Wait… what???? You can’t make this stuff up, but the Dow Jones newswire just did. They later apologized claiming that the article was a “technical error.” The ordeal did seem a bit more elaborate than a simple glitch. Several headline alerts were sent…

Wait… what???? You can’t make this stuff up, but the Dow Jones newswire just did. They later apologized claiming that the article was a “technical error.” The ordeal did seem a bit more elaborate than a simple glitch. Several headline alerts were sent…

…and the full article included a fair bit of detail…

It seems like somebody was testing some serious news algos. I’ve heard of fake news but this one takes the cake.

Bitcoin “Flash Crash”

The popular Crypto News website CoinDesk displayed a price plunge of about $600 per coin for almost 10 full minutes. Even though no major exchange was showing the sudden price movement some financial media ran with the story anyway.

Coindesk has since updated their charts to remove the foul price quote and CNBC has completely revamped the article in which they ran with the story but the original tweet has not been removed.

This one we can probably chalk up to overzealous financial reporting and click bait. Well…. can’t blame them there 😉

Bitcoin Scaling

You’ve probably heard by now that bitcoin is currently undergoing some serious scaling issues at the moment. The main issue is that the network needs to be able to handle a lot more transactions per second if indeed it is to compete with the world’s biggest payment processors.

Visa currently handles about 24,000 transactions per second. Bitcoin would struggle if it were to see a sustained volume of more than 7 transactions per second. We’re well under that level at the moment but as the use of bitcoin continues to grow it’s something that needs to be worked out quickly.

This graph shows the average transactions per second since May 2016…

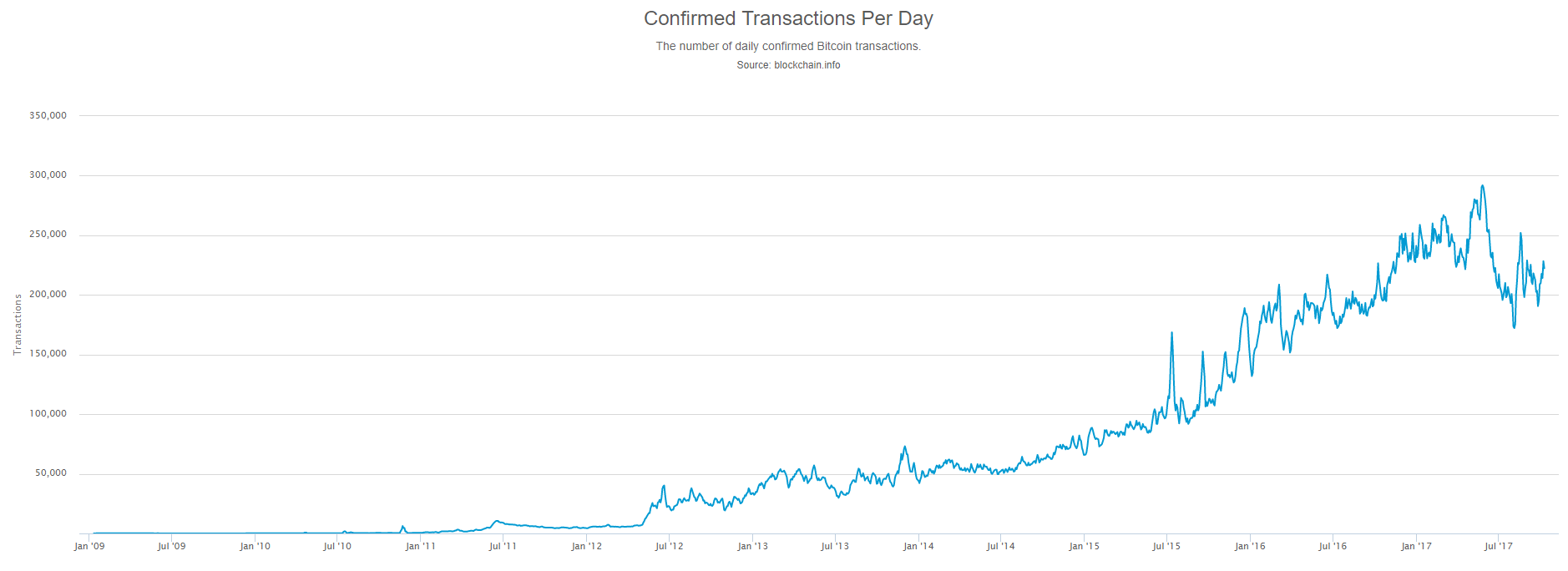

and this one demonstrates the fast pace of bitcoin adoption by showing the average number of transactions per day since the blockchain began.

Segwit2x

The debate on how to improve the network speed is heating up and the proposal currently on the table is to double the size of each block in the blockchain from 1 Megabyte to 2 Megabytes.

The process to do this is called a hard fork and it would essentially create a new bitcoin that people would then need to transfer to. The estimated date for this to happen is on or around November 18th.

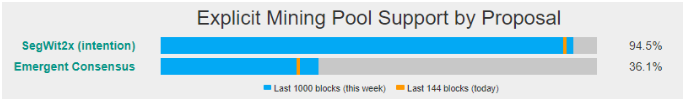

The miners are currently signaling in strong favor of this solution with more than 94% of mining power onboard.

However, much of the community is largely opposed. As this is extremely political and extremely democratic each side does their best to try and force their ideas on the rest of the network.

What’s in a name?

The main question here is what will the new bitcoin be called. Ideally, the proponents of the Segwit2x would like it to simply be called bitcoin.

This could of course create a problem, especially if not everybody is on the same page. If we had two different currencies both with the same name it would create mass confusion and chaos as nobody would really be sure what they’re sending where and who accepts what. The popular exchange site Bitfinex has made the call that they will be calling the old bitcoin BTC and will call the new one B2X.

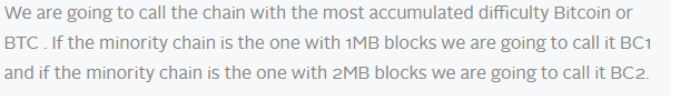

A Hong Kong based wallet and debit card provider named Xapo has issued the following statement.

Meaning, that they are going to support whichever currency the network as a whole decides. Therein lies the problem.

So what’s the solution?

The price of bitcoin however doesn’t seem to be phased by all this and is currently testing its all time high of $5000 per coin.

So, either the alternative investment community is not aware of the dangers lurking or they simply don’t care.

After all, we had some very similar issue on August 1st with the argument whether to implement Segwit or not and even though there was a lot of fuss then, the average user was largely unphased and the price has nearly doubled since that time.

My personal hope and best educated guess is that at the critical moment the community will indeed come together to realize the best solution. Despite all the fuss and bother it does seem likely that we can get through it rather painlessly.

What else?

As far as other markets are concerned all eyes now on the central banks. Specifically, the FOMC meeting minutes that will be released tonight.

The central banks are the biggest market participants at this time so everything they say or do can have a big impact on the direction of the markets.

Tonight, traders will hyper-focus on if the Fed will raise interest rates in December and how they plan to unload their balance sheet.

Tomorrow, there will be a monetary policy conference in Washington DC that will include speeches from several Fed officials and a guest appearance from Mario Draghi.

Wishing you an amazing day ahead!