GBPJPY – a pair known for her high dynamics and volatility, supposedly a favourite instrument of hedge funds, called by some traders “butcher”. From April 2017, moved in the growth channel, where the maximum growth periods reached 1360p. After three rebounds from the bottom of the channel (support) on May 23, the pair left the channel with a dynamic move and has already tested the broken support twice.

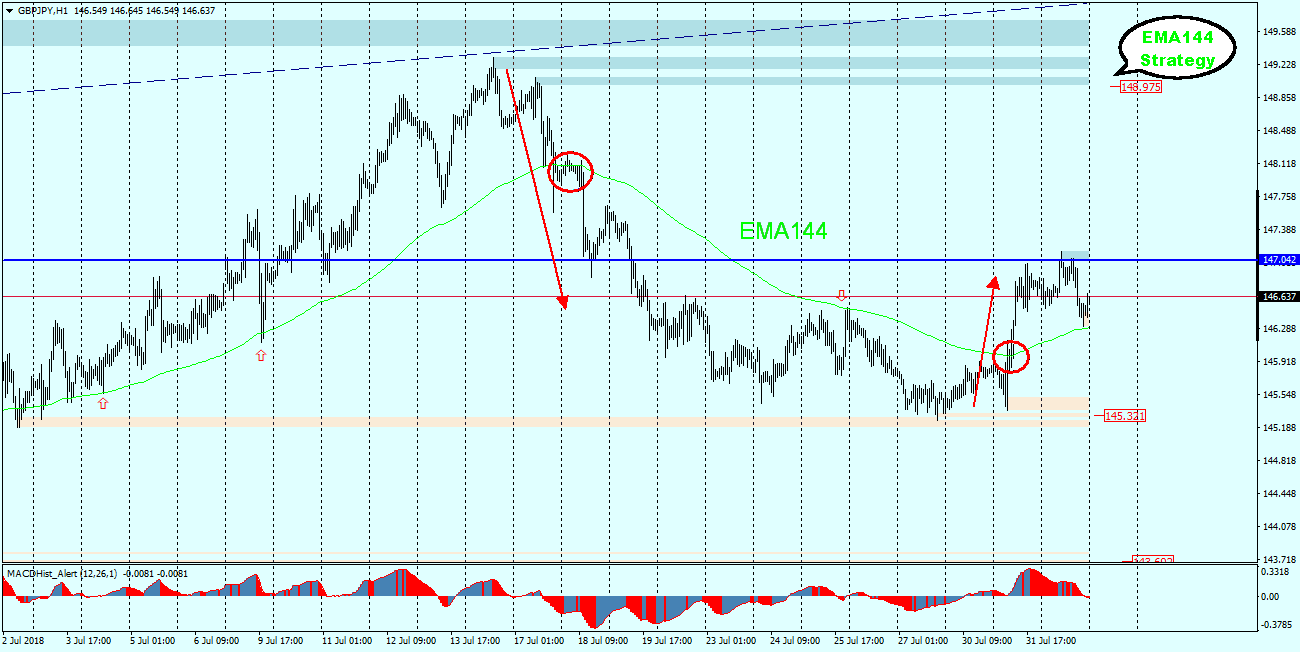

Looking at the H1 chart in terms of EMA144 strategy, we notice that earlier, the average quite accurately fulfilled the role of dynamic support and resistance. Currently, the price has bounced from the average and is likely to continue moving towards the said zone 147.00. The average is currently located around 146.30 and plays a role of a dynamic resistance and its possible breakthrough will change the attitude to bearish.

We can not in our considerations omit today’s (at 13:00 – 13:30) macro events – so-called – “Super Thursday” – where BoE will appear in the main role, giving inflation data and announce the decision on interest rates that will apply for the next 6 weeks. Any change to “bullish” attitude may give a boost to GBP and hence also of the GBPJPY pair being analyzed.