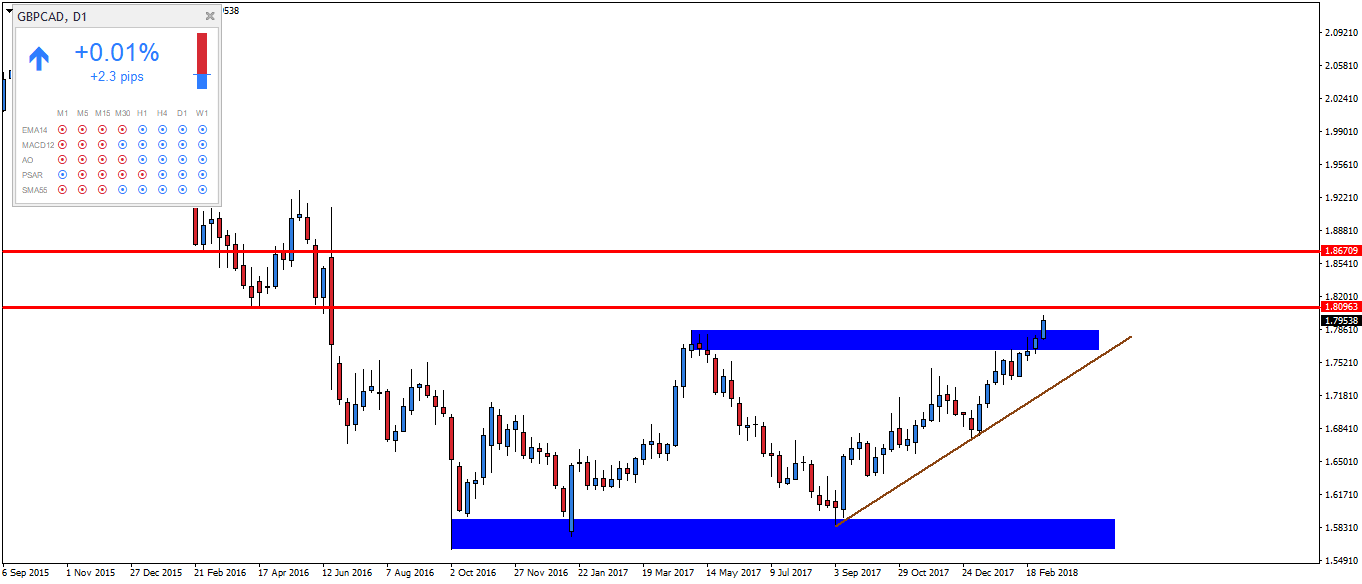

The upward trend in pound sterling to the Canadian dollar – GBPCAD has been confirmed. The current trend was started already in January 2017. After a several-week growth impulse, bears once again wanted to test the last minima, in this way the quotes slipped into the area of long-term support 1.559-1.590. A triple bottom formation was created on the market.

On the one hand, we can conclude that the upward trend was started only in September 2017, although the impulse from January was so strong that it changed the general situation on the GBPCAD currency pair. For this reason, we can conclude that the first increase signal was a bullish impulse lasting from January to April 2017.

Looking further, the next impulse started in September continues to the present day and broke the May 2017 high, the upward trend has been confirmed. Currently, quotes are moving above the upward trend line. At the daily and weekly intervals, all five indicators that follow the trend indicate a greater likelihood of continuing the current growth. The same is true for a four-hour interval, so the market at the three mentioned time intervals shows the same direction.

The nearest resistance is around level 1.80. After defeating it, demand will open way towards the next level of resistance 1,867.

Looking at the current growth phase, we can expect a correction at a lower time interval. The main strategy that we can apply to GBPCAD is to wait until correction onH4 will be completed. The correction will mean a change in the trend indicators for H4 to red. Only the re-indication of indicators that follow the trend at the said interval will herald the completion of the correction and the continuation of the long-term upward trend.

In addition, the correction on the crude oil market should support the continuation of the upward trend on GBPCAD.