After yesterday’s confusion the market is somewhat calmer and some currency pairs are rebounding from losses caused by the information of FED’s assets purchase tapering. I Invite you to today’s Ichimoku Forex Review where we analyze the most interesting currency pairs using Japanese trading technique:

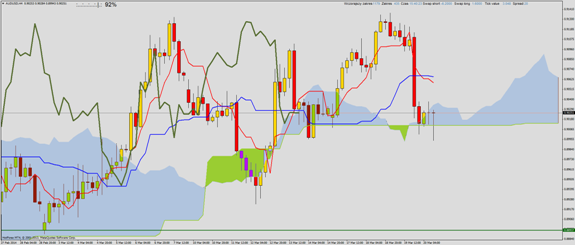

AUD/USD:

An interesting situation on the Australian to US dollar. Pair can give both – sale and buy signals. Last candle looks demand-like and therefore the buy signal seems to be more likely and in line with recent trend, but opposite to yesterday’s momentum.

EUR/AUD:

This morning we saw a sell signal on this pair. It is worth to wait for the correction and returning to the cloud and also the trend confirmation – it will give a better profit-to-risk ratio.

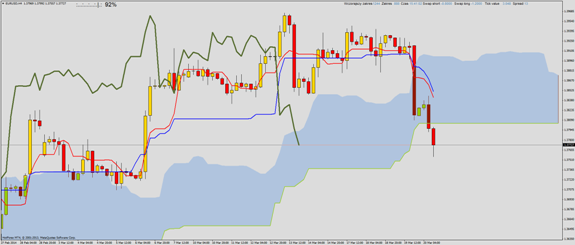

EUR/USD:

We have similiar situation also on Eurodollar. It was possible to open short positions, but now it is worth to wait for the upward correction. Everything speaks clearly for larger downward trend, at least to the cloud from D1 chart – which is about 150 pips down. To be honest, this is the last chance to defend before another big slippage.

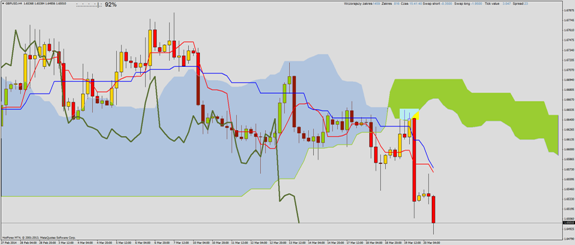

GBP/USD:

Yesterday, I wrote about sell signal on Cable. It definitely gave a chance to earn about 4-5 times more that than the potential risk. Trend now is clearly downward, even the Kumo changed its color showing the bears domination.

NZD/JPY:

Previous candle gave a buy signal, you can now take advantage of it because the price has dropped even more. SL below the minimum will give about 20 pips of risk with about 90 pips to the first serious resistance.