The situation on the markets due to quite unexpected Trumps victory is nervous and highly volatile. Therefore, let’s take a closer look at pairs not directly linked to the US dollar -crosses which may be more “technical” and behave more according to Price Action and Technical Analysis rules, and less to World of Politics .

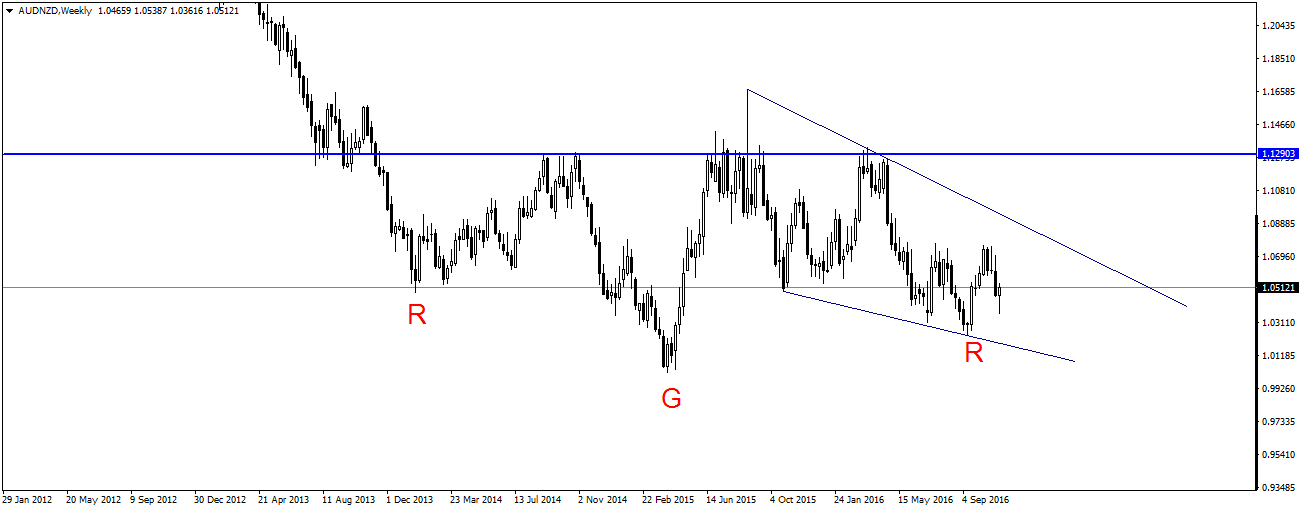

On the cross AUDNZD is drawn an interesting situation. On the Weekly chart we can see formation of inverted Head & Shoulders, additionally pair is moving in descending wedge patern.

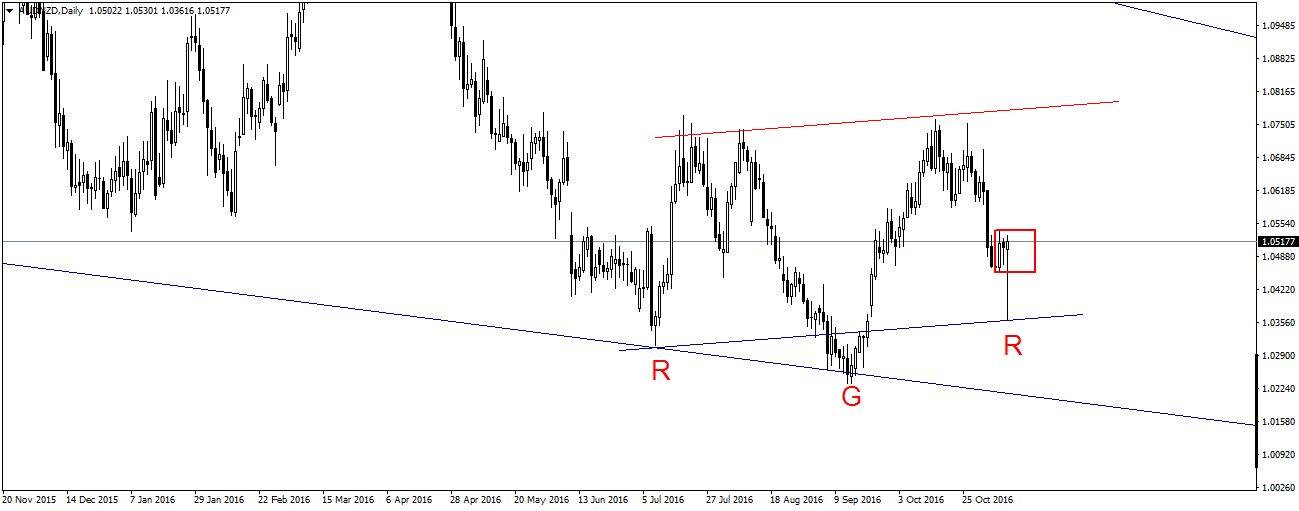

On the daily chart D1 AUDNZD also creates formation of inverted H&S where the line of the neck is marked with a red line. In addition, today’s daily candle struck (false breakout?) lower line of Inside Bar (the mother candle is marked with red rectangular) and then returned to the IB and actually moves to the upper limit of the IB.

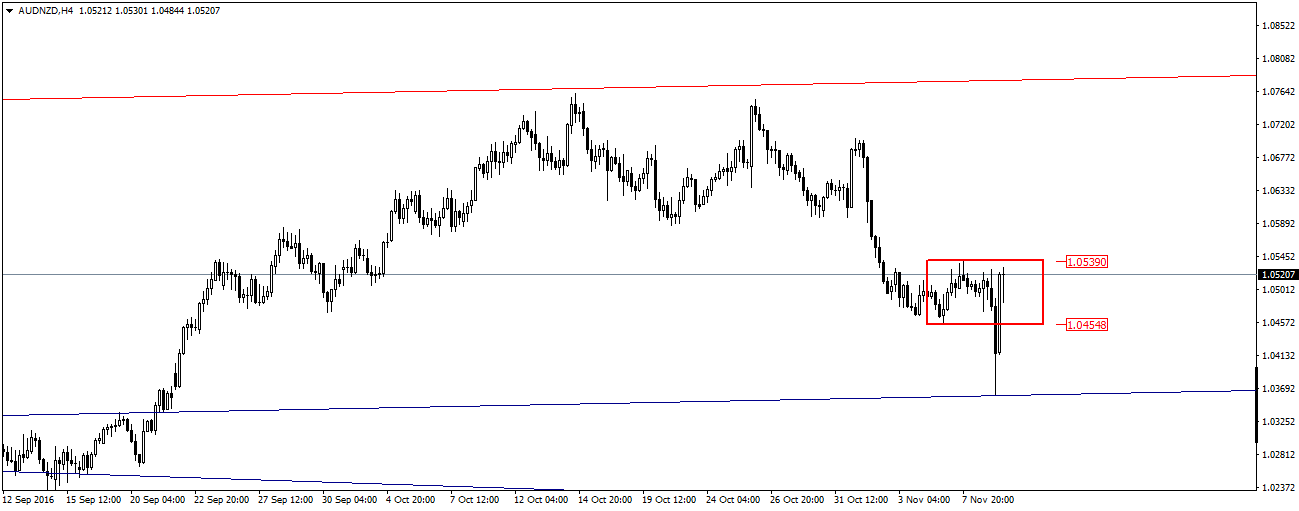

On the chart AUDNZD H4 we can look at the situation closely and if would happen that closing of the candle ending the day above the level of 1.0540, we can think about opening a BUY order with the first target around the neck line that is about. 1.0750-60, and in case of its breakthrough, even to the line of limiting top of the descending wedge in which moves for some time (drawn on the Weekly chart).

IMPORTANT!

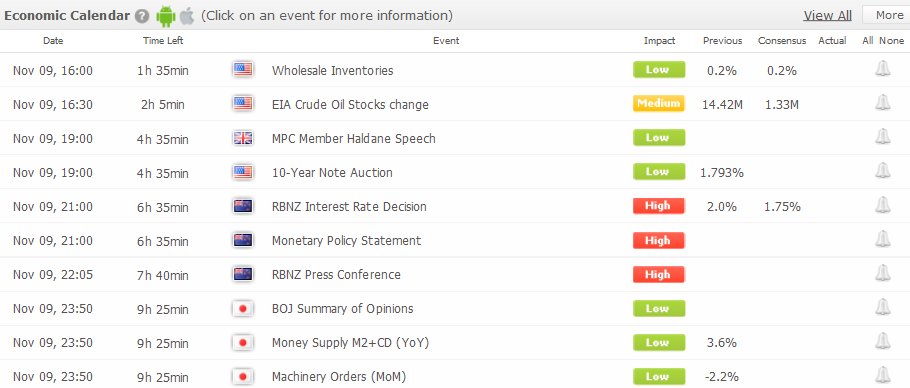

Today at 21:00 Reserve Bank of New Zealand sets interest rates. The event of great importance, therefore, before deciding to enter the market we should wait until we know the position of President of the Bank, especially because analysts predict a decrease of 0.25 p which may weaken the NZD and confirm our market analysis – and AUDNZD will begin to move north .