DAX is one of the most popular indexes in the world. It is listed on the Frankfurt Stock Exchange. Virtually daily there is a very large volatility that gives many trading opportunities.

Summary of the session 28/05/2018

The first session of the week was not favourable for holders of German shares and despite the initial optimism, the market ended the day 0.58% below. Due to the absence of investors from the US and Great Britain on Monday, attention was focused on the political crisis in Italy, the drops on eurodollar also did not help.

Among the components of the DAX index, the best result was recorded by Deutsche Lufthansa, which gained 1.35% and Adidas increased by 0.90%. The worst came the company Commerzbank falling 2.32% and ThyssenKrupp was down 1.52%. DAX Volatility, which measures the implied volatility of DAX options, increased by 8.48%, reaching 17.97, a new 1-month high.

Naga Markets is an investment company licensed by CySEC, offering access to SwipeStox, a social app for traders, where they can share their trading ideas about Forex, stock indices and CFD’s thanks to simple professional investors’ transaction mirroring.

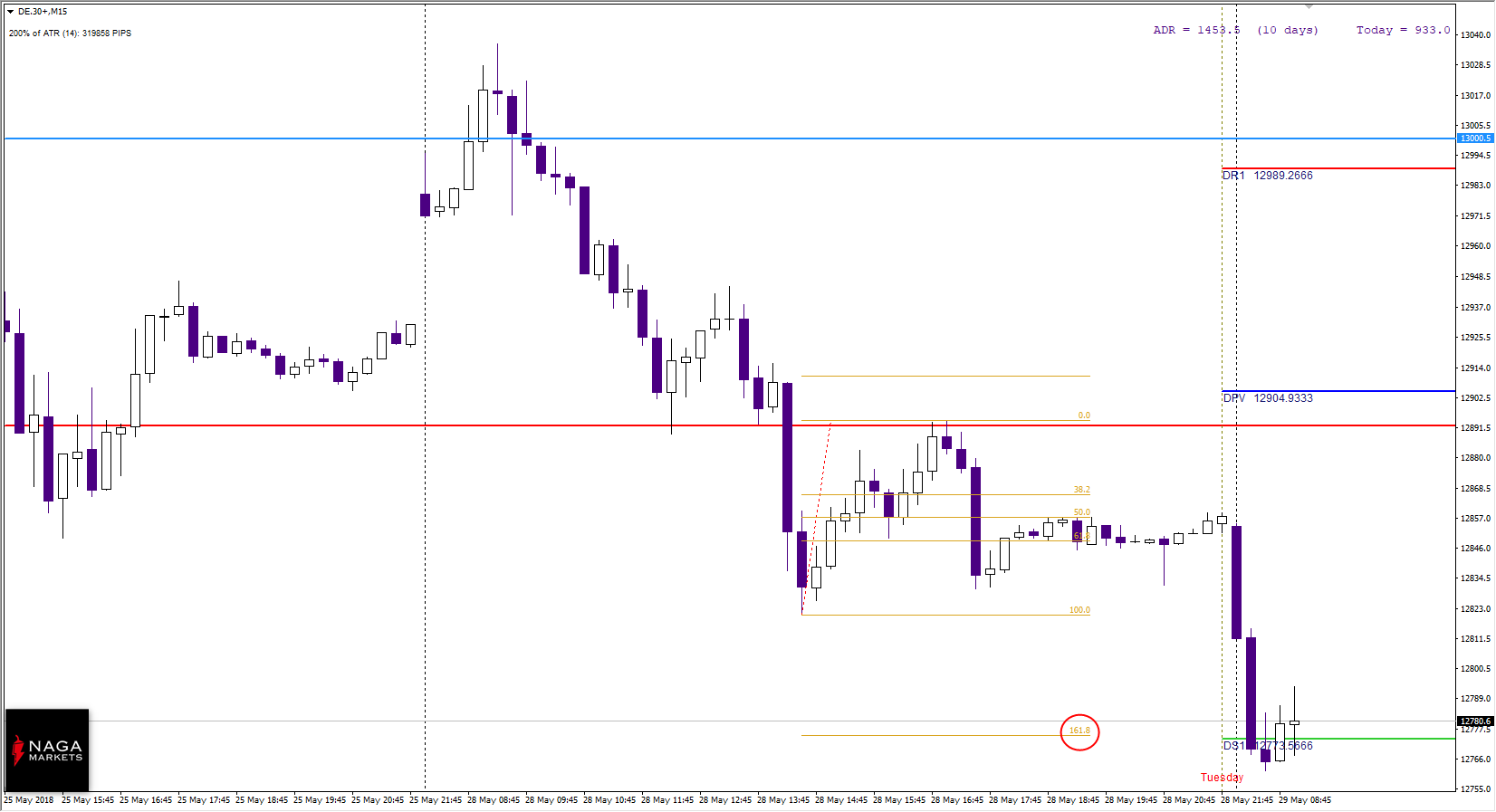

DAX Intraday

The growth above 13,000 was a trap for bulls, and the subsequent sell ended around support S1, where DAX stayed for half of the day. Today, in the morning, quick moves brought DAX to local support S1 12 780.

A large scale of deviation for the fastest players can be an incentive to catch a “falling knife”, in close proximity, there is also an external Fibo measurement 161.8% of the largest correction yesterday.

The breaking of support will be an incentive to drop the market to the area of 12,700 and below, and such a proverbial “final nail into the coffin” DAX could be a dynamic reflection of the eurodollar.