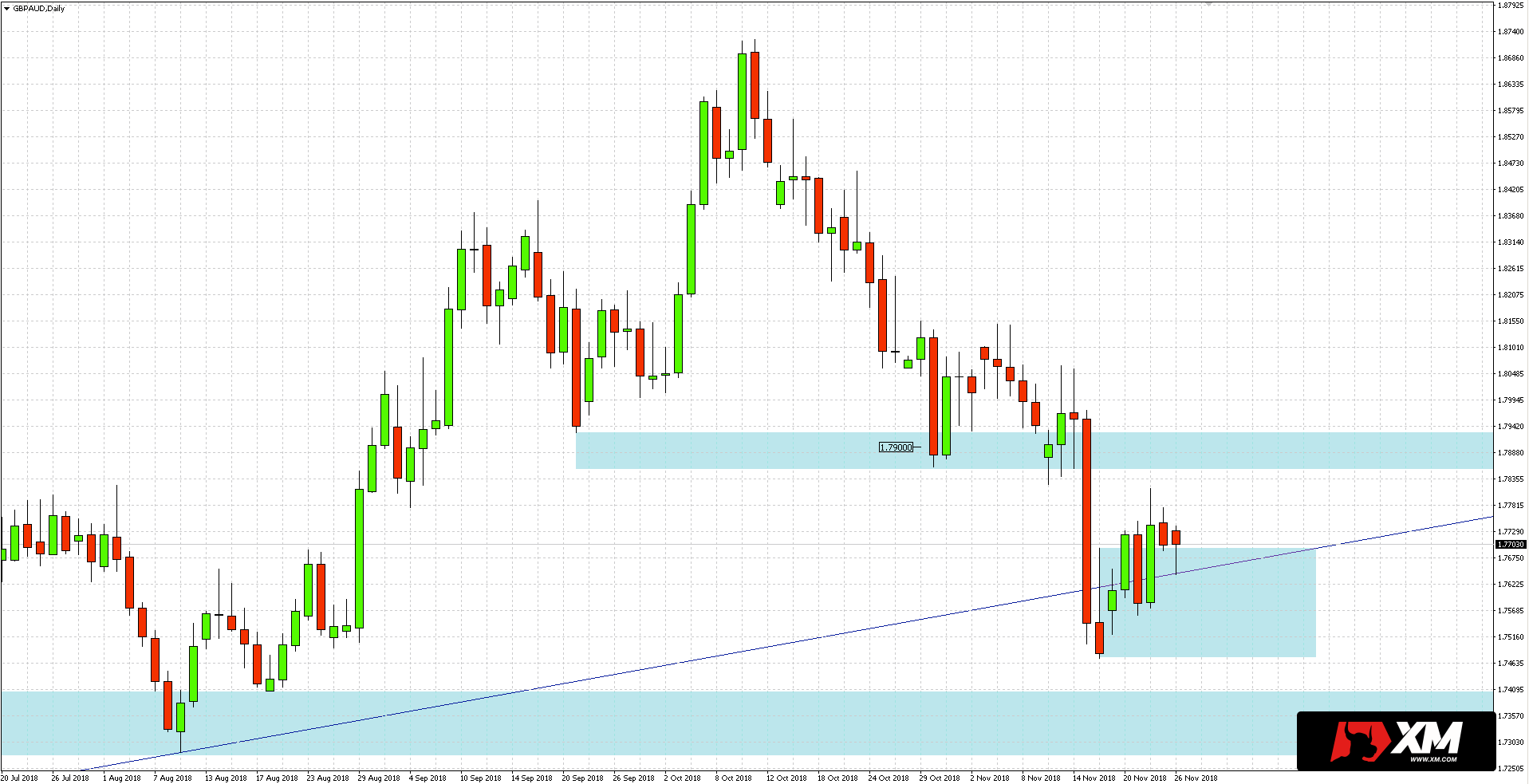

In the middle of the current month, the GBPAUD pair recorded a strong decline, which led to overcoming two significant levels. The first one is horizontal support within 1.7900. The second is the trend line running from the bottom of September 2017.

After breaking the above mentioned levels, the price slumped even slightly the next day. Then, however, the buyers appeared again, where the closing of the session from November 20 took place over the trend line and the maximum of the mother’s candle of Inside Bar formation.

Currently, the price is still above the trend line, and although the momentum is still on the side of the sellers, the GBPAUD pair has a chance for a deeper withdrawal. In this scenario, test of 1.7900 would be crucial, which can now act as a resistance.

Maintaining the resistance at 1.7900 is also a chance to continue the downward trend. As you can see in the daily chart below, the lows and the peak are arranged at lower and lower levels. However, it is worth bearing in mind further Brexit news that may cause volatility and distort technicals on this pair.