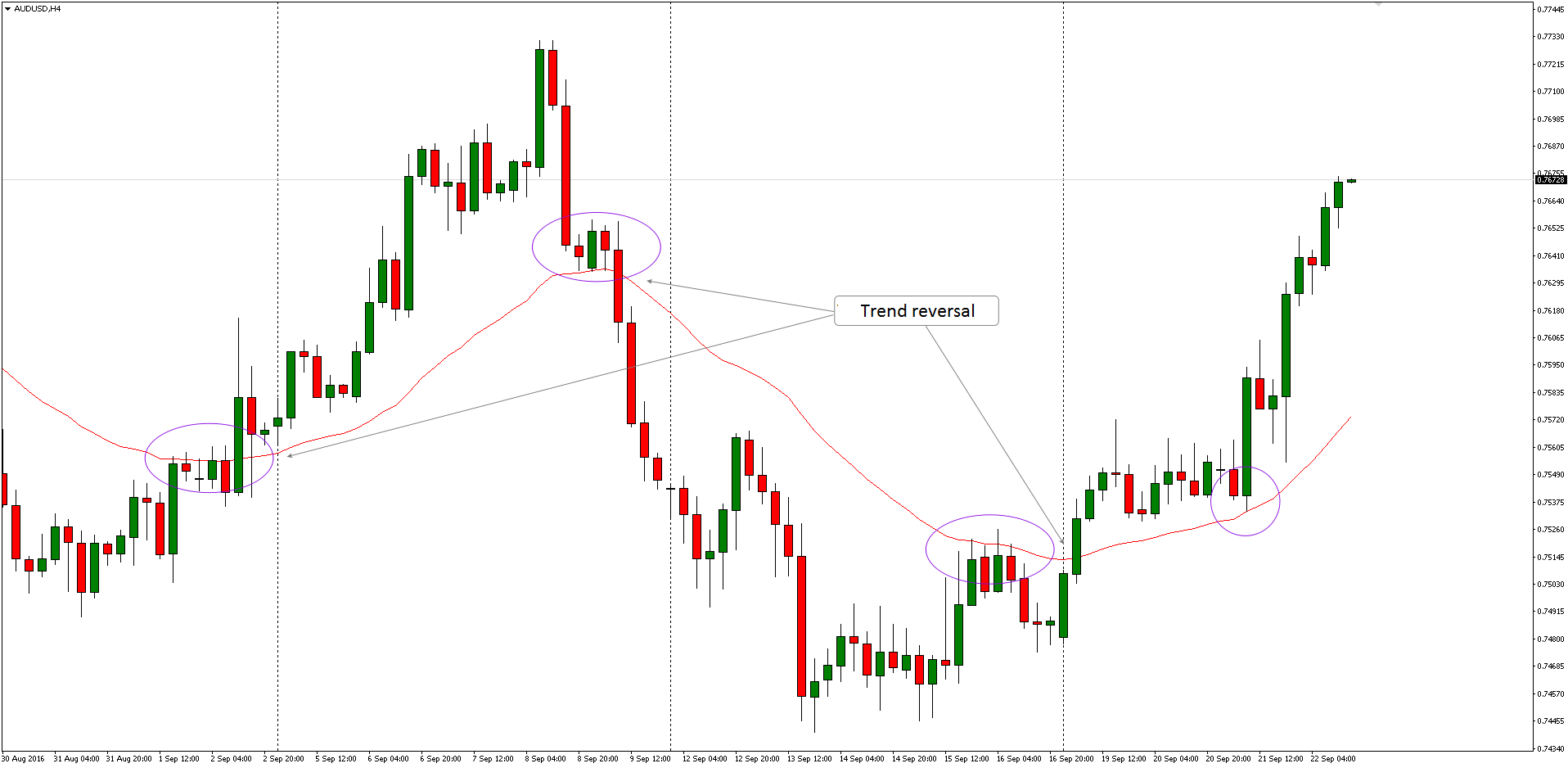

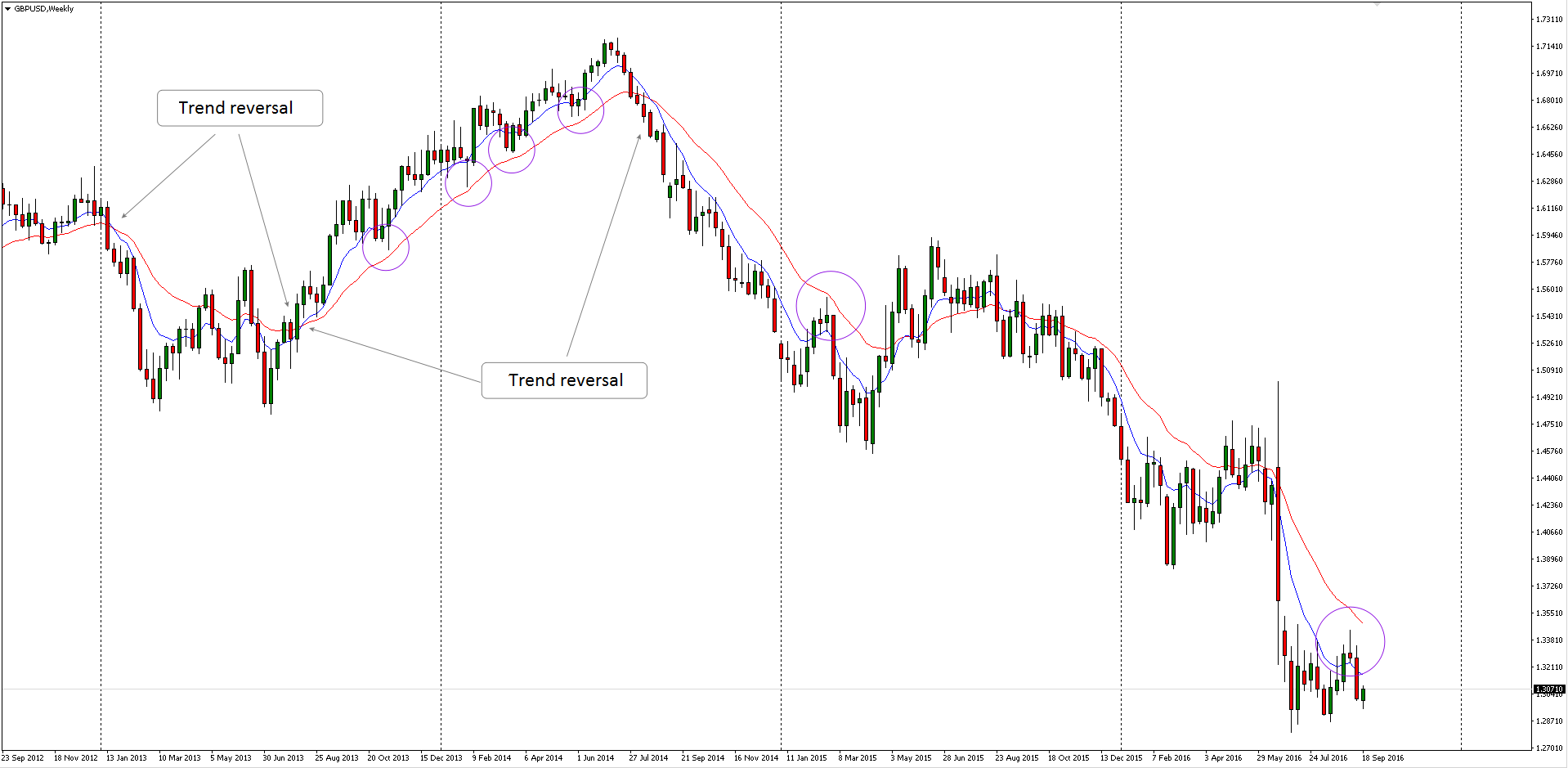

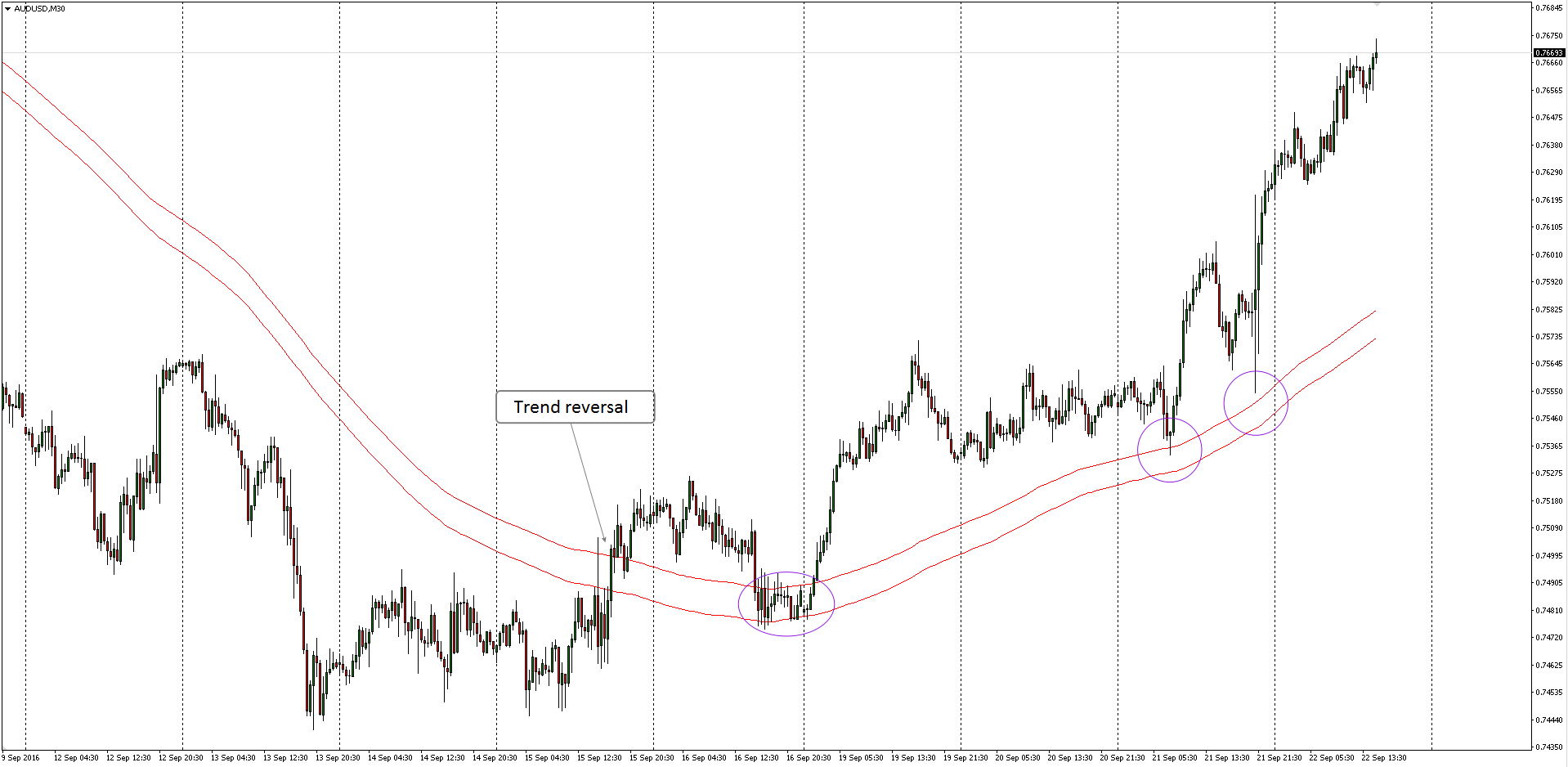

The second possible application is to use two different (one quicker and one slower) MA’s. If the quick average (blue) is above the slow average (red), then there is an upward trend. If the quick average (blue) is below the slow average (red), then there is a downward trend. When moving averages cross, a trend change is confirmed. Depending on what types of periodic averages are applied, potential signals might be more or less credible.

The third way of using moving averages is to create a channel. Interpretation thereof is similar as in the case of one average.

It should also be noted that not only the trend direction is determined by these averages, but also its strength. The averages act very frequently as horizontal support/resistance. The market respects them in the same way as the technical levels.

![How to install MetaTrader 4 / 5 on MacOS Catalina? Simple way. [VIDEO]](https://comparic.com/wp-content/uploads/2020/07/mt4-os-218x150.jpg)