On January 3, 2018, ESMA – the European Securities and Markets Authority was granted interventions for products in connection with the entry into force of the MiFIR regulation. Thanks to this ESMA can temporarily dictate regulations in all 28 EU Member States. As with many new regulations, the general direction – ensuring much-needed consumer protection – is welcomed – but in certain situations, it can lead to unintended negative consequences, about which I write in the last paragraph.

On January 3, 2018, ESMA – the European Securities and Markets Authority was granted interventions for products in connection with the entry into force of the MiFIR regulation. Thanks to this ESMA can temporarily dictate regulations in all 28 EU Member States. As with many new regulations, the general direction – ensuring much-needed consumer protection – is welcomed – but in certain situations, it can lead to unintended negative consequences, about which I write in the last paragraph.

Let’s start with these beneficial effects of the new regulations. The goal is to protect unwary and inexperienced consumers from taking risks that they do not understand and incur disproportionate financial losses. This is a glorious idea that most responsible CFD suppliers already adhere to.

What will change from August 1, 2018?

The key element of CFD, which is both the main risk and the main benefit, is the ability to take a relatively high financial position with a smaller margin – what we call leverage. The measures taken by ESMA include the introduction of a leverage limit when opening CFDs. This level varies depending on the volatility of the underlying instrument, from just 2: 1 for cryptocurrencies and up to 30: 1 for major currency pairs. Details are in a former article here: “ESMA sets dates for new rules on CFD and Binary Options Ban”.

They also include the principle of closing a security deposit at 50% of the required initial margin, which means that the position must be closed by the broker when the loss is 50% of the customer’s capital. It is also very wise to protect against a negative balance, which prevents the customer from losing more than his deposit – this is already the norm for the most reputable suppliers of CFD.

The impact of regulation on the brokerage market

It all seems very reasonable, right? So where is the problem? Well, there are two related issues here. What makes CFD a popular way to trade in financial markets and protect against other risks is the financial leverage described in the previous paragraph. The consequence of the lack of appropriate and desirable leverage for more experienced users is that some customers will simply move somewhere else. The ESMA guidelines do not apply to entities from outside the jurisdiction of the European regulator. Entities registered in Switzerland, the Middle East or the Far East as well as Australia will certainly not fail to take advantage of the competitive advantage offered by the ability to offer a higher leverage to a European customer.

Especially that, as the expert of the Chamber of Brokerage Houses Marek Wołos emphasizes, there are no regulations that can stop an investor from Poland, Germany or Great Britain from using the offer of investment companies from outside the European Union. (We mentioned on our site about this possibility on the occasion of the article: “Legal loophole allows you to bypass the leverage 30: 1 imposed by ESMA.”) A smaller number of clients from supervised brokers in the EU means lower turnover and thus lower profits … But this is a worry for brokers, not us traders.

Safety is most important

So what is the problem? Well, it’s nice that ESMA cares so much about inexperienced participants of the CFD market … but that’s the nature of human beings, that if we are forbidden to do something, we are looking for ways to circumvent the prohibitions and in this case, it will probably not be otherwise. Traders with experience, which a small leverage can prevent the use of their proven strategies requiring a large leverage, for example, pyramid strategies, whether scalping, will not give up trading and will not change the style of the trading and look for new strategies. They will simply look for new non-EU brokers who do not fall under the jurisdiction of ESMA, or will use the services of their existing brokers, but through their branches operating outside the EU. Big brokers such as XM, which have customers from 196 countries, and is also regulated by the Australian Supervisory Commission (ASIC), gives as much security of our transactions as those supervised by (FCA) in the UK or CySEC (Cyprus).

Worse if the traders in search of the appropriate leverage hit the a broker registered and supervised in one of the tax havens, that I will mention the Virgin Islands, Guam or Trinidad and Tobago … in this case, in the event of a dispute with the broker we will not have a chance to pursue his rights. Check beforehand who you want to entrust your capital to.

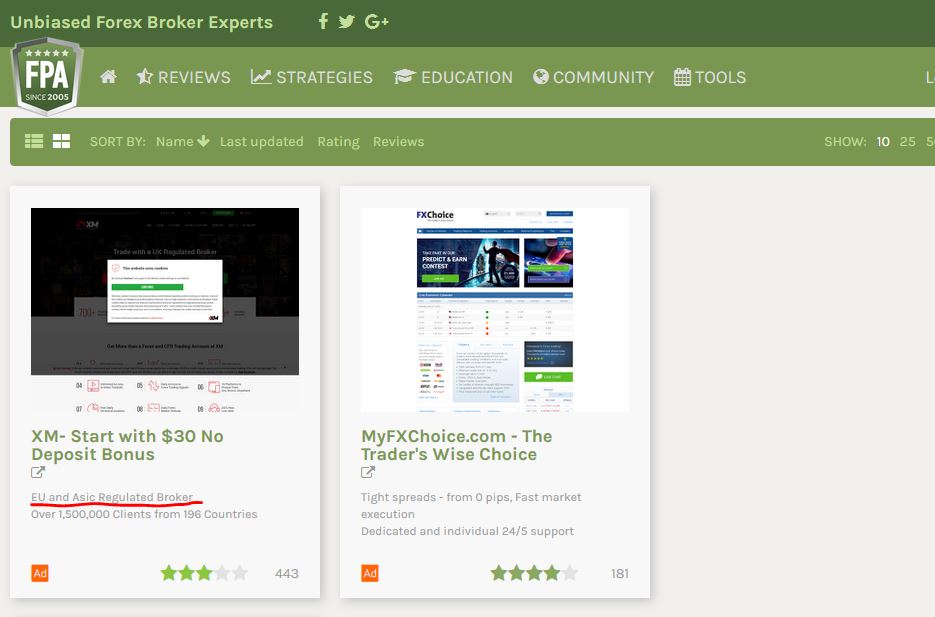

Abowe a screen from the portal where you can find independent reviews about the broker and details about which supervisors are subject. Therefore, dear traders for your own sake, I warn against the hasty choice of the broker only because of the leverage … If you have to change a broker – choose a broker who is known and proven in Europe, and has branches in countries where financial supervision is trustworthy, such as the aforementioned Australia.

![Reltex Group Reviews: Explore business opportunities by Trading [reltexg.com]](https://comparic.com/wp-content/uploads/2023/12/image001-218x150.jpg)

![Mayrsson TG Reviews: Why Choose Crypto-Trading with Them? [mayrssontg.com]](https://comparic.com/wp-content/uploads/2023/12/image1-218x150.jpg)