Daily Forex Market Preview, 23/08/2017

The US dollar was seen strengthening across the board yesterday. The modest gains come in anticipation of central bank chiefs convening at the Jackson Hole Symposium that is due to start tomorrow.

The economic calendar was light yesterday. Data from Canada showed that retail sales rose 0.1% which was lower than the median forecasts. Previous month’s data was also revised down to show a 0.5% increase. Core retail sales, however, increased 0.7% on the month beating forecasts.

Looking ahead the economic data today will include a speech by ECB President Mario Draghi who will be speaking at an event in Germany. This could be the key event risk for the euro currency today. Later in the day, the Eurozone flash PMI’s will be released for August. In the US flash manufacturing and services PMI from Markit will be coming up, and FOMC voting member Kashkari is scheduled to speak.

EURUSD intraday analysis

EURUSD (1.1759): The EURUSD weakened slightly yesterday, but price action was subdued, trading within the confines from Monday’s range that was established. After rallying towards the highs from 11 August, EURUSD gave up the gains as the price fell back. The decline coincides with the upside breakout from the ascending triangle. The current retest of this breakout level could see price attempt to make another move to the upside. However, further gains are likely to be limited. This potentially keeps EURUSD range bound with support at 1.1688 in focus. A breakdown below this support will extend further declines in the currency pair. To the upside, the previously established range remains in place at 1.1882.

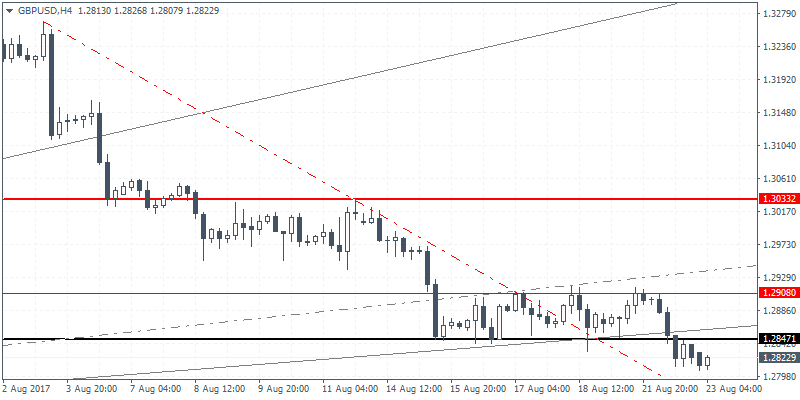

GBPUSD intraday analysis

GBPUSD (1.2822): The British pound weakened strongly with price closing below 1.2847 support. However, the declines were limited which could mean that there is a possibility for the price to rebound to the upside. However, on the 4-hour chart, the price has broken to the downside. Therefore, a retest of the broken support at 1.2847 could turn to resistance. A reversal at this level could suggest further downside in price towards 1.2786 marking the completion of the downside move following the breakout from the range.

USDJPY intraday analysis

USDJPY (109.41): The USDJPY posted strong gains yesterday rising to a three day high and clearing above the price level of 109.15 which has acted as support so far. Currently, the weakness in the currency pair is seen pushing USDJPY lower back to 109.15. A rebound off this level could, however, keep the bias to the upside. The resistance level of 110.72 remains in focus currently as long as the support is held. In the event that USDJPY fails the support once again, we could expect to see the current ranging price action to continue.