Daily Forex Market Preview, 26/06/2017

Over the weekend, ECB Governing Council member and Bundesbank president Jens Weidmann told a German newspaper Welt am Sonntag that the time might be nearing for the European Central Bank to begin discussions on ending its stimulus program. Mr. Weidmann, is one of the staunch opponents of the ECB’s QE program and his comments over the weekend were therefore not surprising.

Looking ahead the economic data today includes a speech by ECB president Mario Draghi while in the US, the durable goods orders will be released. Headline durable goods orders are expected to fall, while core durable goods orders are expected to post a modest recovery, rising 0.4% according to economists polled.

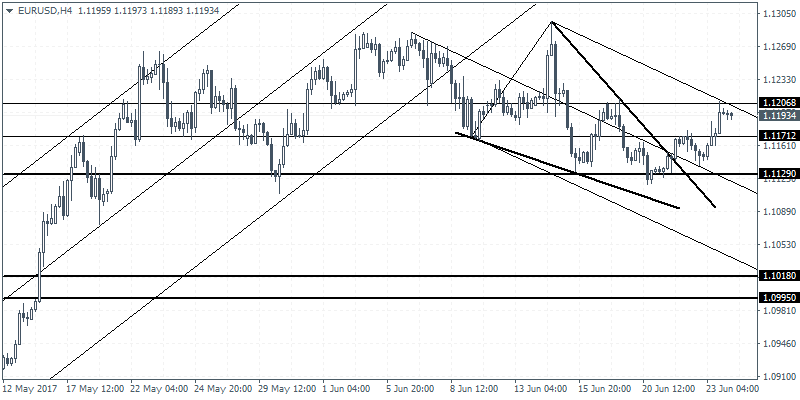

EURUSD intraday analysis

EURUSD (1.1193): The EURUSD is seen trading within Friday’s range today with price action seen well supported above 1.1129. After testing 1.1200 resistance on Friday, we could expect to see some downside bias in the EURUSD prevailing. On the 4-hour chart, following the upside breakout from the triangle pattern and with the price at resistance, EURUSD could be seen range bound between 1.1200 and 1.1171 levels. A breakout below 1.1171 will signal a continuation to the downside with 1.1129 support coming into focus. Below 1.1129 further declines could be seen coming. Alternately, above 1.1200, EURUSD could potentially target the upside towards 1.1300.

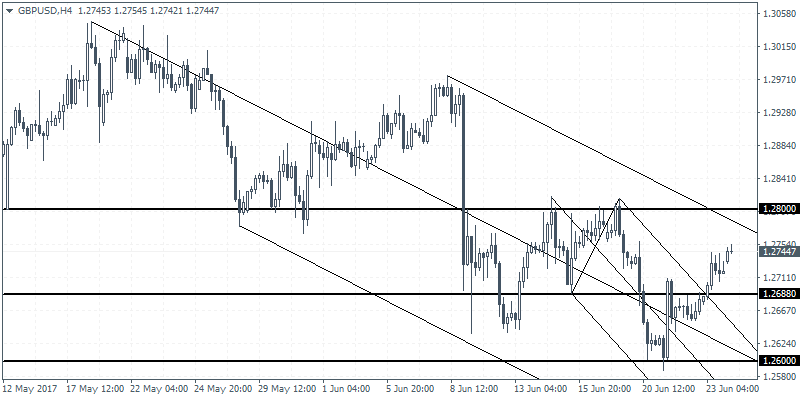

GBPUSD intraday analysis

GBPUSD (1.2744): The British pound is seen pushing higher this morning after Friday closed above 1.2688. Further upside could see GBPUSD attempt another go at the resistance level of 1.2800 which was briefly tested just a a week ago. The current rally to 1.2800 could, therefore, be a short term recovery before the bias opens to the downside. With the test of 1.2800, GBPUSD could be potentially forming a head and shoulders pattern. Therefore, watch for a higher low after the resistance at 1.2800 is tested. On the 4-hour chart, any near-term decline could be seen held near the support level at 1.2688.

Above article was provided by Orbex – Serving Traders Responsibly. Check the trading conditions and open your own account.

The Latest News covering forex, commodities, and indices in addition to exclusive CFD and forex trading opportunities identified by the Orbex research team

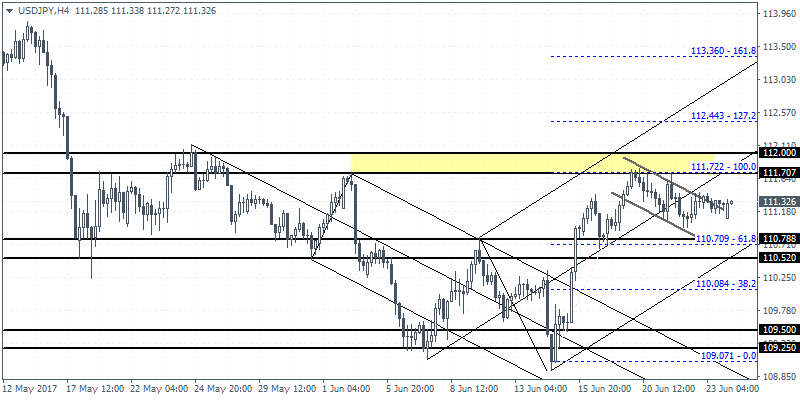

USDJPY intraday analysis

USDJPY (111.32): USDJPY which has been struggling to break the resistance level at 111.61 is likely to see a near term pullback in price. However, price action is attempting to retest this resistance level once again. This comes following the bullish breakout from the descending wedge pattern on the daily chart. On the 4-hour chart, we notice the bull flag pattern which signals continuation. Resistance at 111.72 – 111.61 will be key, and a breakout above this level is required for USDJPY to extend gains to a minimum of 113.360.