Last week was very successful for bulls. Strong increases of German DAX (almost +7%) and French CAC40 (+4.7%). It was also great week on Wall Street. American S&P500 closed fourth week in a row with appreciation with combined profit of 11%. The end of Friday’s session on S&P500 was with 2,075 pts, just 60 pts below historical top. A little less optimism in China. Although August’s low is not deepened but there is no dynamics in gains and European and US optimism didn’t helped Asian stocks.

IF YOU ARE INTERESTED IN INVESTING ON INDICES LIKE DAX30, TRY FREE FXGROW ACCOUNT

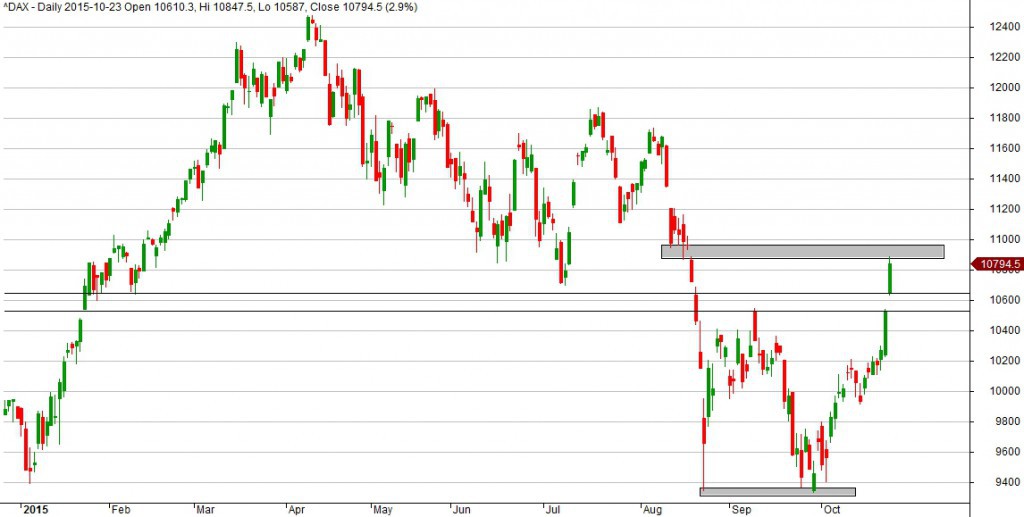

Last Friday DAX was at level where it was for the last time on August 19th, it broke all resistances created in the last two months. It is currently at resistance which is created by bearish gap. Without doubt there will be try of attack on the level 11,000 pts, but success of it depends on sentiment on Wall Street. Next Wednesday there will be FED meeting after which we will get to know decision about interest rates. Just few percent of investors believe in rate hike this year, but there would still be some uncertainty on the markets.

When we analyze DAX chart according to wave theory, there should be end of simple ABC correction and beginning of new bullish impulse. You should remember that in this case DAX is just in wave 1 after which comes big bearish wave 2 (it often retrace 78.6% of increases). Also we shouldn’t exclude negative for bulls scenario. Currently index can be in large wave B after which it should deepen last month’s low and then come back to gains. The key factor is whether depreciation will break September’s low or they will rebound from it.