DAX is one of the most popular indexes in the world. It is listed on the Frankfurt Stock Exchange. Virtually daily there is a very large volatility that gives many trading opportunities.

Summary of the session 01/06/2018

At the first session of the month, the DAX index did quite well and increased by 0.95%. In May, the German stock exchange was on minus 1.54% due to the reversal from the high that took place on May 23. The German PMI index for the industry turned out to be better than expected and amounted to 56.9 vs 56.8. Data from the US labor market were also better, which strengthens market expectations regarding the number of rate hikes in 2018.

Among the components of the DAX index, the best result was recorded by Commerzbank, which gained 4.83% and Deutsche Bank increased by 2.76%. The worst performers were Vonovia, which fell 1.14%, and E.ON was down 0.68%.

Naga Markets is an investment company licensed by CySEC, offering access to SwipeStox, a social app for traders, where they can share their trading ideas about Forex, stock indices and CFD’s thanks to simple professional investors’ transaction mirroring.

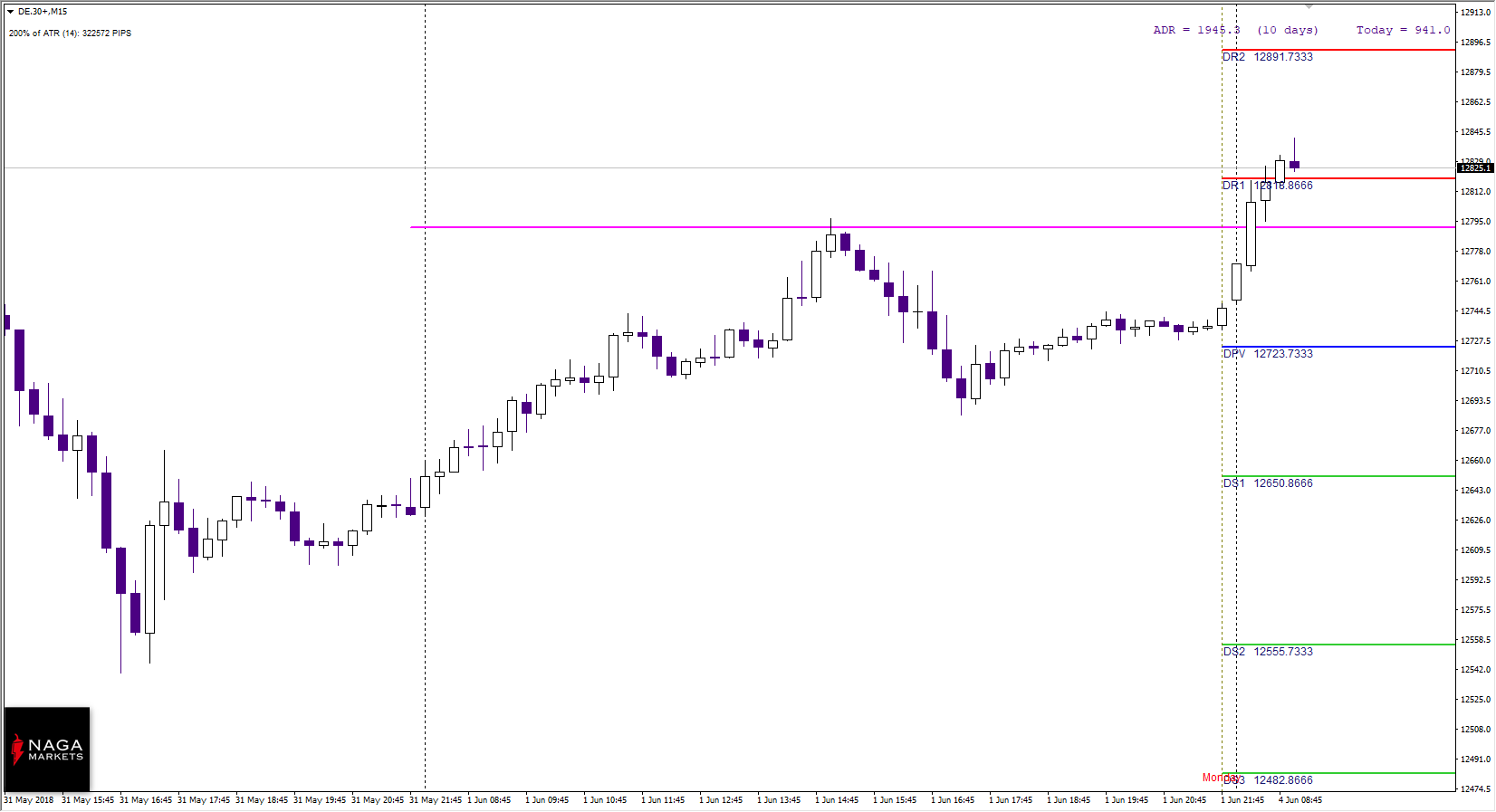

DAX Intraday

DAX reached an important resistance last Friday, it is the monthly Pivot point at 12,800, after which we saw a correction. Today, this level in the morning has been crossed and so far the quotes are also above the daily R1. A weak correction will be an incentive to attempt reaching 12 900, while the fall under the daily pivot will call into question the current increase.

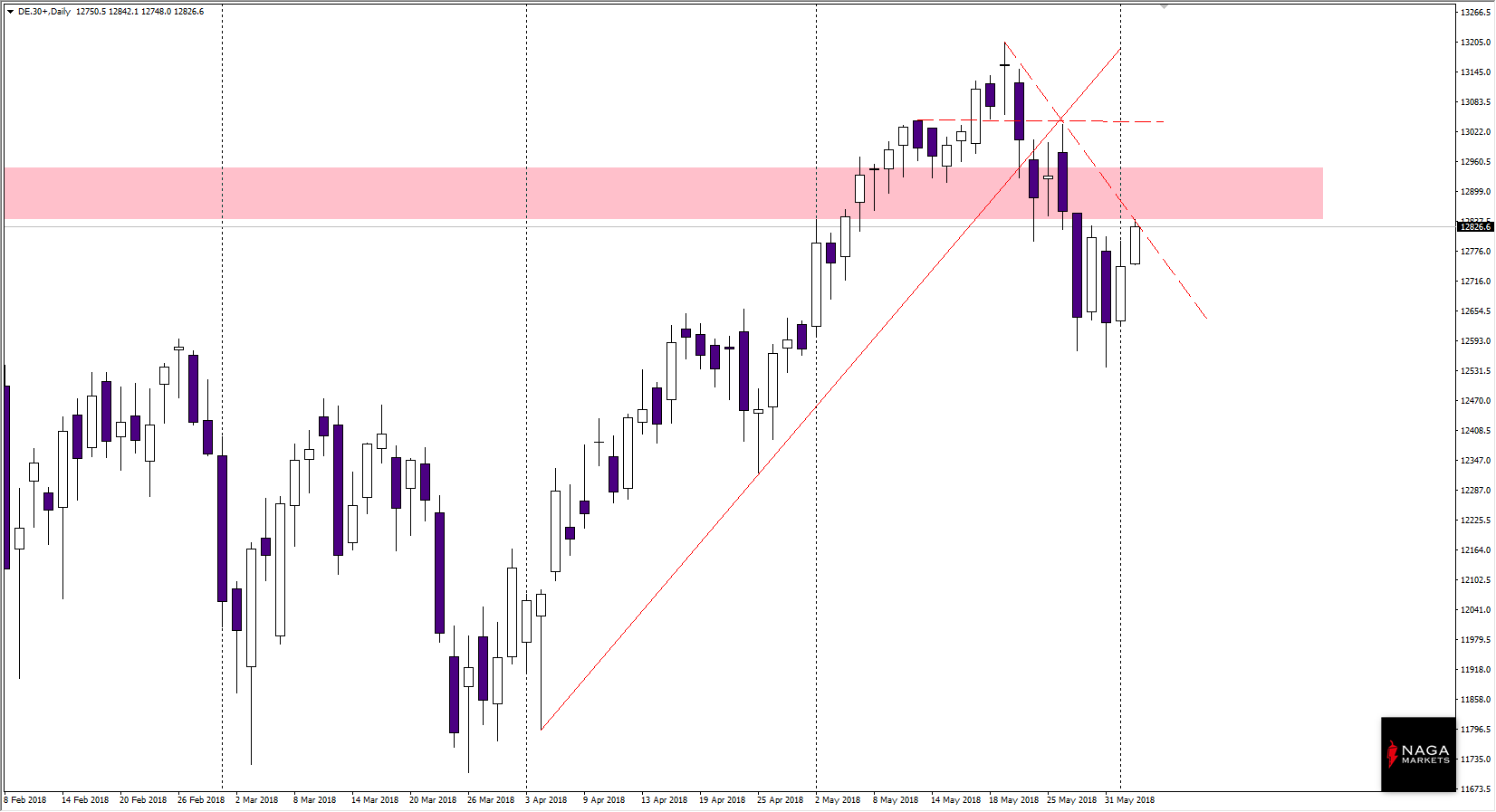

In the wider interval you can see the rejection of the level of 13,000 points, even though the index tried to go up several times. Ultimately, however, it was not possible to maintain a wide support zone, which can now be used as a barrier to supply or a level of profit taking from long positions. In addition, a downward trend line from May highs is in close proximity.