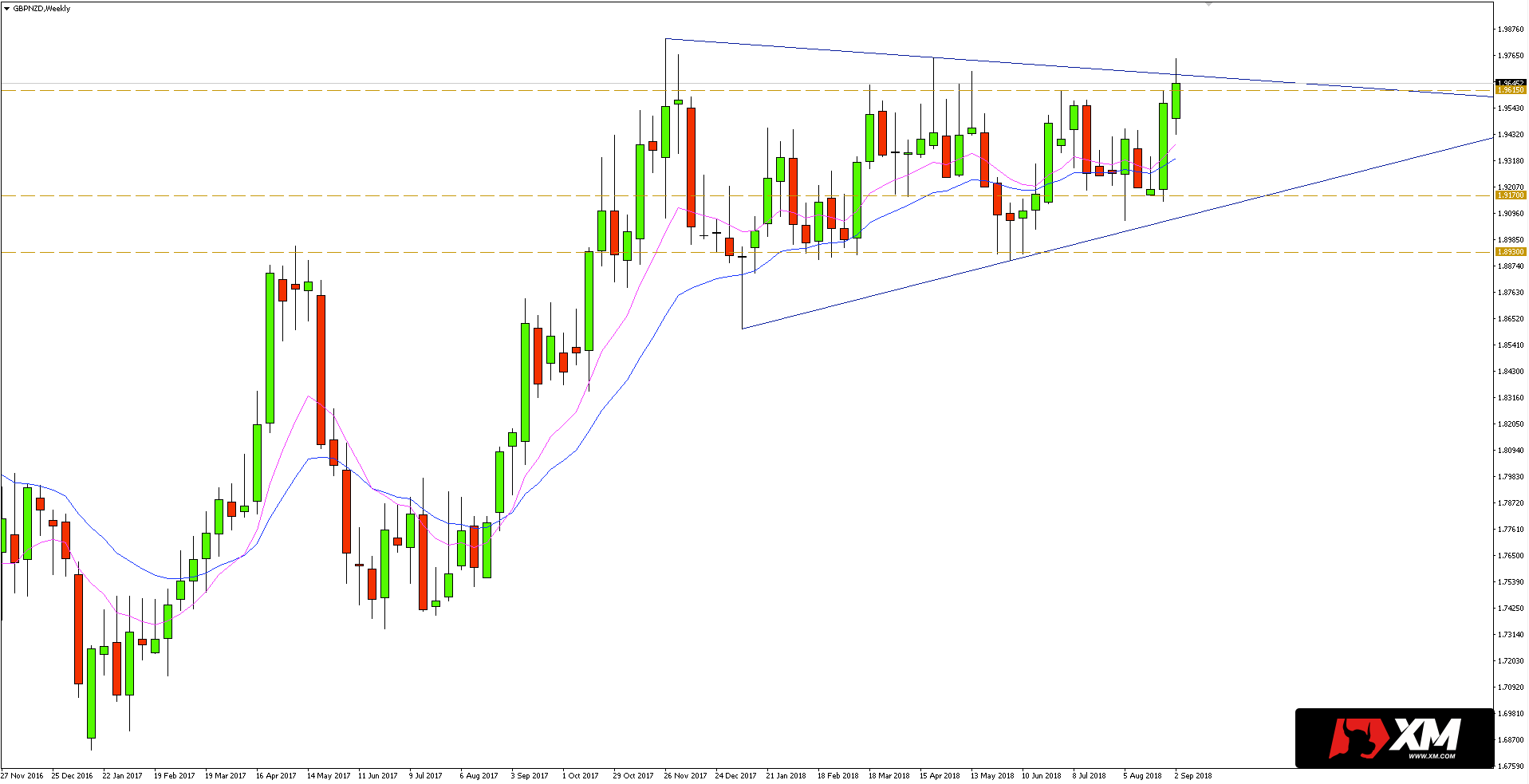

A triangle formation is created on the weekly chart of the GBPNZD , and in addition, significant horizontal resistance within 1.9615 can be distinguished. As you can see below, the course tests both the horizontal and the upper edge of the triangle this week.

Breaking up from this formation would give the potential to continue the previous upward trend. The nearest key resistance in such a scenario can be found in the vicinity of 2.0720, where there are maximums that were established in the week in which the referendum on Brexit took place.

If we have already returned to Brexit, it is worth bearing in mind the many uncertainties associated with the agreement between the EU and the United Kingdom regarding ‘divorce’. Speculation on pairs with a pound can therefore be troublesome due to changes in volatility as a result of emerging news.

As Goldman Sachs points out: “The positive resolution of UK debates with the European Union should lead to easing the cycle of BoE rates increases. Such a departure from pressure should in turn support GBP in the range of around 5% against the dollar and the euro. If the United Kingdom does not reach agreement with the European Union, it would drastically increase the prospect of a sharp correction of the pound […] “.

As Goldman Sachs points out: “The positive resolution of UK debates with the European Union should lead to easing the cycle of BoE rates increases. Such a departure from pressure should in turn support GBP in the range of around 5% against the dollar and the euro. If the United Kingdom does not reach agreement with the European Union, it would drastically increase the prospect of a sharp correction of the pound […] “.

Bearing in mind the above, in the case of the long-term horizon, a better solution may be to wait at least until the end of talks, and preferably to finalize the agreement between the EU and the UK.