The US Government failed to reach any sort of deal to approve a budget last Friday. If there’s no budget there’s no money to pay government employees or to keep things open. Welcome to Day 1 of the US Government Shutdown. Technically, the shutdown started on Friday night but short of a last minute arrangement, today will be the first day that it actually matters…

The US Government failed to reach any sort of deal to approve a budget last Friday. If there’s no budget there’s no money to pay government employees or to keep things open. Welcome to Day 1 of the US Government Shutdown. Technically, the shutdown started on Friday night but short of a last minute arrangement, today will be the first day that it actually matters…

Traditional Markets

Asian markets seem little affected by the government shutdown in the United States. I guess this isn’t much of a shock to most people. Even President Trump himself tweeted several times that this was a possibility that didn’t particularly concern him.

The biggest question is how long it will last. Shutdowns in previous Presidencies were mostly resolved quite quickly. However, with the Democratic leaders feeling like they’re “negotiating with jello” something tells me there’s a good chance this time might be different.

As I’m writing, we’re getting word that there will be a vote on the floor at 01:00 in Washington DC, but if that fails Trump’s trip to Davos may be in question. 🙁

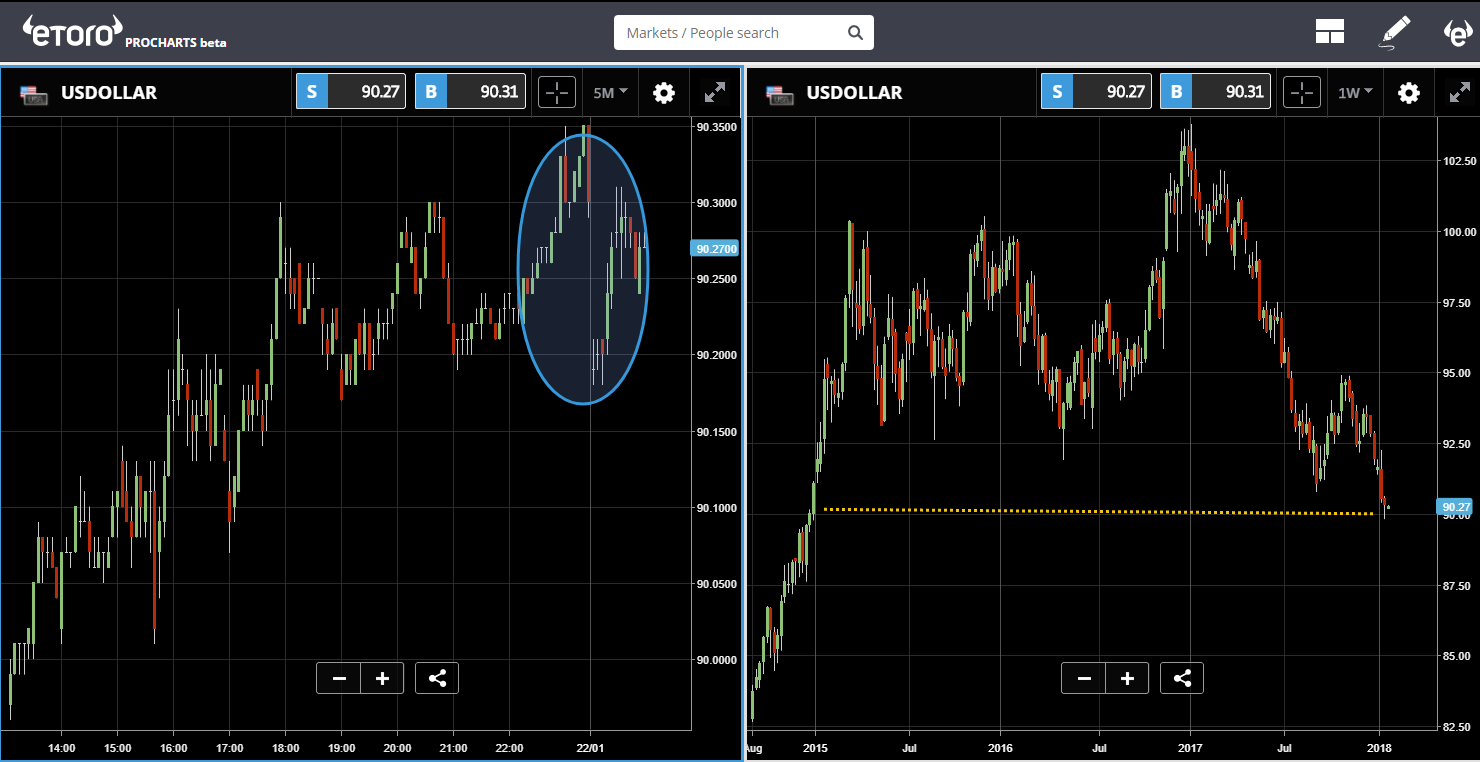

Currency markets opening up for the week are showing the US Dollar with a small gap down (blue circle). Of course, a good deal here could see the Buck much higher as it already is at multi-year lows (dotted yellow line).

OPEC’s Framework

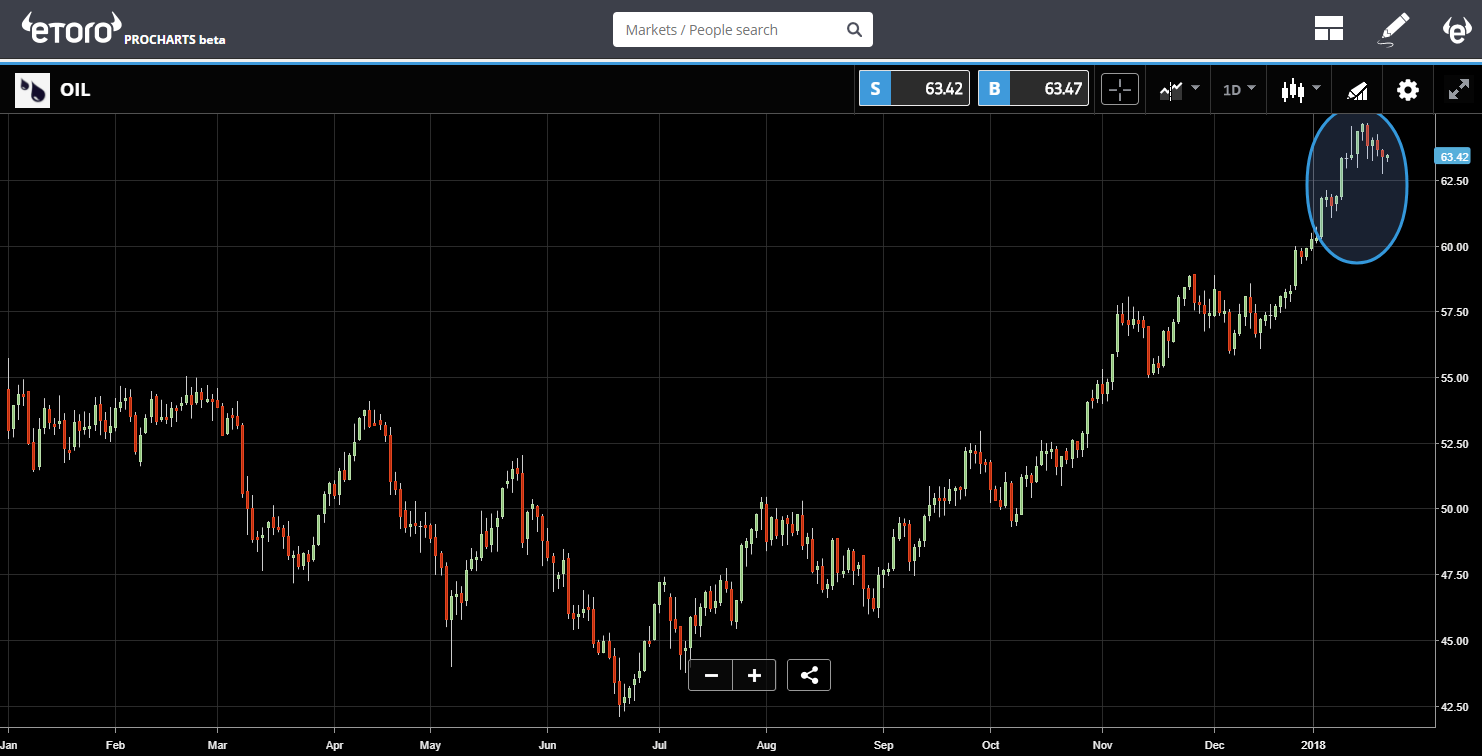

The OPEC cartel has done a great job in the past of controlling the price of crude oil by limiting the amount that OPEC partner countries produce. However, Saudi Arabia’s Energy Minister Khalid Al-Falih pointed out yesterday that OPEC nations have dwindled in market share over the past few years.

At the moment, OPEC only produces about a third of the world’s oil. Yet, most oil that is produced globally is actually consumed locally. So OPEC oil still accounts for about 60% of global trade.

Their main competition is US Shale producers. The US has invested big on fracking technology and they’re getting pretty good at it. With the collapse of oil prices in 2014 however, the fracking math just didn’t seem to add up and there are currently plenty of pumps in the United States that are not being used to their full capacity.

With Oil now holding above $60 since New Years, the shale guys might just have a prime incentive to start priming the pumps.

Khalid Al-Falih’s statement involved a fair bit of forward thinking but was rather vague, saying that by the end of 2018 OPEC and her partners would need to come up with some sort of a “framework” rather than continue to limit production. I mean, what does that even mean?

It would seem, the role is now reversed. Saudi Arabia and her partners now have a clear incentive to keep prices low in order to continue to corner this market.

Crypto’s In Red

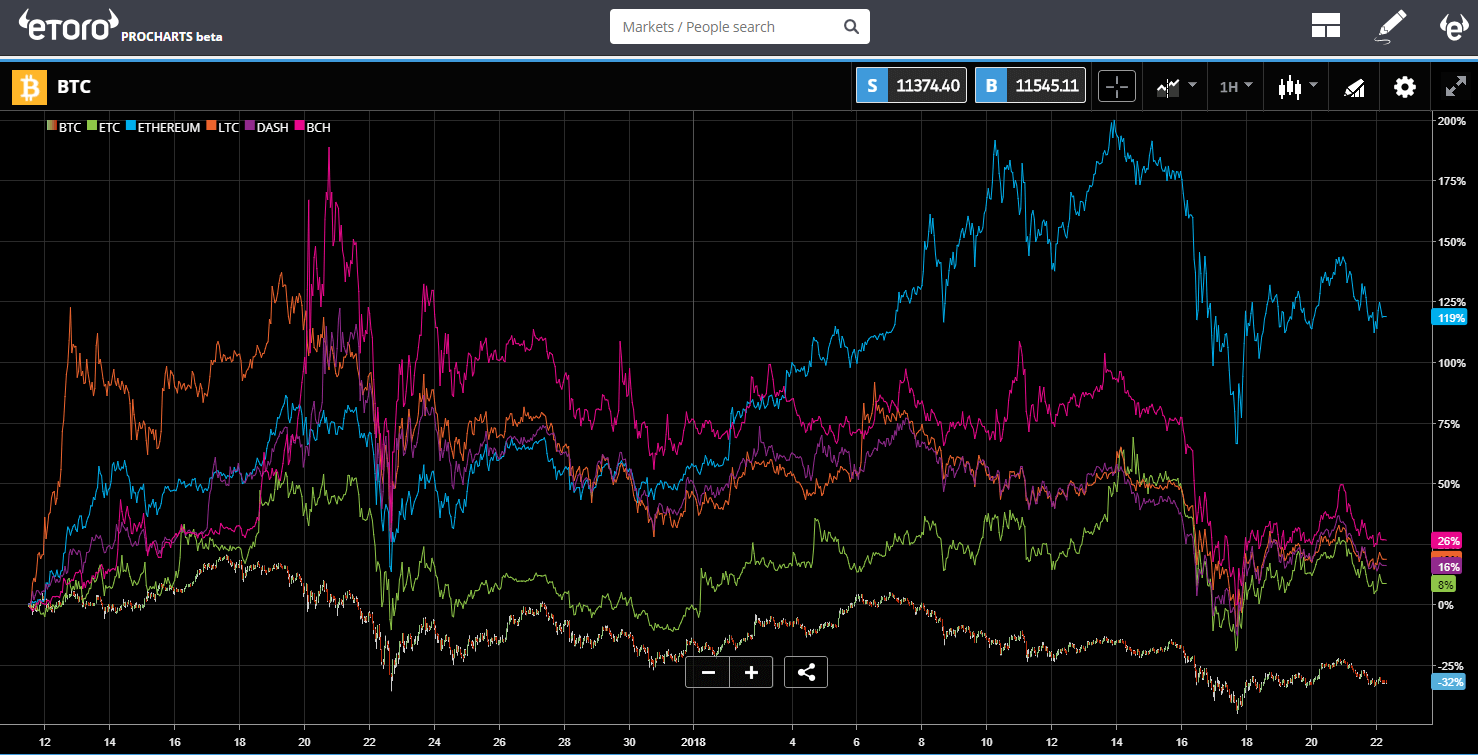

Looks like the Crypto markets may have been more affected by Trump’s government shutdown than the stocks.

As we mentioned in previous updates, a dip is usually a good time to get in but it is possible that we go down even further from here as technical support is still a way away.

The good thing is that volumes are holding in Japan and South Korea. Though real FOMO won’t start to kick in unless we get an indication that the dip is over.

It’s been a wild year so far so it’s good to see things calming down a bit as far as the volatility. Let’s hope the gyrations remain subdued for the next few weeks to give the market some more time to even out.

Meet the Bank of Japan

The BoJ has just gone into a two day meeting at the end of which they will make a public statement that could prove symbolic for global monetary policy and have a sizable impact on financial markets.

As we know, most of the central banks in the world have been practicing an extremely loose monetary policy since 2009. Yet, out of everyone, the Japanse have been the most aggressive by far. According to some, their bond-buying program has gotten way out of hand and the BoJ now owns more than 75% of the ETFs in the country and a good portion of all the financial assets in the world.

Try out social trading features

They may have been trying to give us a hint last week when they reduced their monthly bond purchases ever so slightly. Some traders reacted quite quickly taking this as a sign that they might be about to pull out and tighten up.

If this is the case, we may witness the last of the titans of loose money fall tomorrow morning. For those of you who are hardcore FX traders, this could be an amazing opportunity but might require staying up all night depending on where you are in the world.

Watch the USDJPY closely, and if they are indeed about to shake things up, we could see the pair drop pretty quickly as investors pile into the newer stronger Yen.

Very sorry for sending the daily so early today. No doubt there will be updates that may have changed things before you read this. I’ll be on a plane to Geneva at the usual sending time, so better early than never.

Let’s have an awesome week!