GBPAUD a Head and Shoulders under construction

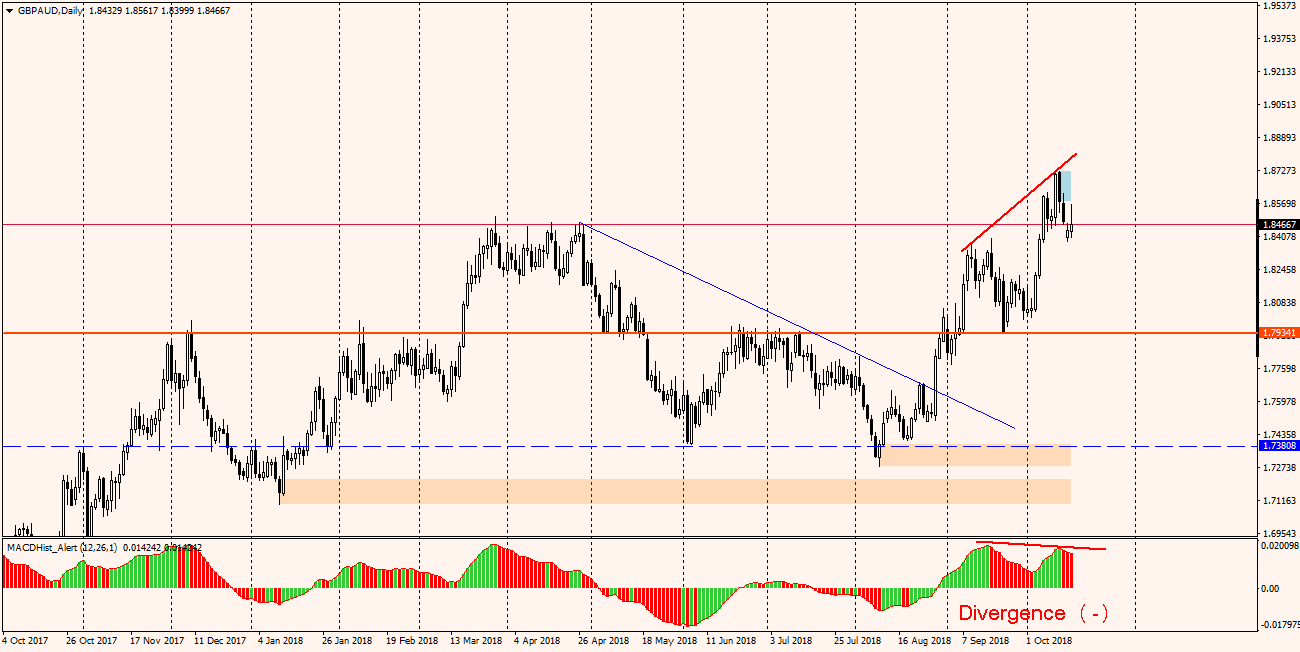

GBPAUD – the pair has been moving quite dynamically since the beginning of August. Last week, the maximum of this year was set at 1,8725. This week opened with a downward gap, which was closed on Tuesday. On the Daily chart, the MACD indicator creates divergence with the price.

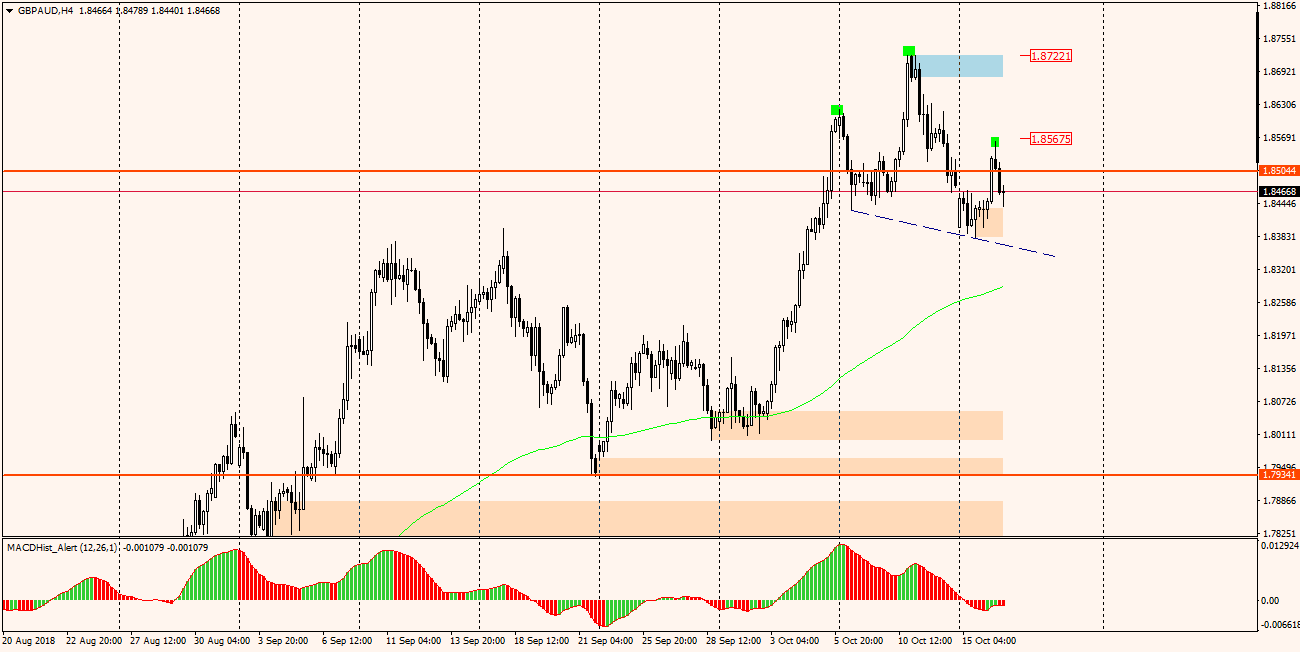

If we look at the H4 chart, we can notice the characteristic shape of the emerging Head and Shoulders formation. It is still too early to open a sell order, because the formation only hypothetically predicts declines and is not confirmed until the neck line is broken (blue dotted). However, it is worth adding a pair to the “observed” and in the case of a confirmed breaking the neck line, consider opening a short position, the potential range of falls is about 350p. Each movement in the opposite direction and overcoming the level of the right arm 1.8560 will negate the bearish scenario.