Looking at the prices of the Australian dollar index, we notice that it has been moving in a growth channel for some time. As a result of recent declines, the market again tested the lower limit of this formation, where today there was a strong demand reaction signaling a potential rejection of this support and the re-appreciation of AUD.

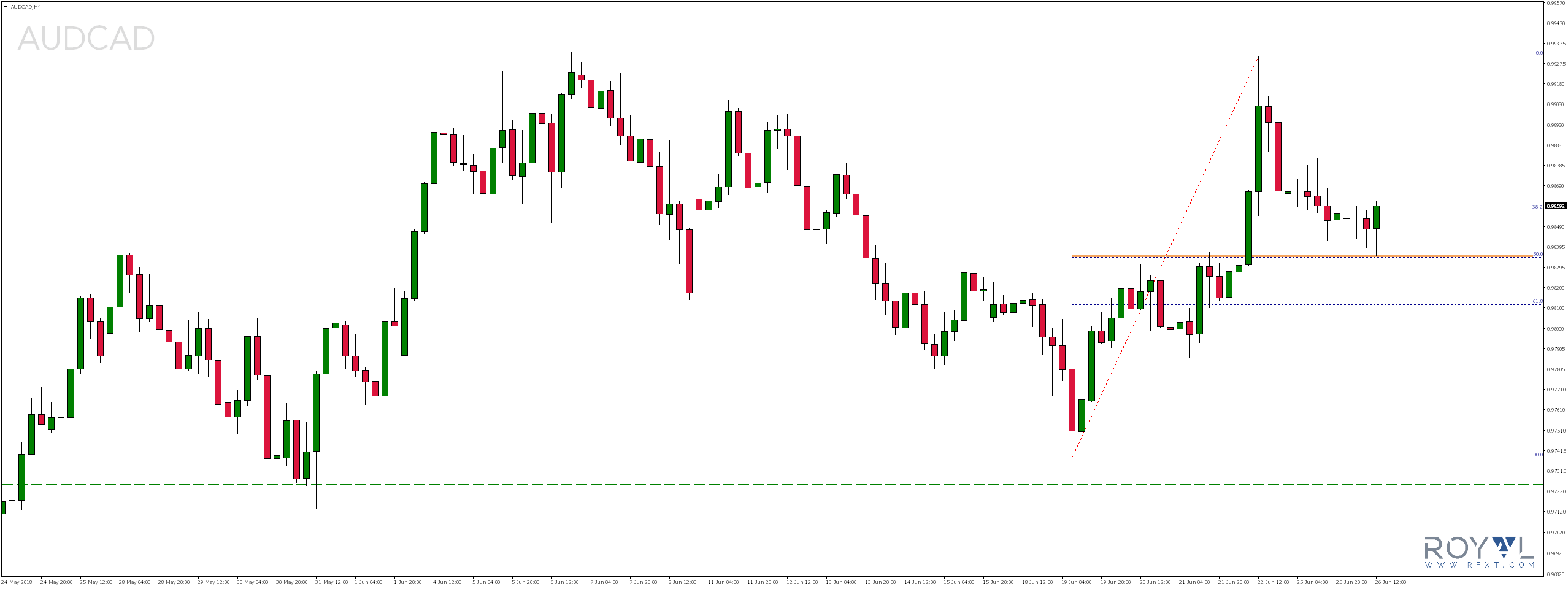

AUDCAD

AUDCAD

Looking at AUDCAD we can see that due to declines lasting since last Friday, the rate has reached today the technical support level and 50% Fibonacci correction from previous increases, where the first, quite strong demand reaction has already appeared. So if the zone is rejected, we could expect even the pair to return to growth.

To invest on AUD currency pairs, I recommend checking the ROYAL broker’s offer

EURAUD

The current situation on the EURAUD currency pair also speaks in favor of the potential strengthening of the Australian dollar, where the exchange rate reached the local level of resistance and 61.8% of the Fibonacci correction due to the last three weeks of increases. There also today appeared a supply reaction signaling the potential rejection of this zone, which from a technical point of view could open the way to new declines even to around 1.5220.

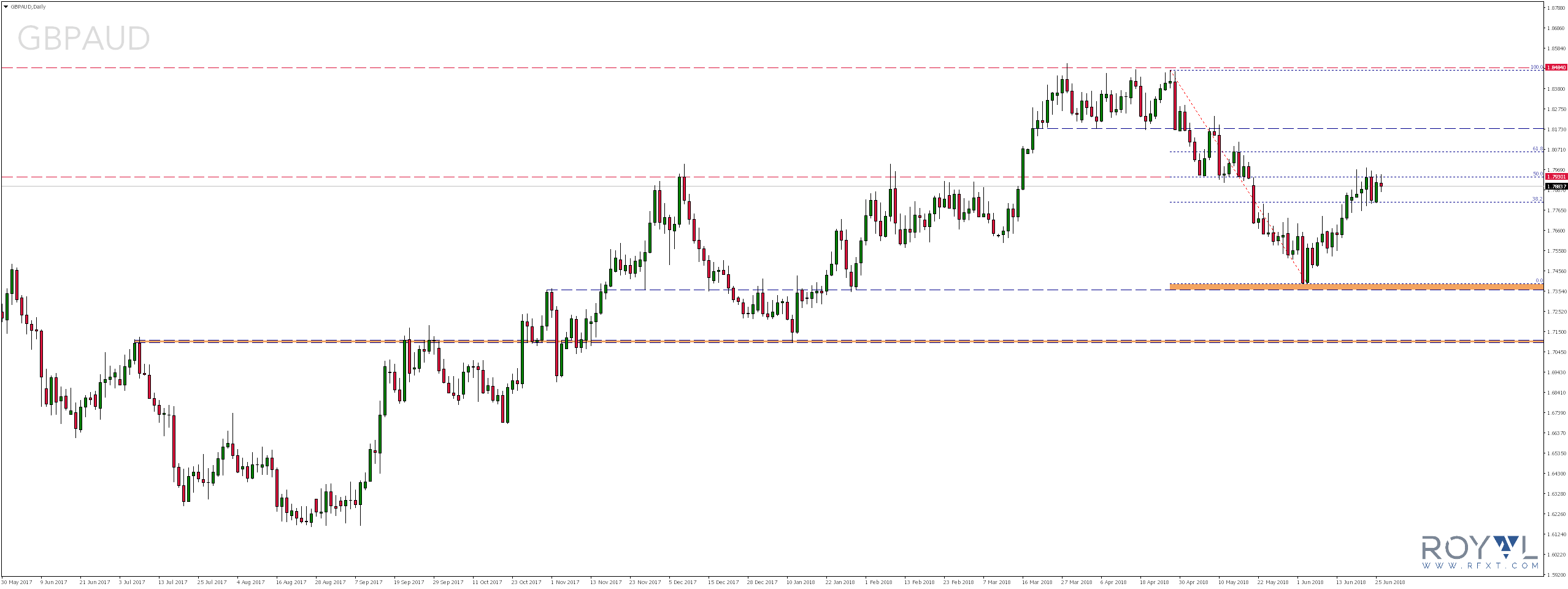

GBPAUD

Another instrument pointing to the potential strengthening of the Australian dollar is also the GBPAUD currency pair, where for several days the rate fluctuates in the vicinity of quite significant resistance that precisely coincides with the 50% Fibonacci correction. There, too, the supply reaction appeared several times. If, therefore, the zone would eventually be rejected, we would expect further decline.