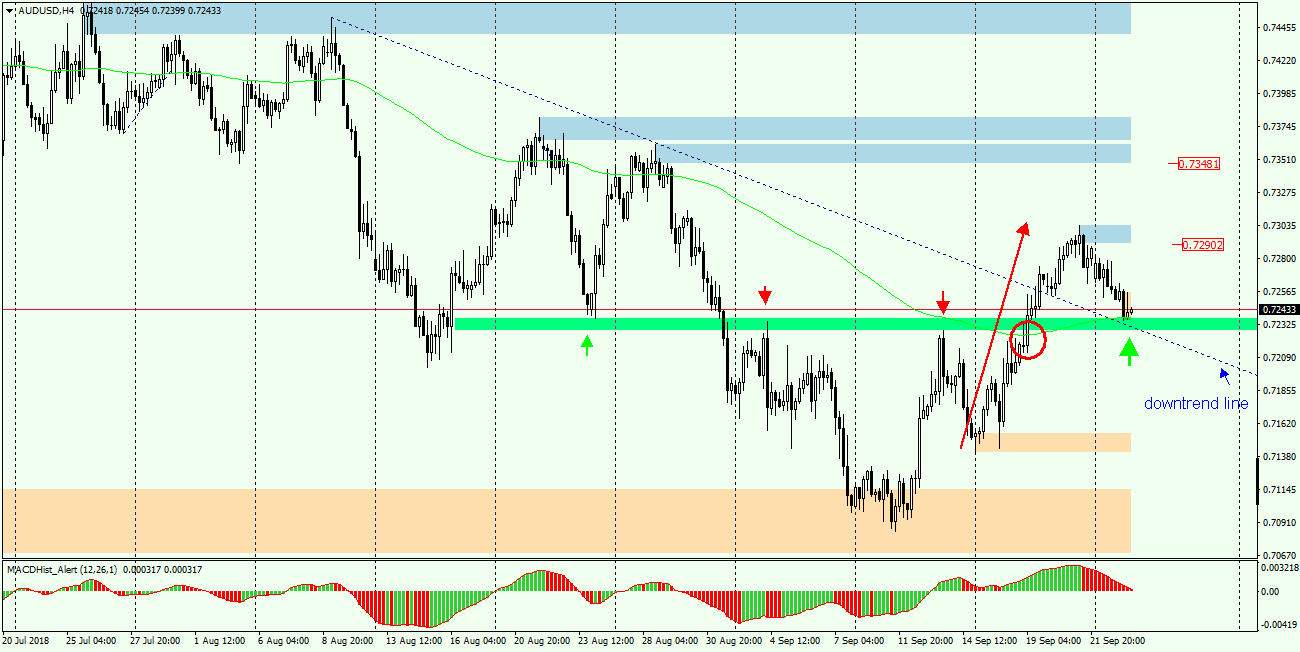

Yesterday I wrote about the confluence resulting from the use of 2 strategies to confirm a signal to open an order. Today’s analysis of the AUDUSD pair also is based on confluence, this time it concerns the levels of support and EMA144 strategy assumptions.

In the H4 graph, we have two supports – horizontal (green zone) resulting from August and September lows and highs and the diagonal line of the downtrend trend. In addition, the current situation on the chart fits very well with EMA144 strategy, where you can see a clear dynamic breakdown and return of the price to the average. So here we have the confluence resulting from the intersection of the two levels of support and the average EMA144. It is worth considering buy order with TP in the vicinity of the first resistance of 0.7290, and perhaps 0.7350 is achievable, but remember about the FED meeting on Wednesday and the expected US interest rate decision, which will certainly increase the dynamics of moves on pairs from USD.