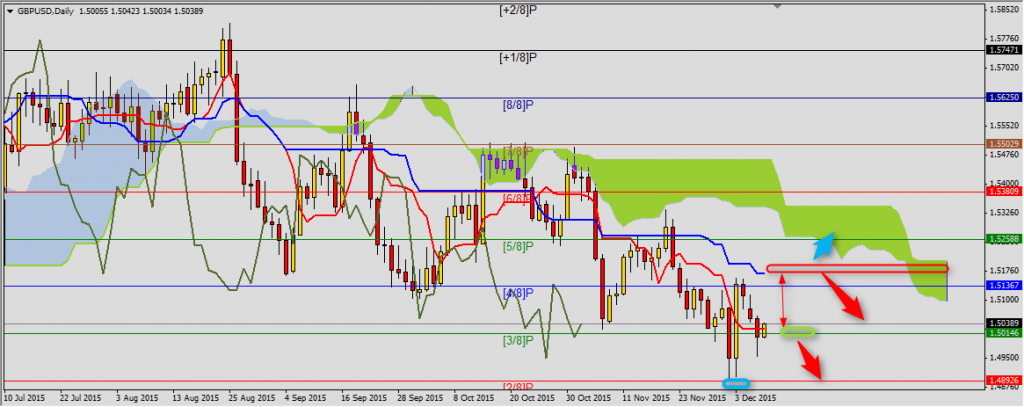

GBPUSD

Yesterday there was signal generated after decrease below Tenkan-sen 1.5026, but price quickly came back above this level. Now with (3/8)P 1.5015 it is support area. In this case there is possibility of correction of bearish trend to (4/8)P 1.5137 and Kijun-sen 1.5170. Above Senkou Span B 1.5201 GBPUSD will turn into side trend. Because of strong bullish candle from December 3rd we can expect continuation of bearish trend only after breaking its low.

You can read Ichimoku strategy description here.

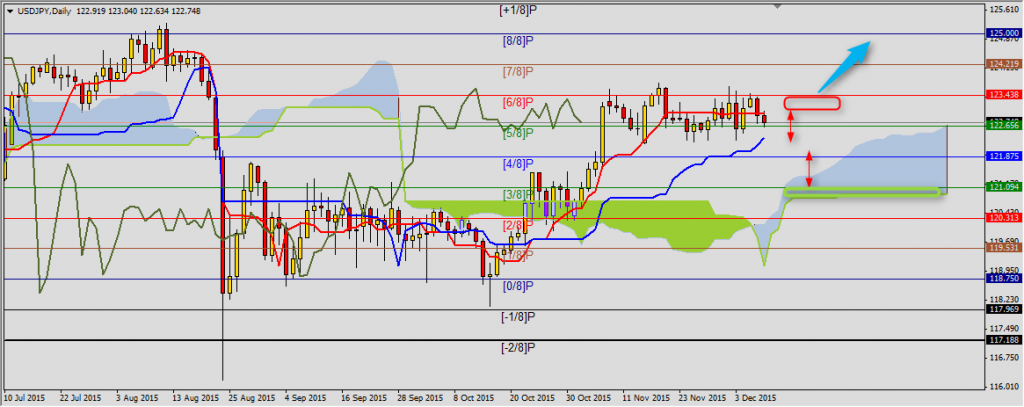

USDJPY

Similar situation here. Not only breaking Tenkan-sen 122.98 is needed to generate buy signal, but also break above (6/8)P 123.44. Support area are set by: Kijun-sen 122.37, (4/8)P 121.88 and Senkou Span B 120.90.

YOU CAN TRADE USING ICHIMOKU STRATEGY WITH FREE FXGROW ACCOUNT.

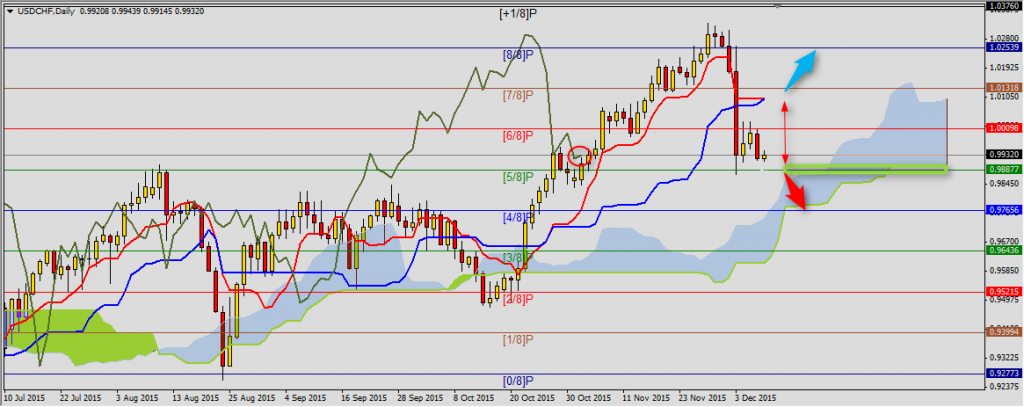

USDCHF

This pair is in very interesting position. Senkou Span B support 0.9901 and (5/8)P 0.9888 are defended. Both levels differ bullish trend from side one. First resistance is at Kijun-sen 1.0100 and only breaking this level exclude drop of USDCHF to (4/8)P 0.9766. It can be solved tomorrow morning. Maybe Swiss Cental Bank will do something unexpected. They are complaining about CHF being too strong all the time, it harms country’s export. Weakening of Swiss franc is a long term target of monetary policy of this country.