The current technical situation on these indexes looks extremely interesting and promises us interesting returns in the week just started.

extremely interesting and promises us interesting returns in the week just started.

Last week ended with a breakthrough on the DAX30 index. Buyers managed to bring a dynamic rebound from the support of 12100 points. The downward trend line was broken, and the index was at the highest level for 1.5 months. Unfortunately, this optimism wasn’t shared by bulls on other two indexes described here. CAC40 and Euro Stoxx 50 still failed to break their bearish trend lines.

This week it turns out if DAX30 has come out before the series and will be brought back to the support area of 12100 points or maybe CAC40 and Euro Stoxx 50 will get some power and effectively break their downward trend lines. It is certain that all indexes in the medium term will move in one direction and the divergence that currently appears on the charts is only temporary.

Euro Stoxx 50 (index grouping 50 largest European companies from 11 countries in Europe):

In the past week, buyers of Euro Stoxx 50 Index once again managed to return above 3440 points. However, this level clearly loses its importance, so the breakthrough here will only break through the downward trend line. Currently, the line is located at 3480 points. Its permanent breakup should give bulls fuel to derive a new growth impulse. As long as this does not happen the index will continue to move in the 3440 area without giving any advantage to either side.

Try trading on indexes. I am trading on a Broker’s account with Windsor Brokers, which offers all the listed indices available on the MT4 platform.

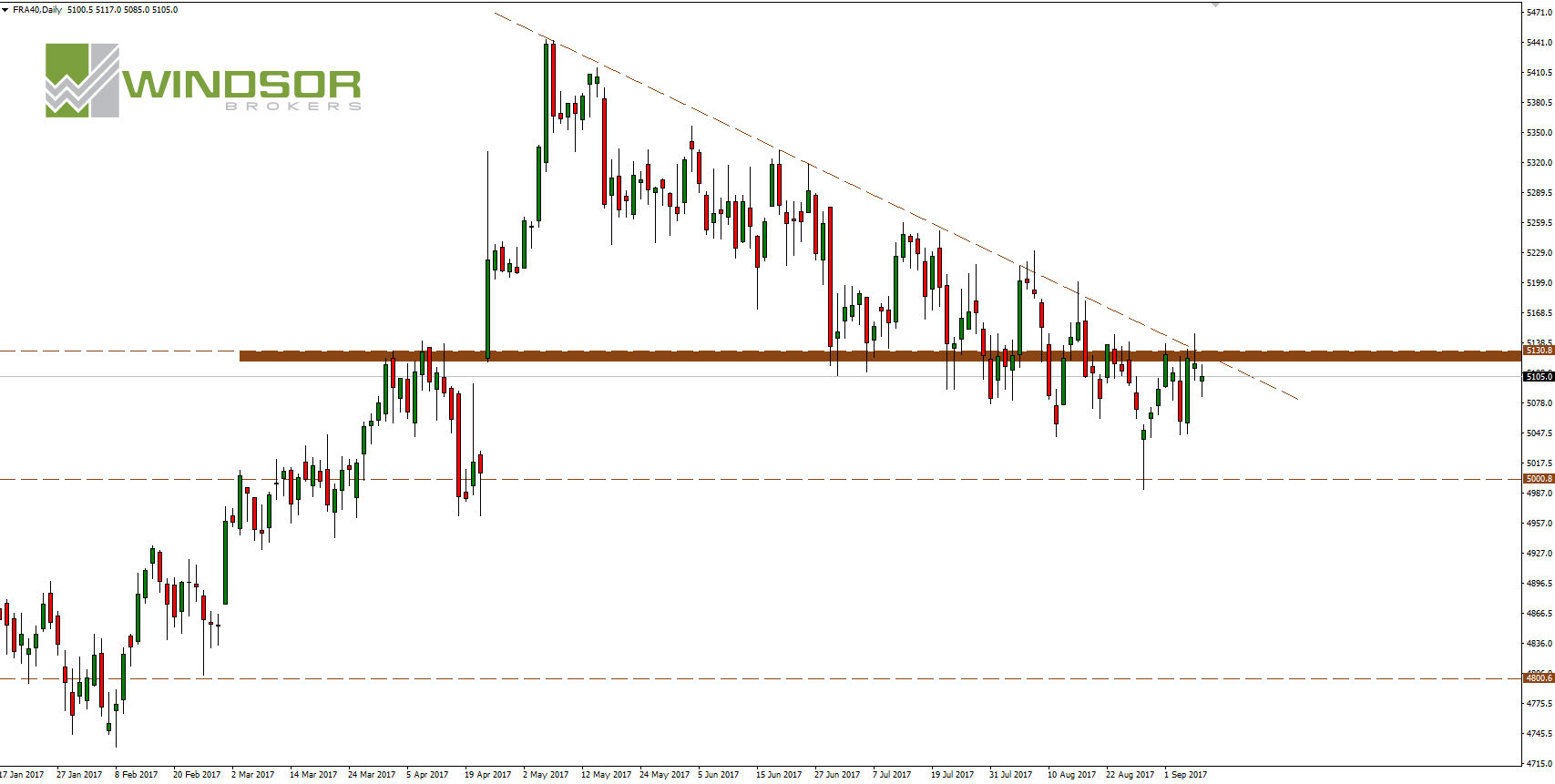

CAC40 (French index grouping the 40 largest companies):

Bulls on CAC40 are currently breaking resistance of 5130 points. Currently, this level is strengthened by the bearish trend line. If Monday’s session starts above Friday’s close, the demand side on the French index has a chance to hit the downtrend line as early as Monday’s session.

On the other hand, before there is 5000 pts support on the way. It was tested two weeks ago and a bullish candle with a long lower shadow indicated clearly that demand was not yet going to give up.

DAX30 (German index grouping 30 biggest companies):

The situation in the DAX30 index looks most optimistic. Already past Tuesday, demand has tried to break the trend line, ending with a bearish daily candle with long upper shadow. However, this did not stop effective growth and the next day on Wednesday the index reached the highest level for 1.5 months.

The buyer’s closest target is 12400 points resistance. However, before testing it can not be excluded a support test at 12100 points from the top. Such a move would cause confusion and uncertainty, but looking at CAC40 and Euro Stoxx 50, this less optimistic scenario can not be ruled out either.