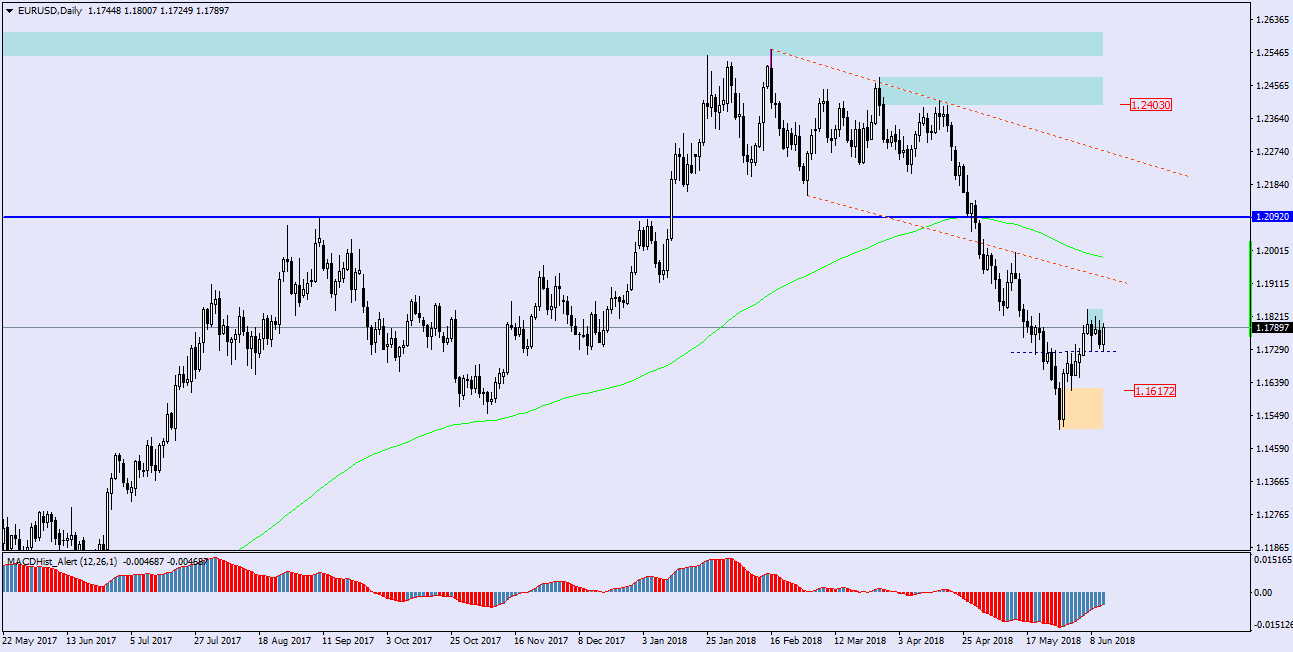

EURUSD since mid-April this year was moving south, drawing 7 consecutive weekly bearish candles. At the beginning of June returned to growth and despite the Wednesday decision of the FED raising interest rates to 2% and quite dynamic but short-term declines, the day ended with a 40 pips growth.

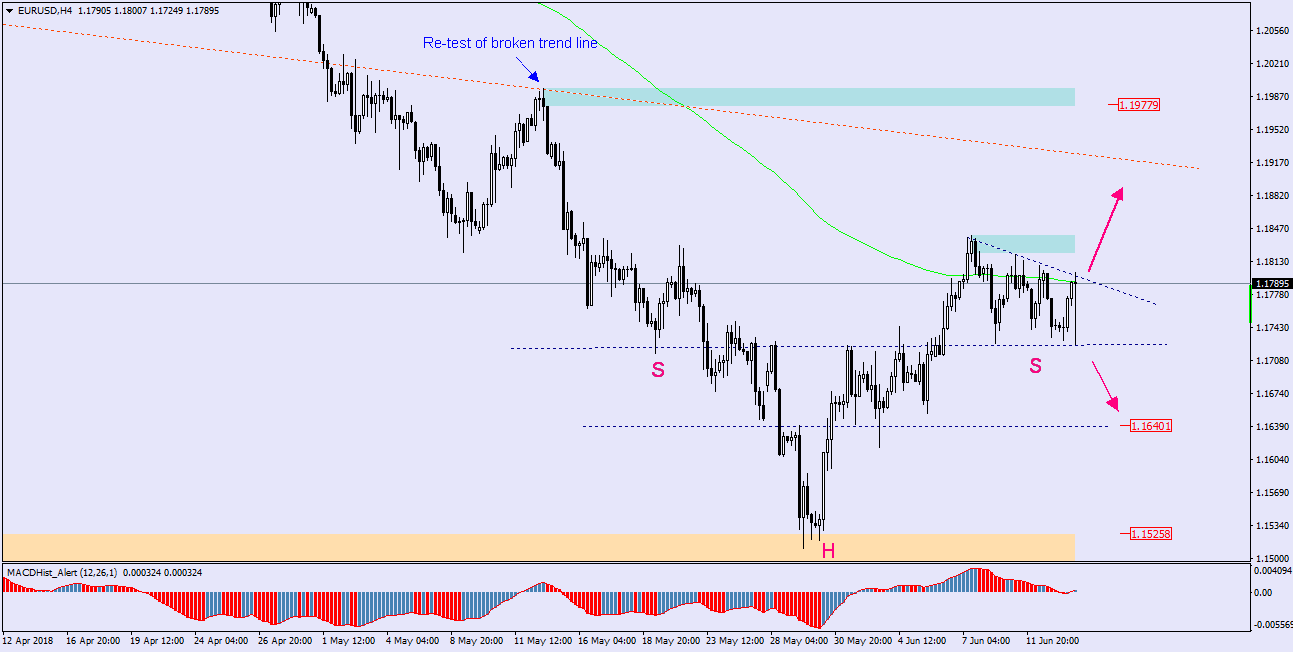

On the H4 chart, we can see that for few days the pair is in consolidation, whose bottom and the upper limit formed a triangle.

Breaking from this formation may lead to further increases for which the nearest resistance may be the lower edge of the bearish channel (red dotted), which the pair left on May 1, and two weeks later tested from the bottom with a distinct pinbar.

When we look closely at the graph – we can see a formation of inverted Head & Shoulders forming, where the neck line runs at 1.1840, and the shoulder line at 1.1725. In this case, the formation is pro-growth and supports the above-described scenario.

It is less likely in my opinion to break the bottom of the consolidation, but if the market decides so, it may aim at support at the level of 1.1640.

Today at 13:45 (GMT + 2), the ECB will announce the interest rates, and at 14:30 a press conference will take place at which time we will find out what financial policy the ECB anticipates in the near future. Perhaps the date and manner of termination of the QE program will be given, which may increase the demand for Euro.