Ichimoku is an investment strategy of trend following, it works great on H4, D1 and higher time frames. In this series of articles I present my setups and observations using Ichimoku, supports and resistances and Price Action patterns.

Ichimoku is an investment strategy of trend following, it works great on H4, D1 and higher time frames. In this series of articles I present my setups and observations using Ichimoku, supports and resistances and Price Action patterns.

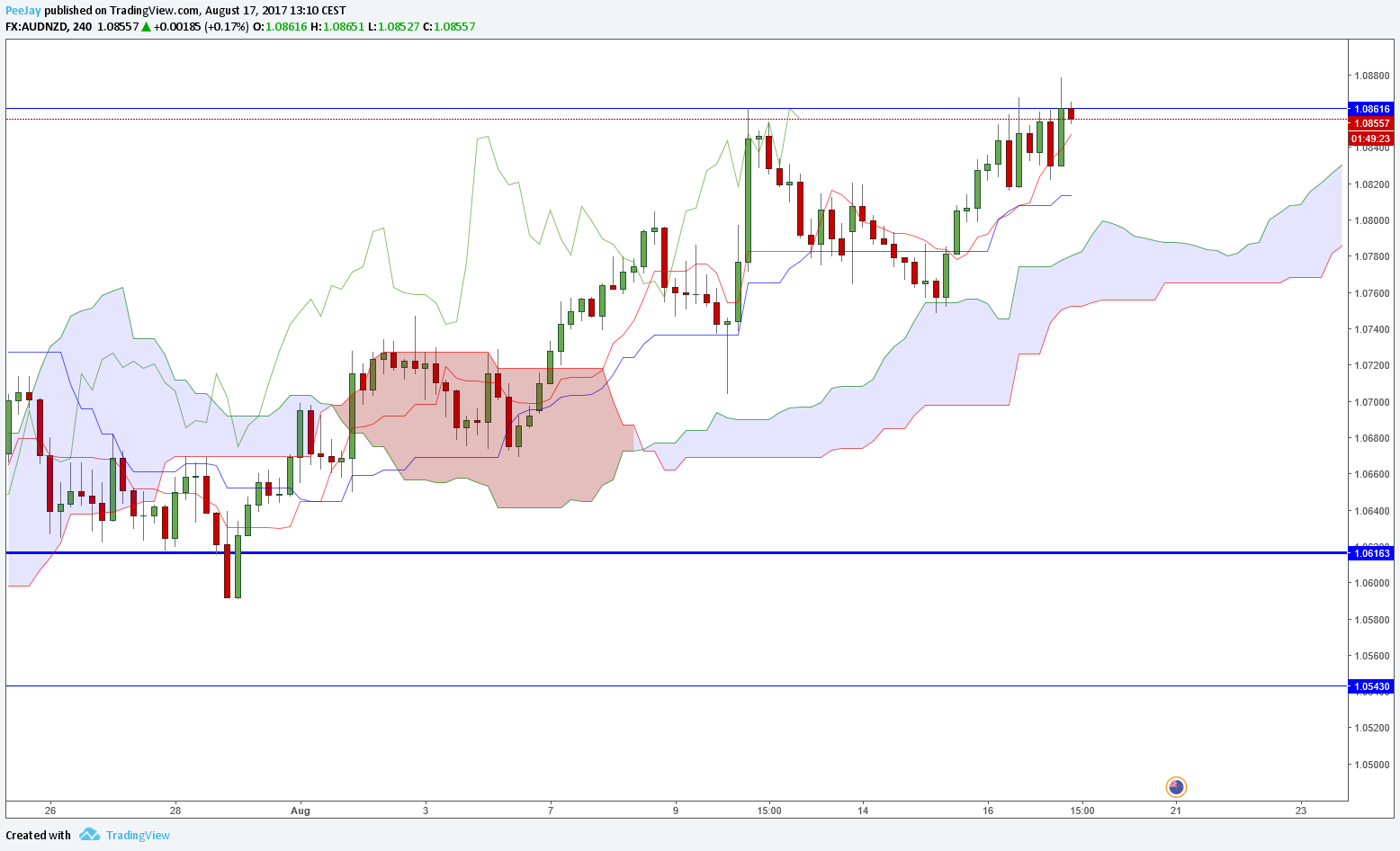

AUDNZD

On H4 chart we can see that price since beginning of August was appreciating. Latelty there was a stronger bearish correction which was almost totally negated. Tenkan crossed Kijun line what is a signal for further gains. To be certain I suggest to wait with opening the position for the break above resistance set by previous high from August 10th.

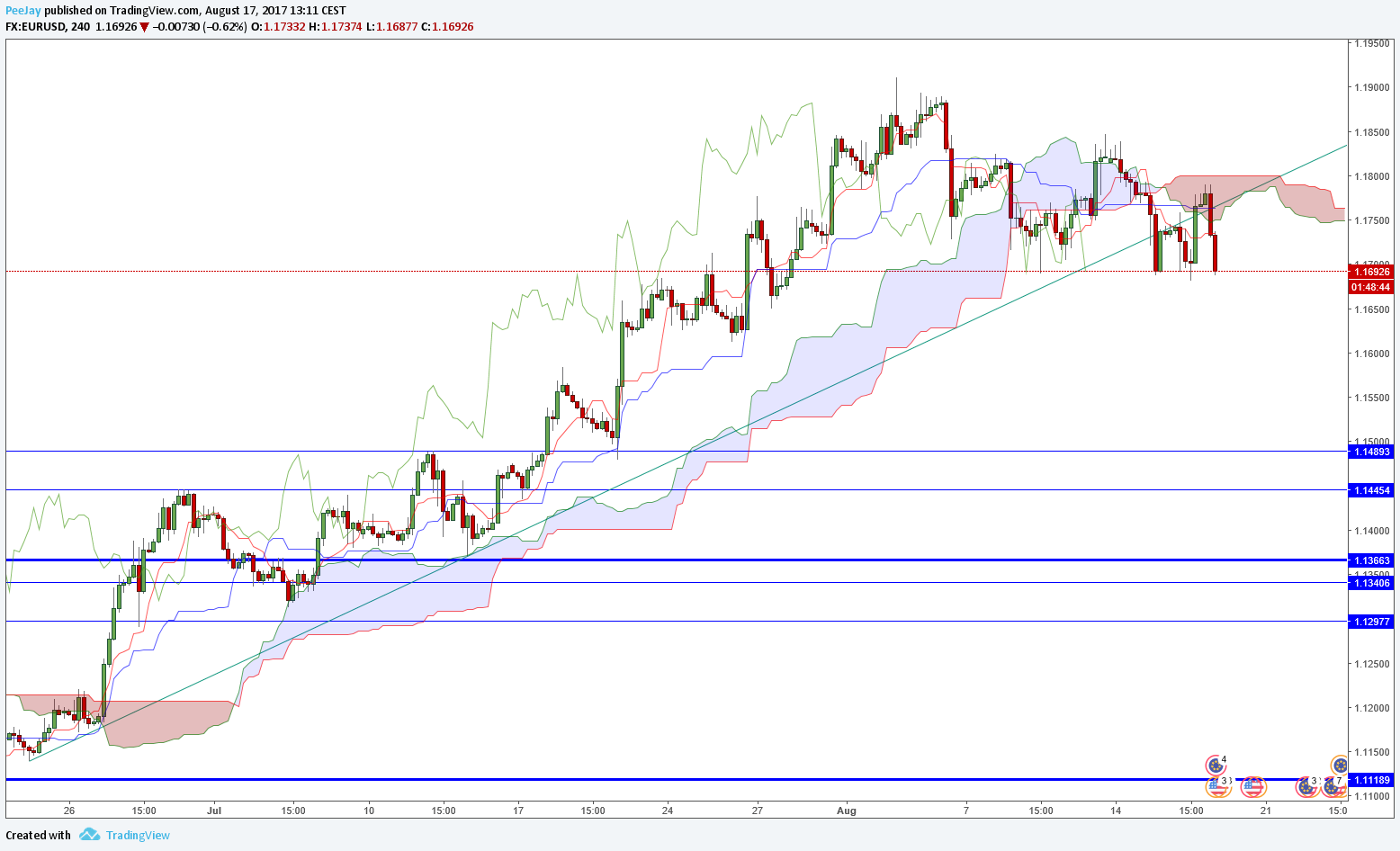

EURUSD

On Tuesday price broke below working since June bullish trend line. Kumo cloud changed colour to bearish and Tenkan crossed below Kijun, generating sell signal. Currently there is a good moment to open short position, we can create sell order a little below last lows.

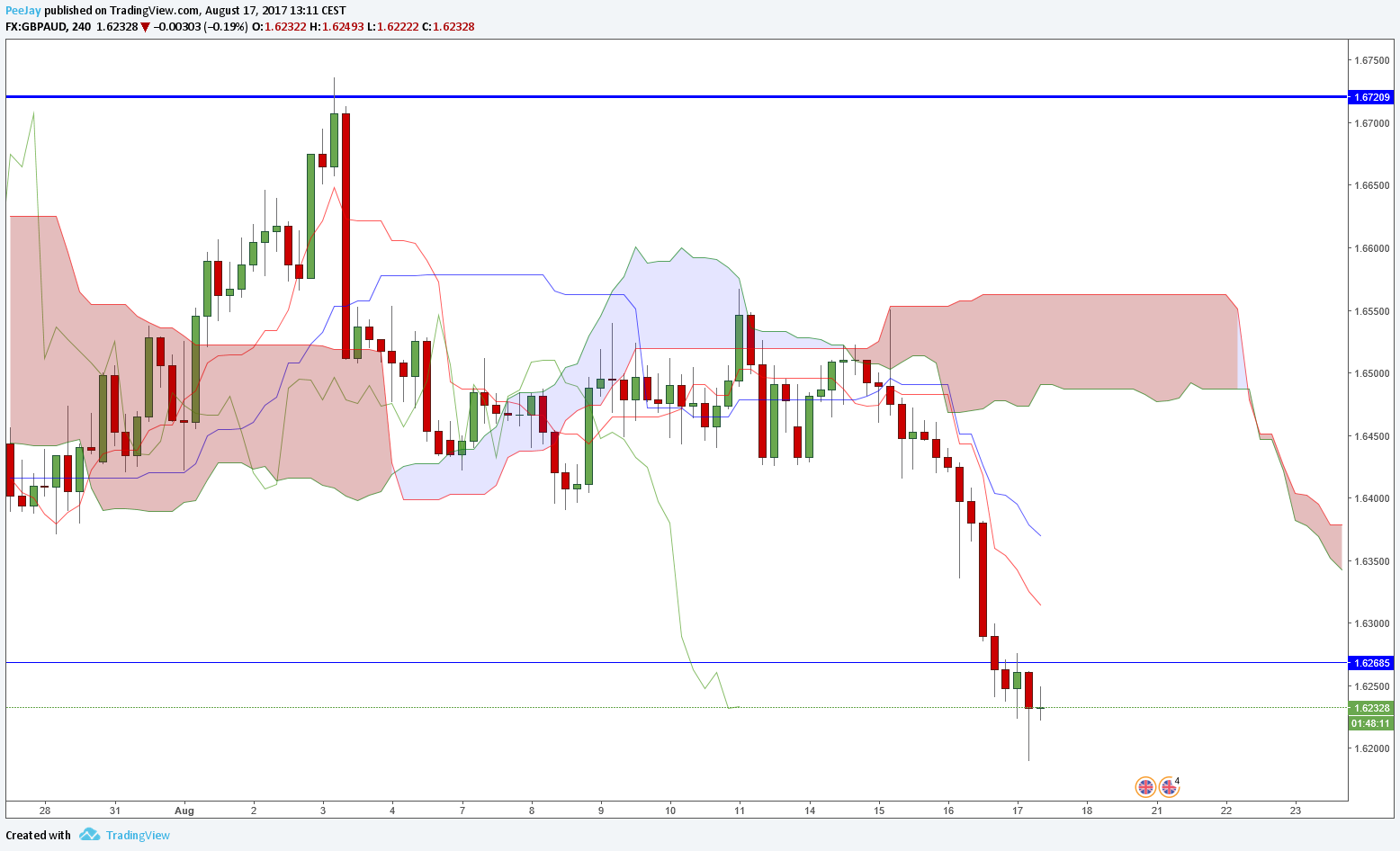

GBPAUD

Opportunity to open short position happened some time ago, we could already make some oney. I trade with FXTM broker, who offers low spreds starting from 0.1 pips and fast order execution. Currently price broke below support at 1.6268, in this area we can look for opportunity to open short position.

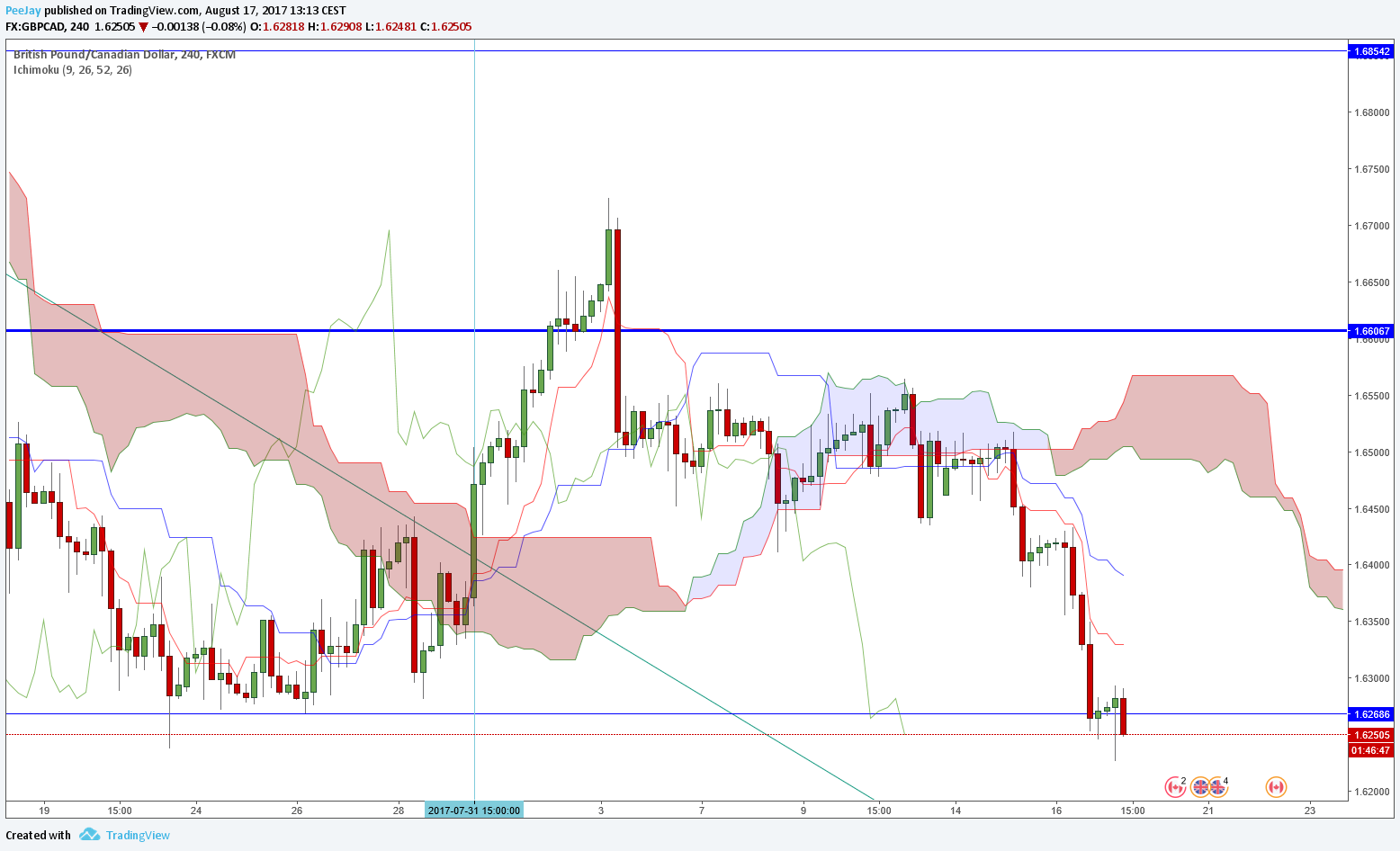

GBPCAD

Situation looks almost identical as on GBPAUD. On H4 chart after strong decreases price is next to support area 1.6268. There it can try to come back above broken support, if ti will fail, we can open short position. Remember that you should watch for correlation during trading, if you open position on GBPAUD, do not open the same one on GBPCAD, you will increase your risk exposure.