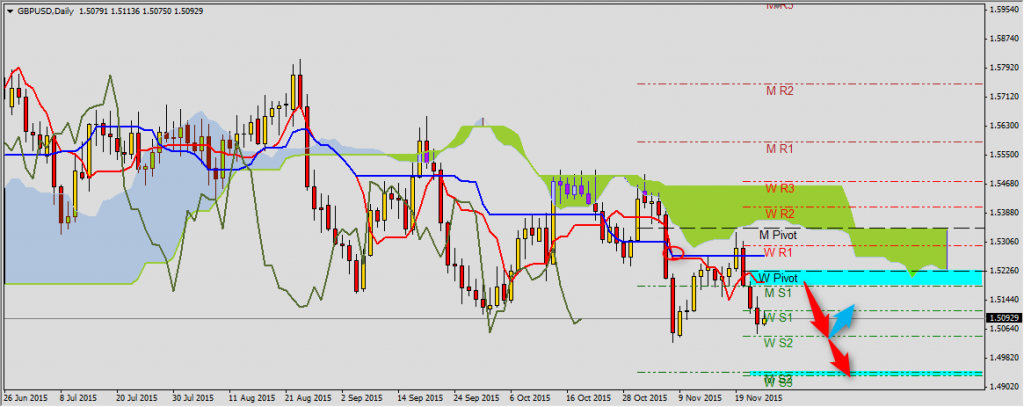

GBPUSD

As we can see on GBPUSD chart correction of bearish trend stopped below monthly pivot and Senkou Span B 1.5342. After breaking Tenkan-sen 1.5213 support sell signal was generated and price got close to weekly S2 support 1.5043. Resistance area 1.5183-1.5225 is set by monthly S1, Tenkan-sen and weekly pivot. If bearish trend will be continued the range is 1.4943-1.4933 area set by weekly S3 and monthly S2. GBPUSD is currently close to first resistance – weekly S1 1.5114.

You can read Ichimoku strategy description here.

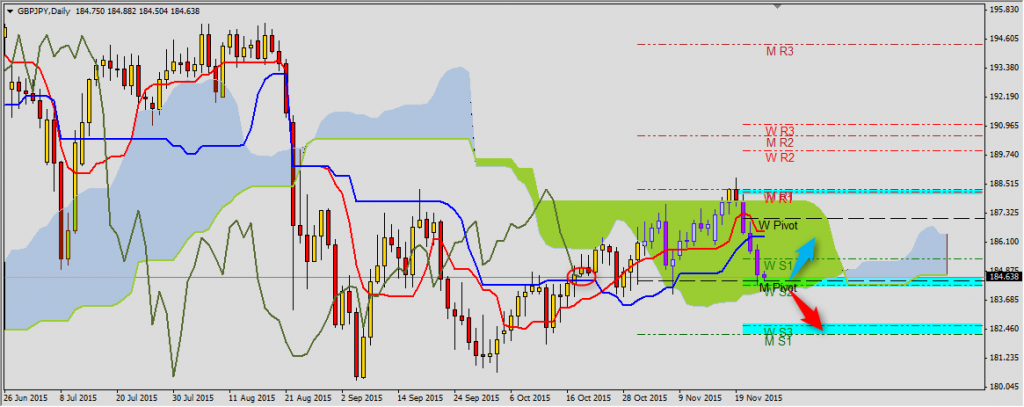

GBPJPY

Next to important support stays GBPJPY. It is 184.72-184.09 area created by Senkou Span B, monthly pivot, weekly S2 and Kumo bottom. what’s more Chikou Span is next to Kijun-sen support and it can cause correction gains to weekly S1 185.13. Break from Kumo will be a signal of continuation of decreases to 182.59-182.22 area, wherewe can find weekly S3 and monthly S1. GBPUSD going back to Kijun-sen 186.31 will be a sign of side trend on currency pairs.

YOU CAN TRADE USING ICHIMOKU STRATEGY WITH FREE FXGROW ACCOUNT.

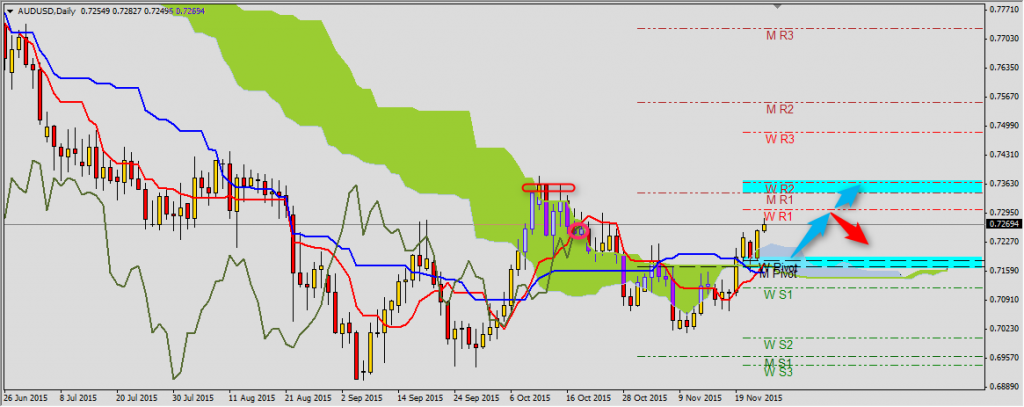

AUDUSD

Reverse situation is on AUDUSD which is moving to resistance at weekly R1 0.7303. Chikou Span B reached chart and Tenkan-sen what can indicate temporary correction on Aussie. The most important area 0.7342-0.7366 (monthly R1 – weekly R2), which covers high from October 12th. As you can see on the chart, bullish trend started from support created by pivots.