Last week we saw record highs of the most important cryptocurrency – Bitcoin. Price reached 2730 USD per unit. Since that moment it already fell, however besides hype for Bitcoin we have to notice that cryptocurrency market is getting more and more popular and it influences our reality. This is why we should have at least basic knowledge about that topic.

Cryptocurrencies basics

Blockchain

The best example of cryptocurrencies influence is technology based on which this market was created. It is called Blockchain and it is similar to huge accounting book, except it is digital. Technology is based on chain of blocks containing data about internet transactions.

While so far we needed third party (banks) to pay for the transaction, Blockchain technology changed everything. By rejecting any central computers or transaction verification systems, Blockchain has reduced the time needed to transfer funds or data.

Since technology is not limited to just sending money, but it also enables data transfer, it quickly grows the number of potential uses. We can read very often about using Blockchain in public institutions (for example cars registration via a blockchain system). Another idea is possibility to trade stocks without brokerage house.

Mining

Probably many people unfamiliar with the subject are asking where the cryptocurrencies come from. The vast majority of them are “extracted” by decrypting the cryptographic algorithms. For this type of activity you need efficient hardware (fast processor and graphics cards). Interestingly, with the current increase in interest in cryptocurrencies, the waiting time for graphics cards used to mine coins is 1-2 months.

The supply of most cryptanalysts is limited by algorithms, so the more people take for coins, the more time it takes to achieve any effect.

However, it is important to note that there are also cryptocurrencies that are not being extracted. In these cases we have to deal with a certain number of coins from the beginning.

Bitcoin madness

The recent hype around cryptocurrencies was mainly due to the Bitcoin rally, although some of its competitors recorded even higher increases (percentage). Let us remember that the cryptocurrency market is characterized by variability incomparably greater than that we know from the stock market. With this awareness, it is easier to assume that Bitcoin gained 50% in a week, lost 35% in the next 2 days and rebounding again.

What’s more, despite the recent decline, Bitcoin is today worth 130% more than in mid-March.

This is the second largest rally in the history of this currency. The biggest one we witnessed in the end of 2013 – after strong appreciation Bitcoin was losing for months.

It is difficult to say without doubt how many people use Bitcoin to pay with it and how many to speculate. Much depends on the regulations in different countries. For example, in Japan, Bitcoin payments are becoming more common. On the other side there are countries where the vast majority invest in Bitcoin to sell it at a much higher price just few days later.

Due to the popularity of Bitcoin, this currency is mined by most of interested people. The advantage is on the side of those who pay the lowest energy bills. As a result, the extraction of Bitcoins across Europe has become unprofitable, with the Chinese being the leaders.

Other cryptocurrencies

Despite huge popularity of Bitcoin, its market share in cryptocurrency market is clearly declining. It looks like Trader21’s forecast from 3 years ago can come true. He said that Bitcoin is the biggest cryptocurrency but it will eventually change.

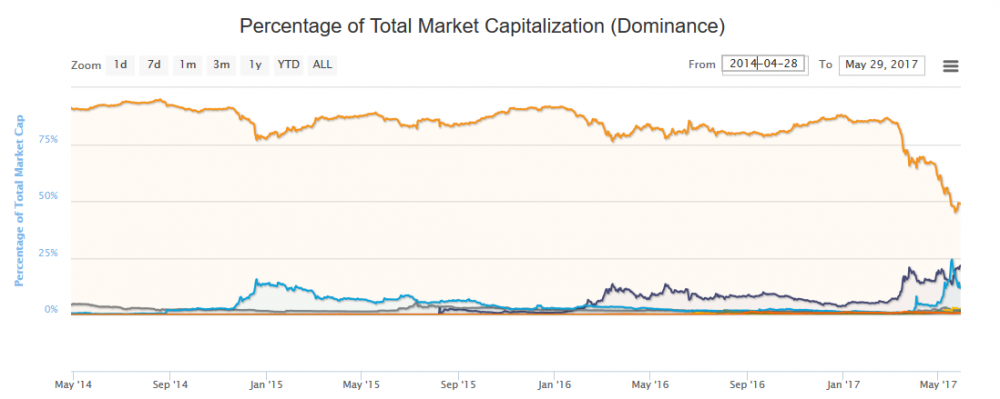

The changes you can see on the chart below. Bitcoin is marked with orange colour, Ethereum – dark blue, Ripple – blue.

Bitcoin’s share in total market capitalization fell from 80% to 48% in less than three months. At that time Ethereum increased 11 times, while Ripple – 34 times! The share of these 2 cryptocurrencies in the market increased to 20% and 14.5%, respectively.

Both Ethereum and Ripple are more common to use. For example, in Germany there was a possibility of charging electric cars in exchange for ETH (Ethereum).

Even more interesting is the case of Ripple, which enables faster transactions than is the case with Bitcoin. As a result, several banks in the US began to settle with each other through Ripple. The change made it possible to reduce half of the transaction costs.

Among other cryptocurrencies, I pay attention to Tether. It is a reflection of US dollar, it is used for valuing cryptocurrencies, for example in the largest cryptocurrency stock exchange Poloniex. If you ever see the abbreviation “USDT”, remember that it is not a US dollar. The values of Tether and the American currency are similar but not identical.

Who makes money on the popularity of cryptocurrencies?

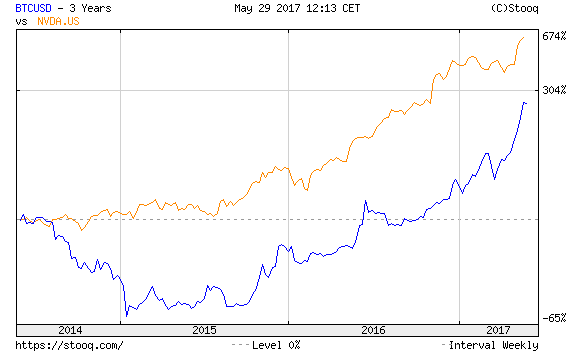

There are several groups profiting from current hype for cryptocurrencies. First we have to mention hardware companies used in crypto mining. These include mainly AMD and Nvidia.

In the case of AMD, price of stocks is very strongly correlated with Bitcoin in recent years, check the chart below.

Nvidia graphic cards are also used in Big Data and machine learning, so price of this company increased faster than Bitcoin.

Hardware companies are not the only ones benefiting from current situation.

Currently people who extract coins most often join bigger pool. In turn, the owner of such a popular pool earns up to 3% of each coin mined.

We cannot forget about owners of crypto exchanges. They get fees from transactions, these are much bigger in the last few weeks.

Main sources of risk

The main threat to the cryptocurrency market is the interference of politicians. I have already pointed out that blockchain technology is outside current transactional framework. Certainly this situation does not like the governing and financial supervisors. It remains a question of how strong is the will to regulate the cryptocurrency market. It is possible that national governments will select one of the cryptocurrencies and then favour it on their territory to ultimately benefit from its appreciation. Who knows whether this is the intention of the National Bank of Canada, who has joined the project to create business applications using Ethereum. A few weeks earlier, the same bank mentioned the need for Bitcoin regulations.

Another source of risk is possible hacker attacks on the stock exchanges. In the past, the cryptocurrency market has already seen stealing some large funds. It cannot be ruled out that, despite better protection, participants in any cryptocurrency exchange will also become victims of thieves.

There is a lot of uncertainty about functioning of ICO (Initial Coin Offering), including introduction of new cryptocurrency projecst (for example creating apps to pay with cryptocurrencies). It functions similar to crowdfunding. Currently new projects are created every few days, if not every day. It seems that this way cryptocurrency market will go through natural selection that will cool down present optimism.

Cryptocurrencies work through technologies that most people are completely unfamiliar with. For some of them (Bitcoin, Ethereum), it may soon be possible to change or extend the algorithms on which they are based. Even the biggest specialists find it difficult to determine how these changes will influence the market.

Of course, the current situation is a source of huge risk – we can clearly call it a speculative bubble. Such dramatic increases over several weeks were largely based on the assumption that another person would buy cryptocurrencies even more expensive. Most speculators fear that the falls will happen in the worst possible moment. So when a slightly clearer downward movement starts, it is immediately deepened by thousands of panicked speculators.

Summary

Looking at current situation, we expect Bitcoin to fall as it happened before after strong gains. There is still many times higher number of speculators rather than people using Bitcoin as payment method. Current situation is similar to dotcom crisis from 2000. Back then the bubble burst, scared investors and at the same time destroyed many ideas of internet businesses. Some of them succeeded after many years. It is possible that the situation with cryptocurrencies will be similar.

However, if we take wider look at cryptocurrencies, we will see that they introduced some kind of division between generations. Of course this is a partial generalization, but it is primarily the young generation who believe in cryptos. On the other hand, most 20- and 30-year-olds have never experienced a war or a break in the supply of energy from which the crypto market is dependent. This is the source of differences – among older generations, scepticism and propensity to invest in metals or real estate dominate (of course, those who have a critical attitude to the virtual currency).

Young people are convinced to invest in cryptocurrencies also because of higher risk tolerance. In the case of cryptocurrencies the variability of 50% in a few days is not unusual. This is an additional element that attracts young and detracts the elderly who accumulate retirement assets.

We mentioned many times about the fact that influential groups are seeking to centralize power and supervision. The cryptocurrency market is proof that the more creative part of humanity naturally (learning and creating) will oppose any centralization process. What about the globalists? Any loud bans on using cryptocurrencies would be suicide on their part. We should rather expect that they will strive to take over the new market and then use it for their own purposes.

Article created by Trader21

![Mayrsson TG Reviews: Why Choose Crypto-Trading with Them? [mayrssontg.com]](https://comparic.com/wp-content/uploads/2023/12/image1-218x150.jpg)