DAX is one of the most popular indexes in the world. It is listed on the Frankfurt Stock Exchange. Virtually daily there is a very large volatility that gives many trading opportunities.

Summary of the session 11/05/2018

The DAX index has another good week behind it and it is growing 1.42% despite a slight fall in the Friday session. In the first half of the month, the level of 13,000 points is played and only 550 points remain to the historical peak. In the previous week, the important resistance zone of 12850-12950 also was broken.

Among the components of the DAX index, the best result was recorded by Deutsche Lufthansa, which gained 3.38% and ThyssenKrupp increased by 1.40%. The worst performers were E.ON, which fell 1.45% and HeidelbergCement was down 1.13%.

Among the components of the DAX index, the best result was recorded by Deutsche Lufthansa, which gained 3.38% and ThyssenKrupp increased by 1.40%. The worst performers were E.ON, which fell 1.45% and HeidelbergCement was down 1.13%.

Naga Markets is an investment company licensed by CySEC, offering access to SwipeStox, a social app for traders, where they can share their trading ideas about Forex, stock indices and CFD’s thanks to simple professional investors’ transaction mirroring.

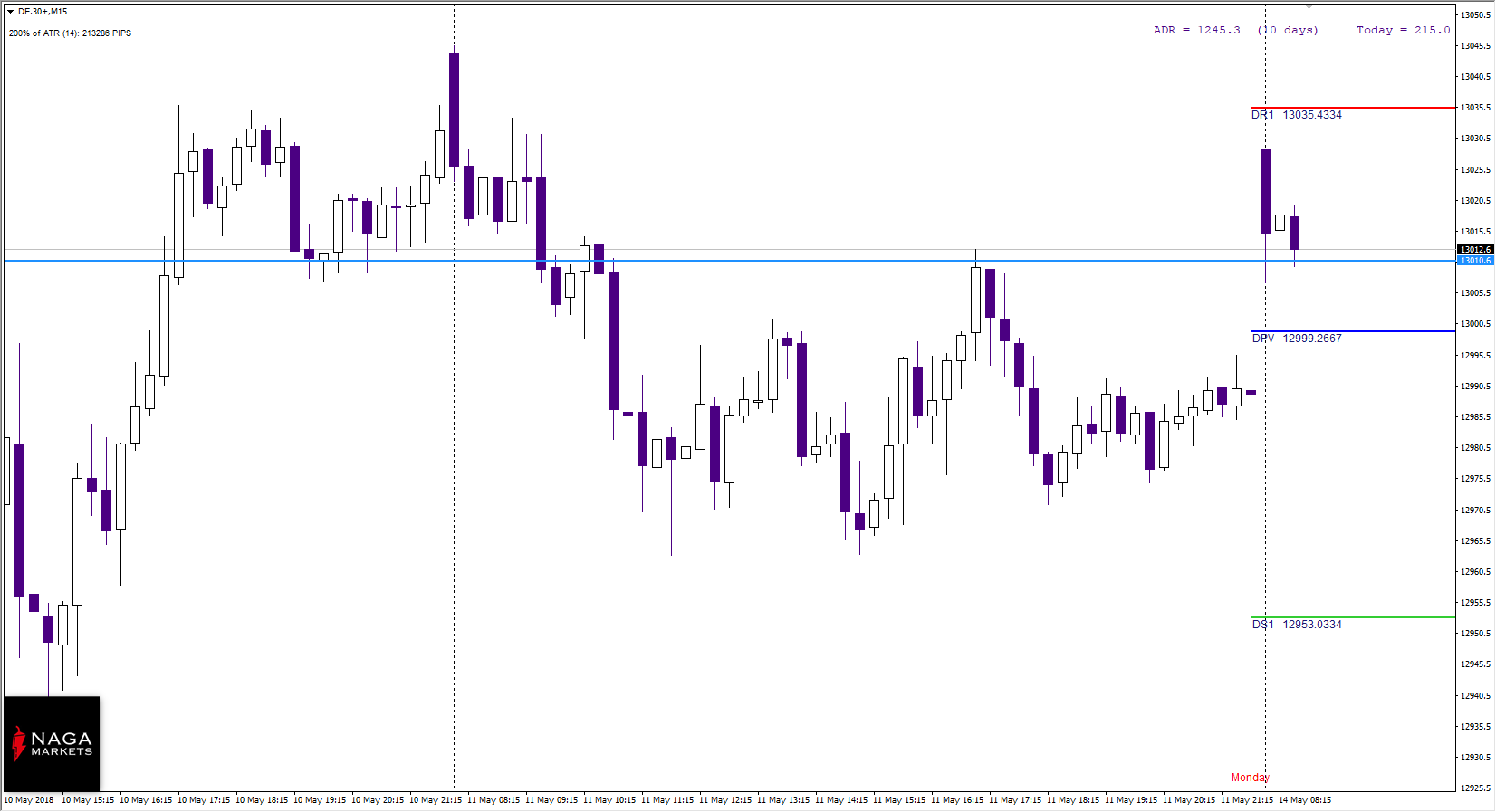

DAX Intraday

In the morning there is demand and the price returns again above 13 000 points, the opening above the direction point also favours stock bulls. The first local resistance is around the Friday maxima and the level R1 – 13035, the price well respected this place in the previous week, so I expect there to be an influx of offers. In the case of downward movement, I expect demand pressure around 12,950 points.

After seven weeks of increases, the German market is already slightly overbought, but the buyers do not seem to care. The defeated resistance zone and level 61.8 should now serve as a support, level 12 850 is a strong bastion of bulls. The stock market saying “Sell in may …” does not seem to be applicable this year, because so far the situation is in line with buyers’ minds.

After seven weeks of increases, the German market is already slightly overbought, but the buyers do not seem to care. The defeated resistance zone and level 61.8 should now serve as a support, level 12 850 is a strong bastion of bulls. The stock market saying “Sell in may …” does not seem to be applicable this year, because so far the situation is in line with buyers’ minds.