LTCM Collapse almost brings economy to its knees

One of the most enduring and downright unbelievable quotes from my entire trading career was publicized following the bail out of one of the world’s largest hedge funds by the Federal Reserve

Long Term Credit Management (LTCM) was a hedge fund with close to $130 bio. Under management when it nearly collapsed in 1998. Had it been allowed to go under, the feeling at the Federal Reserve was that the domino effect it would have caused as its positions were liquidated would have brought about the collapse of the entire financial system. The sheer size of the fund brought questions about the wider market; whether there should be a limit on the size an individual fund can grow to?

Long Term Credit Management (LTCM) was a hedge fund with close to $130 bio. Under management when it nearly collapsed in 1998. Had it been allowed to go under, the feeling at the Federal Reserve was that the domino effect it would have caused as its positions were liquidated would have brought about the collapse of the entire financial system. The sheer size of the fund brought questions about the wider market; whether there should be a limit on the size an individual fund can grow to?

LTCM was created by a Wall Street trader and two Nobel prize winning economists who were determined to become legends but managed to find only infamy. John Meriwether had been a trader at Solomon Brothers, was joined by Myron Scholes and Robert Merton.

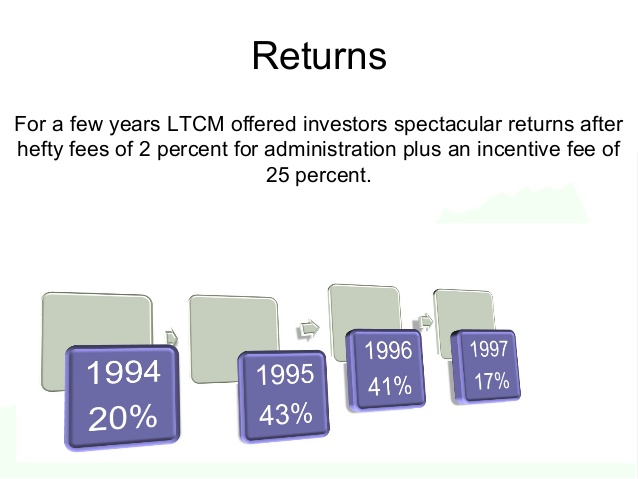

The whole fund was swathed in secrecy. Investors had to make a minimum investment of ten million dollars and they were “locked-in” for three years. Each of the principals were highly experienced and used to trading derivatives to make above average returns. Despite these restrictions, investors clamoured to invest. LTCM boasted spectacular annual returns of 42.8 percent in 1995 and 40.8 percent in 1996.

The whole fund was swathed in secrecy. Investors had to make a minimum investment of ten million dollars and they were “locked-in” for three years. Each of the principals were highly experienced and used to trading derivatives to make above average returns. Despite these restrictions, investors clamoured to invest. LTCM boasted spectacular annual returns of 42.8 percent in 1995 and 40.8 percent in 1996.

Russian Devaluation and Default brings Market Collapse

In 1998, Russia declared that it was devaluing the Rouble and defaulted on its bonds. This event was way outside the parameters to which LTCM hedged its exposures. The Dow fell by 20% and European markets by an average 35%. This set off a chain reaction and by August, LTCM had lost 50% of the value of its investments because of the huge leverage they had on their trades.

Bear Stearns, the now defunct investment bank dealt the final blow to LTCM’s survival prospects. It called in a five hundred million payment that had been rolled over a several times and LTCM was unable to come up with the cash.

Fed Chair Alan Greenspan was so concerned about the effect on the financial market that he convened a meeting and New York Fed President William McDonough managed to persuade 15 banks to provide a bail out of close to four billion dollars. There have been numerous reports and dissertations on this over the years and the general consensus is that the bail-out was a knee-jerk reaction which wasn’t warranted since Warren Buffett had offered to buy out the shareholders for “just” two hundred and fifty million dollars.

Quotable quotes and unquantifiable risks

Once the bailout had been agreed, one of the partners was heard to enquire “does that mean we can pay the bonus now?” The LTCM Management Team were due a Christmas Bonus of fifty million dollars. There is no official record of either the reply or the payment being made. The former is probably unprintable and the latter unconscionable!

I, along with my colleagues in banks outside the U.S., watched this drama from afar. There was a sense of detachment and a belief that “it couldn’t happen here. How wrong we were!

The major fallout from this whole episode is that it started banks on their rush in increased risk which led to the 2008 financial crisis. Banks, possibly unconsciously, took on far more risk in the knowledge that as they had become “too big to fail” and would be bailed out by the Fed which had set a dangerous precedent which, along with his “irrational exuberance speech, to a certain extent destroyed the legacy of Alan Greenspan.

2008 is still a relatively fresh memory but I witnessed it from a totally different angle, an angle that I will describe tomorrow.