ExoticTrading is a series of analyzes, which is created in collaboration with the broker InterTrader and is published on Comparic every Monday, Wednesday and Friday. The theme as the name suggests are so called- exotic currency pairs.

EURNOK

Despite the fact that two weeks ago market broke uptrend line on weekly chart and last week re-testing rejected it from the bottom (as resistance) and it seemed that this will be beginning of change in market sentiment, in this week we see dynamic growth in favouring bulls.

Looking at the daily chart we see that in near future market could reach and retest the upper limit of lasted nearly three months consolidation around the level 9.1350 coinciding with the 38.2% Fibonacci correction.

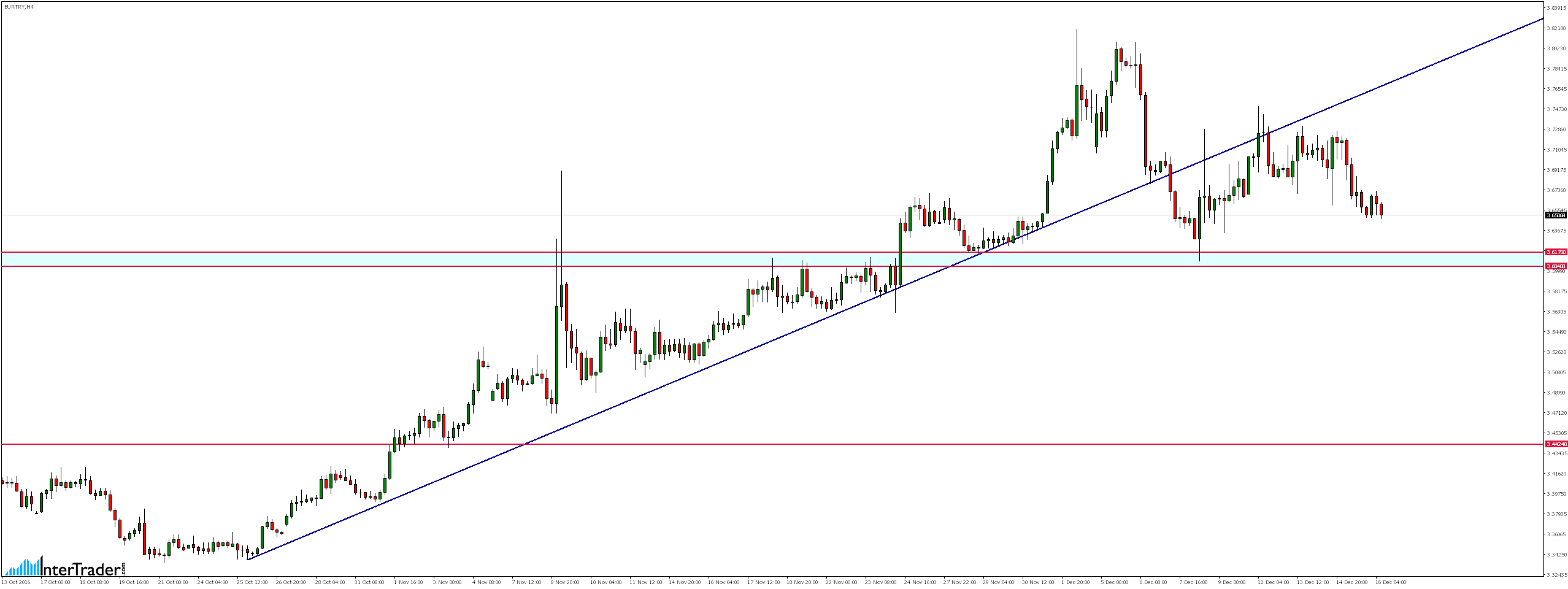

EURTRY

In line with our previous projection, as a result of the rejection from the bottom (as resistance) line of prior uptrend market continues to decline. If only in the short term overcomes today’s lows, then we would expect to test the level of 3.6170 area.

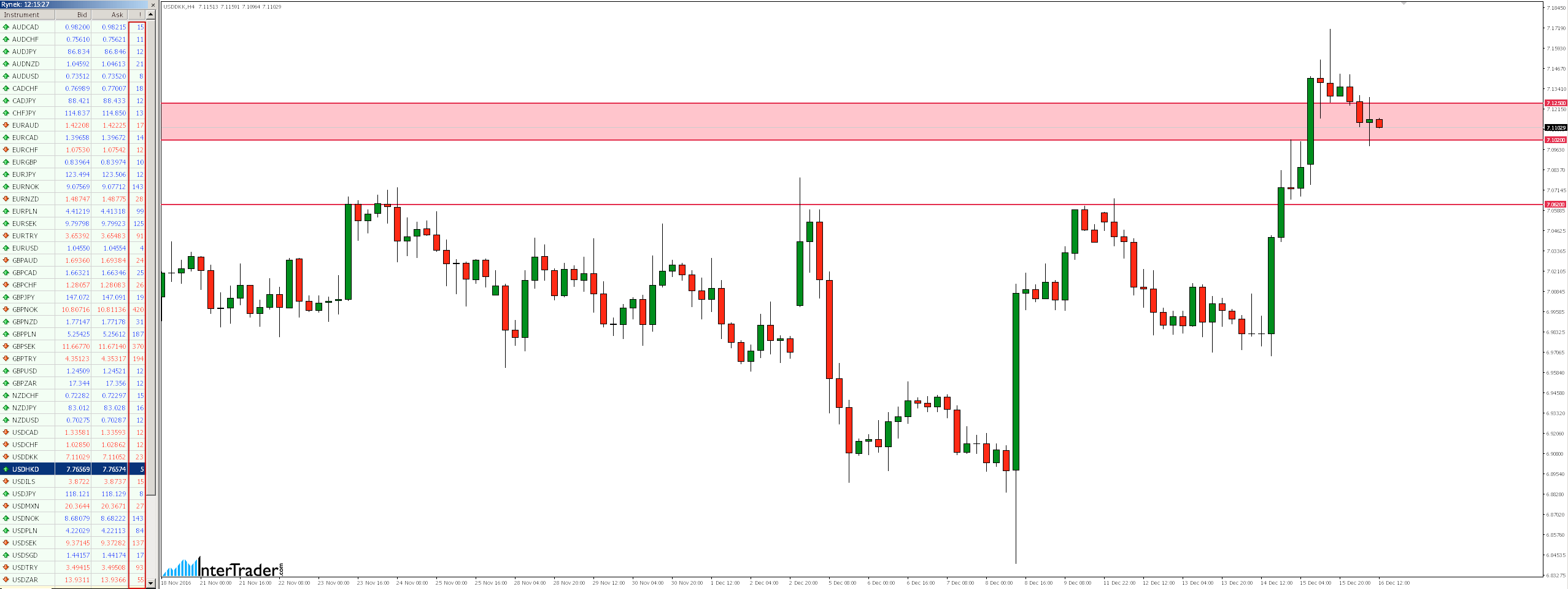

USDDKK

As a result of lasting for long time growth the market reached this week vicinity of zone of resistance which is the upper limit of ongoing for two years consolidation.

Looking on chart H4 we see that as a result of yesterday’s growth market for a moment was on highest level since January 2003. But soon came reaction of supply and in near future we can expect a downward correction, for which the potential target turns out to be even level of 7.0620.

To invest in exotic pairs take advantage of low spreads at the broker InterTrader that at the time of the creation of this analysis for each instrument in turn were 14.3, 9.1 and 0.5 pips