Hold onto your cash!

Capital is THE most basic requirement of trading. Without capital, you are “out of the game”. Therefore preserving or managing your capital is vital.

A lot of investors on Forex market have some experience with financial markets, especially stock markets. The details of fundamental and technical analysis are known to them, but the majority (80%+) still lose money.

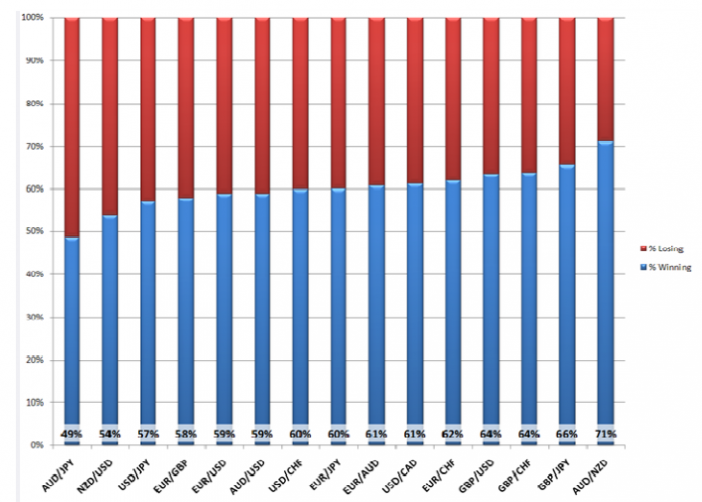

To explain why this is happens, take a look at a table created by David Ruiz from FXCM about the percentage of right decisions on major currency pairs. This data comes from 12 million real transactions made in years 2009-2010.

- Only AUDJPY shows less than 50% profitable decisions.

- EURUSD – 59%,

- USDCAD – 61%,

- AUDNZD – 71%.

You would think looking at this data that most traders, at least, keep their heads above water, why then statistically are most traders (four in every five) losing?

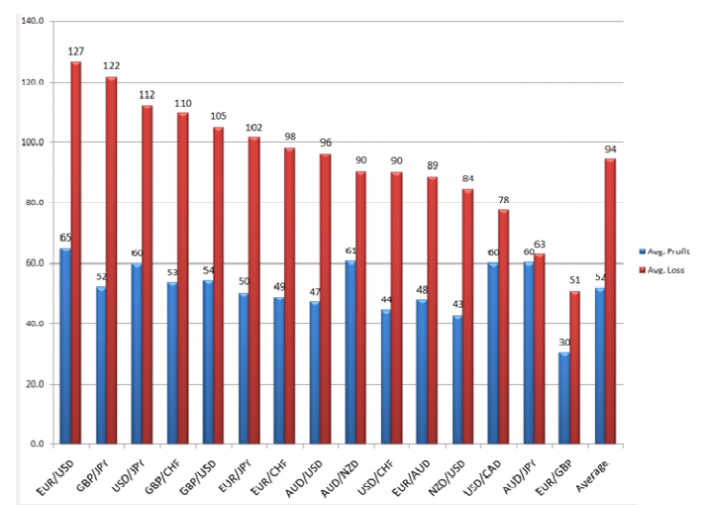

The explanation is shown in the table below; it shows the average loss per trade transaction and the average profit.

So, it is capital management or lack of it that is the problem. In Eur/Usd, for every 65 pip profit there is a 127 pip loss! You can see the other ratios so we need to be more disciplined in our trading strategy to preserve capital.

We all know to run profits and cut losses but our psychology says something different. It is in our nature to always want to be right and not accept defeat. It is called a fight or flight reaction.

Conclusions

- Be more analytical

- Always set stops

- Risk reward ratio should be at least 1.5/1

- Never move the SL lower. If you are wrong you are wrong, You cannot be more wrong

- If we move our take profit higher only move the stop to break-even at worst

![How to install MetaTrader 4 / 5 on MacOS Catalina? Simple way. [VIDEO]](https://comparic.com/wp-content/uploads/2020/07/mt4-os-218x150.jpg)