The morning speech of the Governor of the Bank of Japan (BoJ) had a positive impact on the price of the Japanese yen. What Kuroda had to say to weaken significantly USDJPY?

“We will promote the further loosening of monetary policy”

As reported at the end of September the Bank of Japan announced a technical change in approach to shaping the current monetary policy – the transition from actions based on the expansion of the monetary base to activities related mainly to interest rates.

From his speech today it follows that under the new Monetary policy continued priority will be easing in order to achieve the inflation target of around 2% in the shortest possible time. Chief of the Japanese central bank as usual talked a lot and he was full of optimism.

We heard that:

- The economy does not see any major problems that could affect the destabilization of the local financial system

- Policy of negative interest rates has positive influence on the decisions of financial institutions

- There are no clear signs of market risk

- We will allow inflation to exceed the target of 2%

Getting out from the deflationary spiral is a huge problem of BoJ for decades. Therefore Haruhiko Kuroda assured that if inflation will ramp up he will not be trying to artificially keep it at 2%, but will let it develop further. The next most important elements of his speech below:

BoJ will continue to implement extremely adjusted expansionary monetary policy

Many central bank believes that inflation should stay at 2%, while the BoJ is of the opinion that it can grow to 3% or even 4%

Under the current Abenomics (economic policy of Prime Minister Abe) the government was able to introduce such fiscal tools that provide dynamic changes and flexibility

The most surprising comment was about overcoming the current threshold of inflation up to 2%. It is worth noting that the extremely strong easing in recent years have not been able to conquer the consumer inflation even 1p.p.

Japanese yen gains

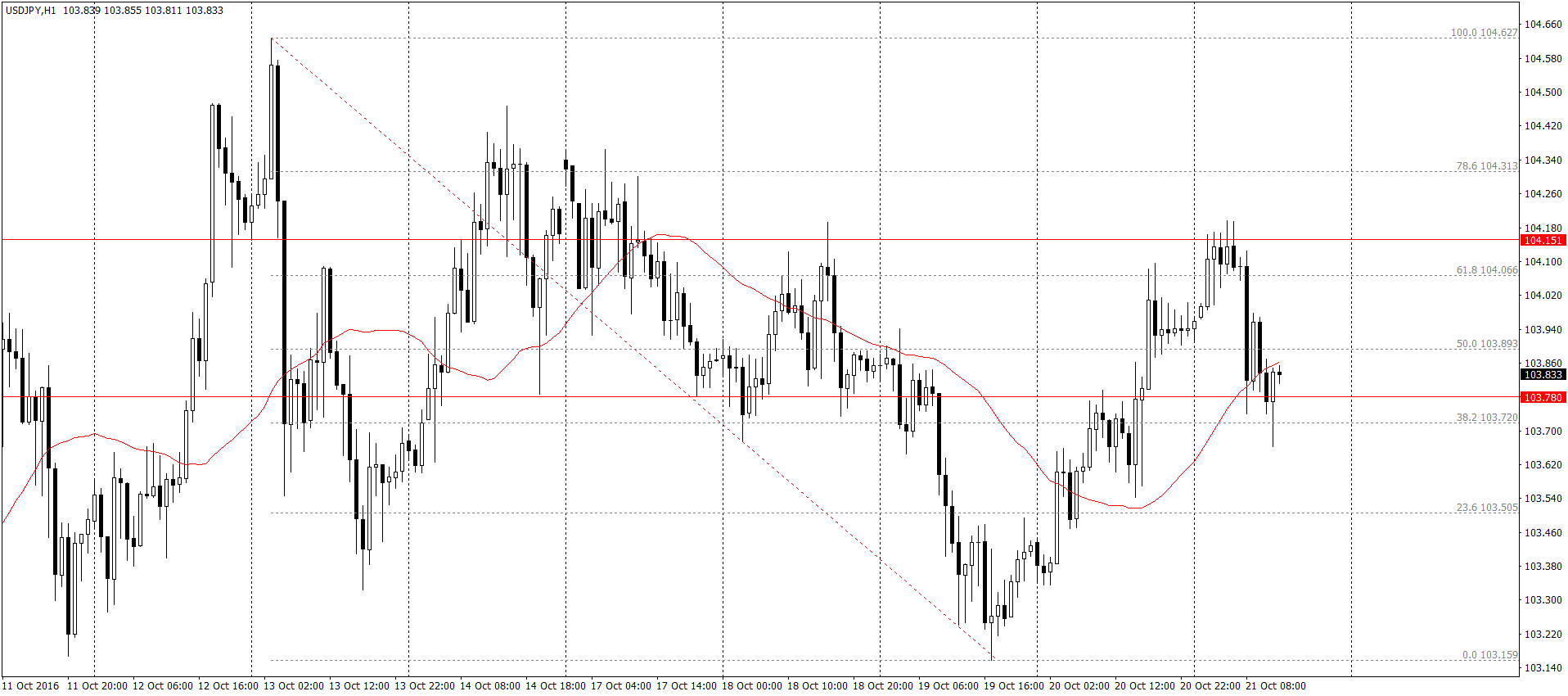

Information about the desire to continue the extremely strong easing in the environment of the new monetary policy provoked a growing reaction of the Japanese yen. In the night hours USDJPY stopped at 104.15 resistance area, after the speech of Kuroda rapidly falls to support 103,780, which is now heavily tested:

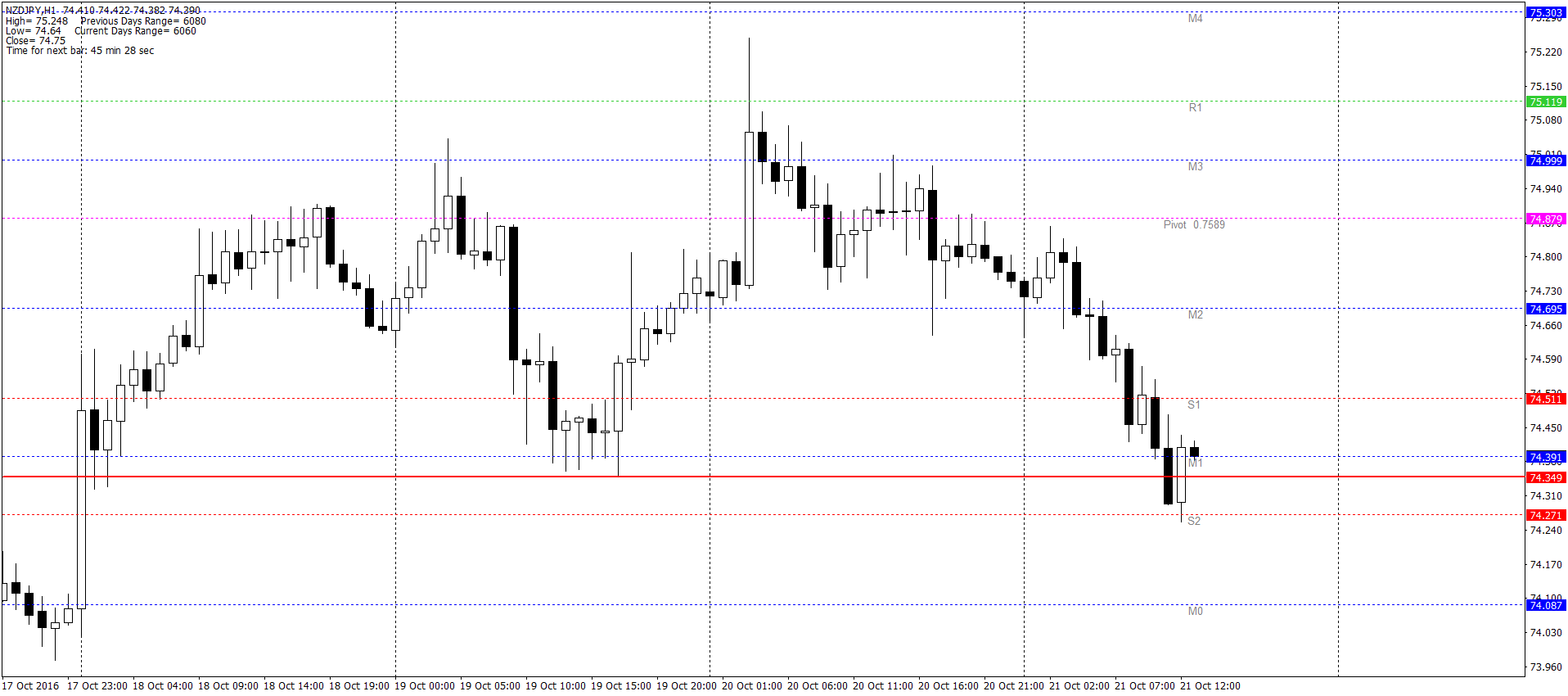

Similar declines, but more gradual, can be seen on the NZDJPY. Here were tested lows from October 19 and the second pivot support. So far, the price in this place rebounded -potential correction to the level of S1 (74.51) would let re-enter short positions:

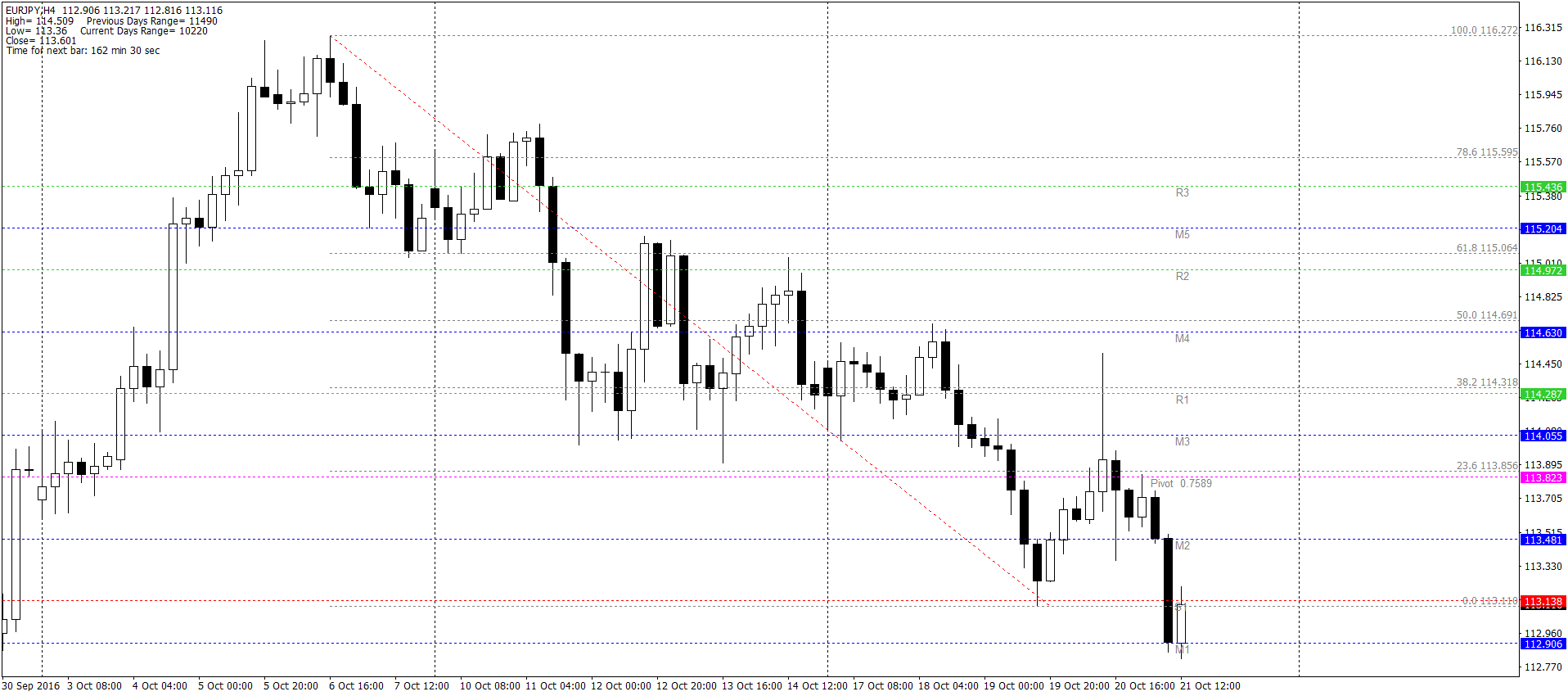

Bears could expect continuation of the downward trend with short positions on EURJPY. Yesterday’s session brought a re-test of 38.2% abolition of the October depreciation in the form of a long pin bar candle, Friday’s session opened under the daily PP and 23.6% abolition. Kuroda helped the pair to fall rapidly to lows of this week, which in combination with S1 PP 113.14 area, are being tested from the bottom, which can provide an opportunity to open SHORT: