A BoE hike in November is now close to fully priced, but the bar for the MPC not to hike is very high as the data momentum keeps recovering from the summer lows and Brexit uncertainty has not deteriorated.

A BoE hike in November is now close to fully priced, but the bar for the MPC not to hike is very high as the data momentum keeps recovering from the summer lows and Brexit uncertainty has not deteriorated.

On the latter, we viewed PM May’s Florence speech and Barnier’s response as positive, and negotiations last week confirmed a more constructive spirit. Once this week’s Conservative Party conference is out of the way, we expect the government to use the political space to work towards a two-year EEA-based transition deal by year-end.

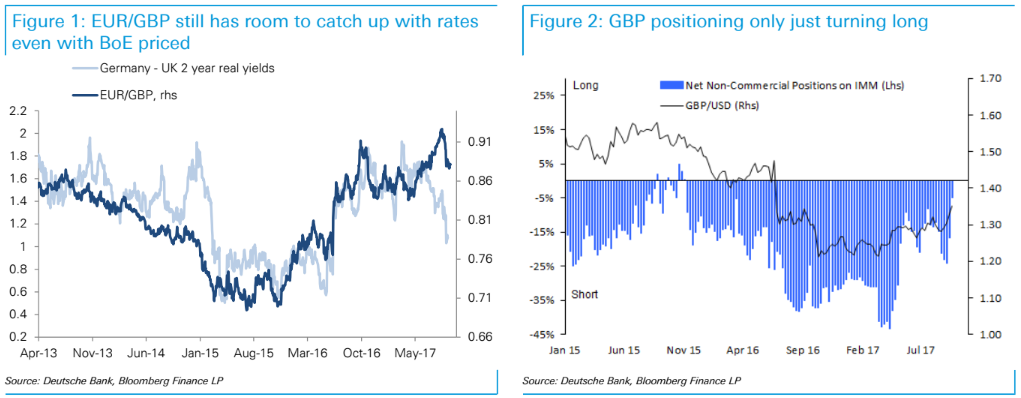

While sterling shorts have been covered, the more constructive outlook is not yet reflected in longs (Figure 2). The euro by contrast should be more sensitive near term to a more hawkish Fed, greater hopes for US tax reform, and political noise in Germany and Catalonia.

While sterling shorts have been covered, the more constructive outlook is not yet reflected in longs (Figure 2). The euro by contrast should be more sensitive near term to a more hawkish Fed, greater hopes for US tax reform, and political noise in Germany and Catalonia.