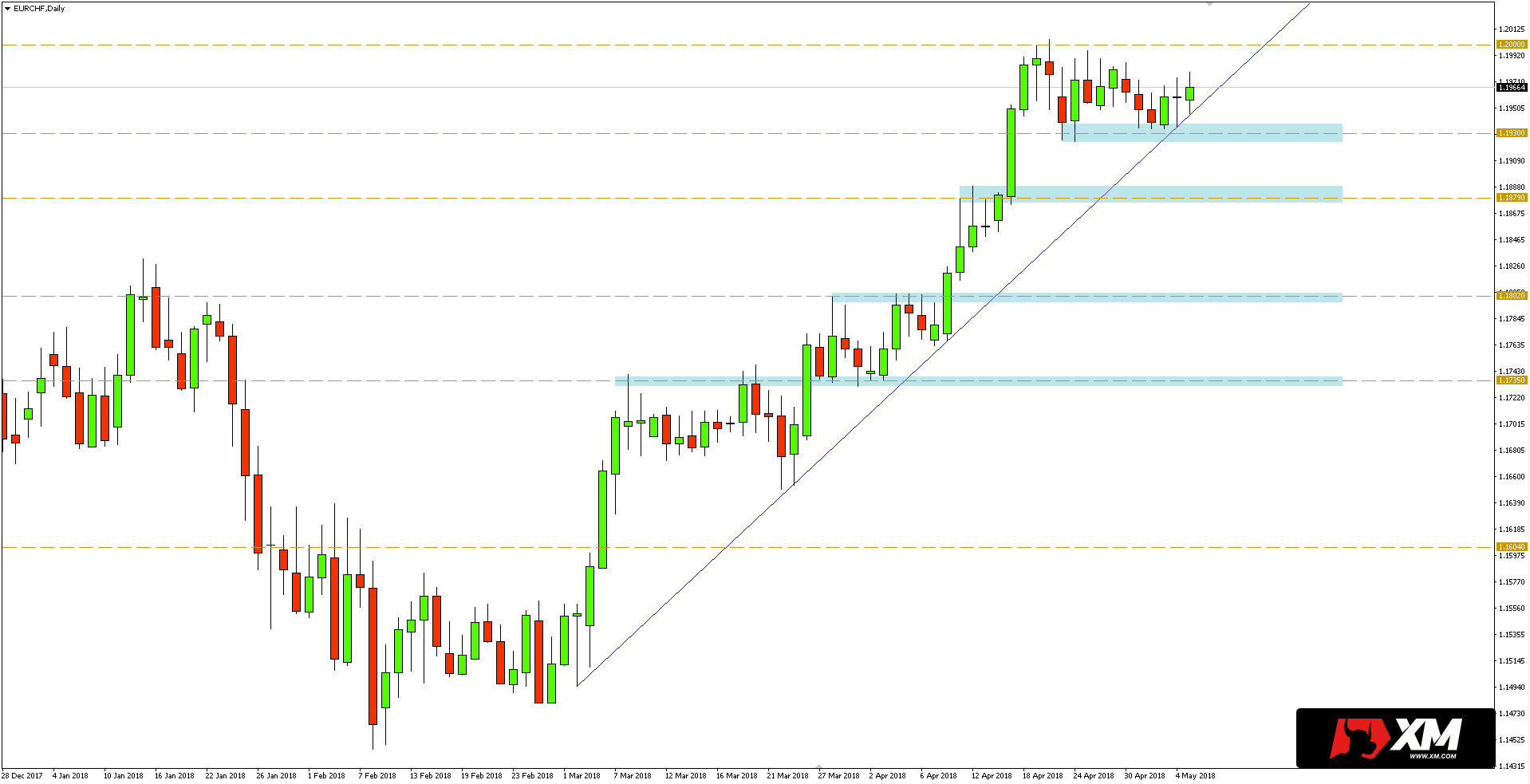

EURCHF in the second half of last month reached the round level of 1.20, which I mentioned in the analysis on 20th April. As can be seen on the daily chart below, from now on the pair remains in consolidation, and last week it reached the support provided by the upward trend line running from the minimum of March this year.

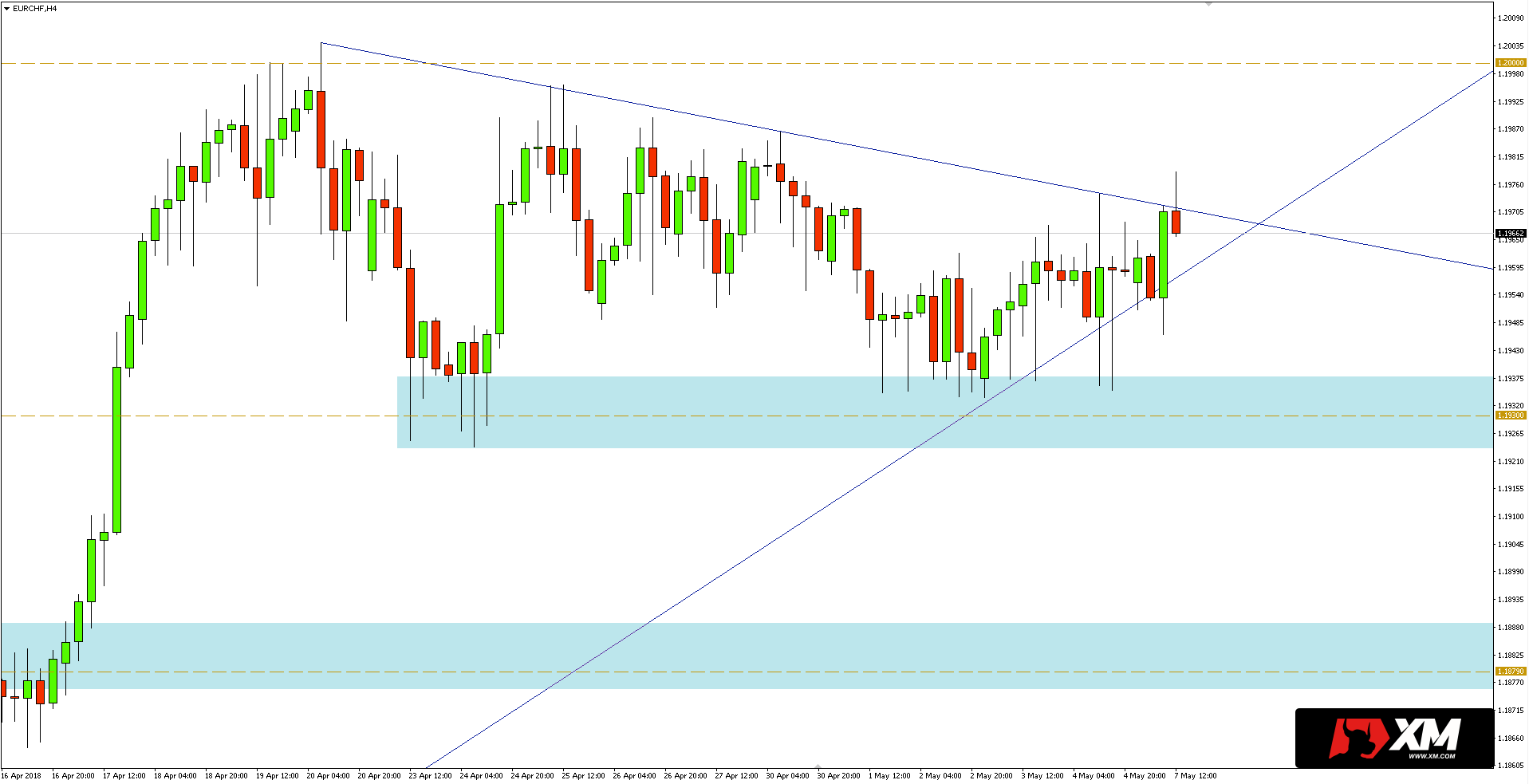

The 4-hour chart shows, in turn, how the price is grappling with short-term resistance in the form of a trend line running from this year’s 1,2004 high. What matters now is how the price action will look like.

The 4-hour chart shows, in turn, how the price is grappling with short-term resistance in the form of a trend line running from this year’s 1,2004 high. What matters now is how the price action will look like.

I trade on this instrument at broker XM, which has in its offer more than 300 other assets >>

The pair is currently dominated by bulls, so breaking the above-mentioned correction line would indicate the potential for its continuation. Then another attack on the round level of 1.20 would be expected.

Otherwise, sellers will have to face the uptrend line and horizontal support within 1.1930. Its breakthrough would open the way to another significant support around 1.1880.