Ichimoku is an investment strategy of trend following, it works great on H4, D1 and higher time frames. In this series of articles I present my setups and observations using Ichimoku, supports and resistances and Price Action patterns. You can also check previous Ichimoku overview.

Ichimoku is an investment strategy of trend following, it works great on H4, D1 and higher time frames. In this series of articles I present my setups and observations using Ichimoku, supports and resistances and Price Action patterns. You can also check previous Ichimoku overview.

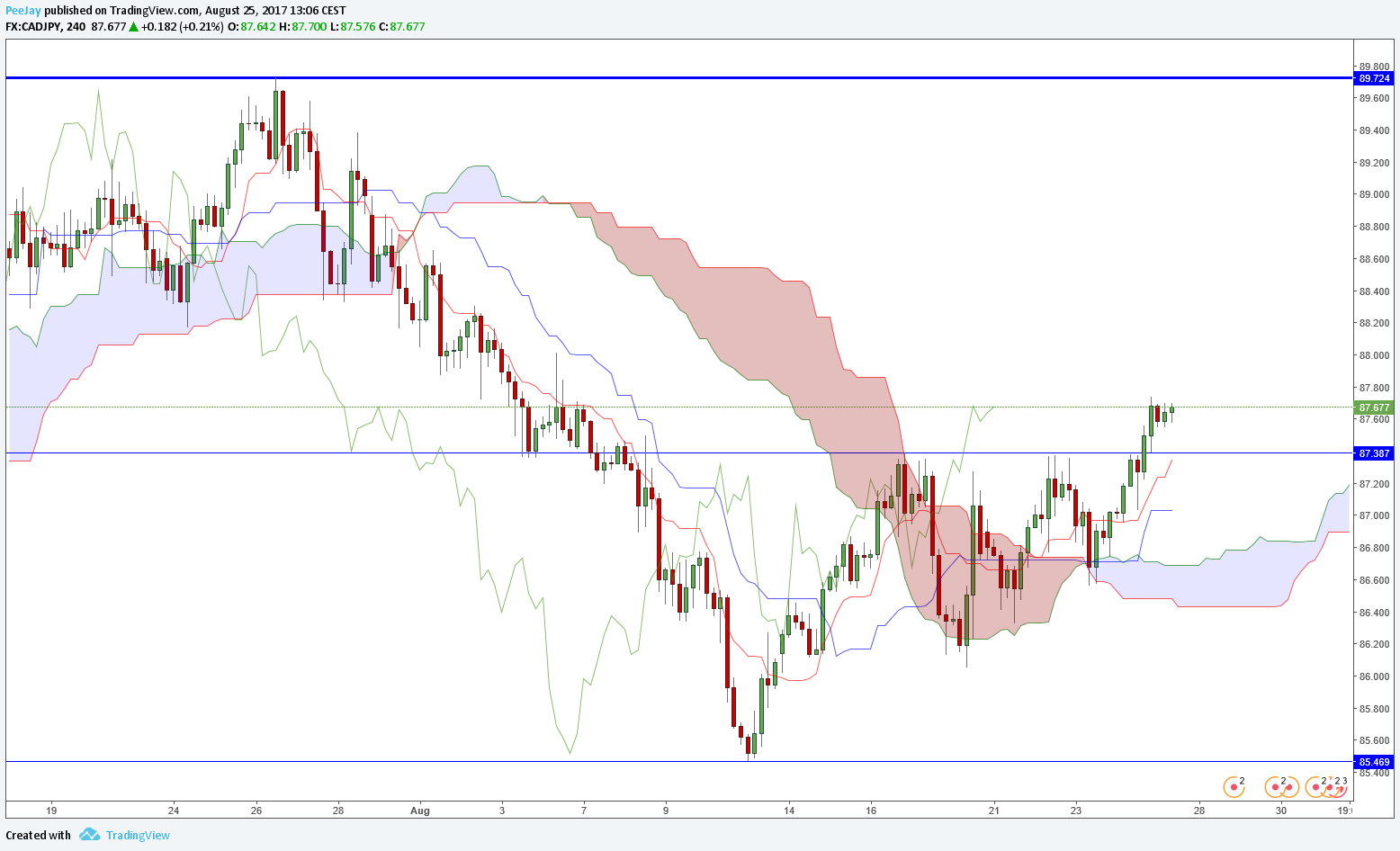

CADJPY

On H4 chart we can see that after third try price managed to break above resistance at 87.40, now it should work as support. It is a good moment to open long position, Kumo cloud changed colour to bullish and Tenkan line is above Kijun. Another important level is resistance from daily chart at 89.70, so we have a lot of space for appreciation.

GBPAUD

We still don’t see strong losses on GBPAUD. Position opened yesterday at some time gave more than 60 pips of profit, now it is just about 20. We should follow this pair because it may show up that this position was wrong and it is just consolidation or even trend reversal. It should all be clear in the beginning on new week.

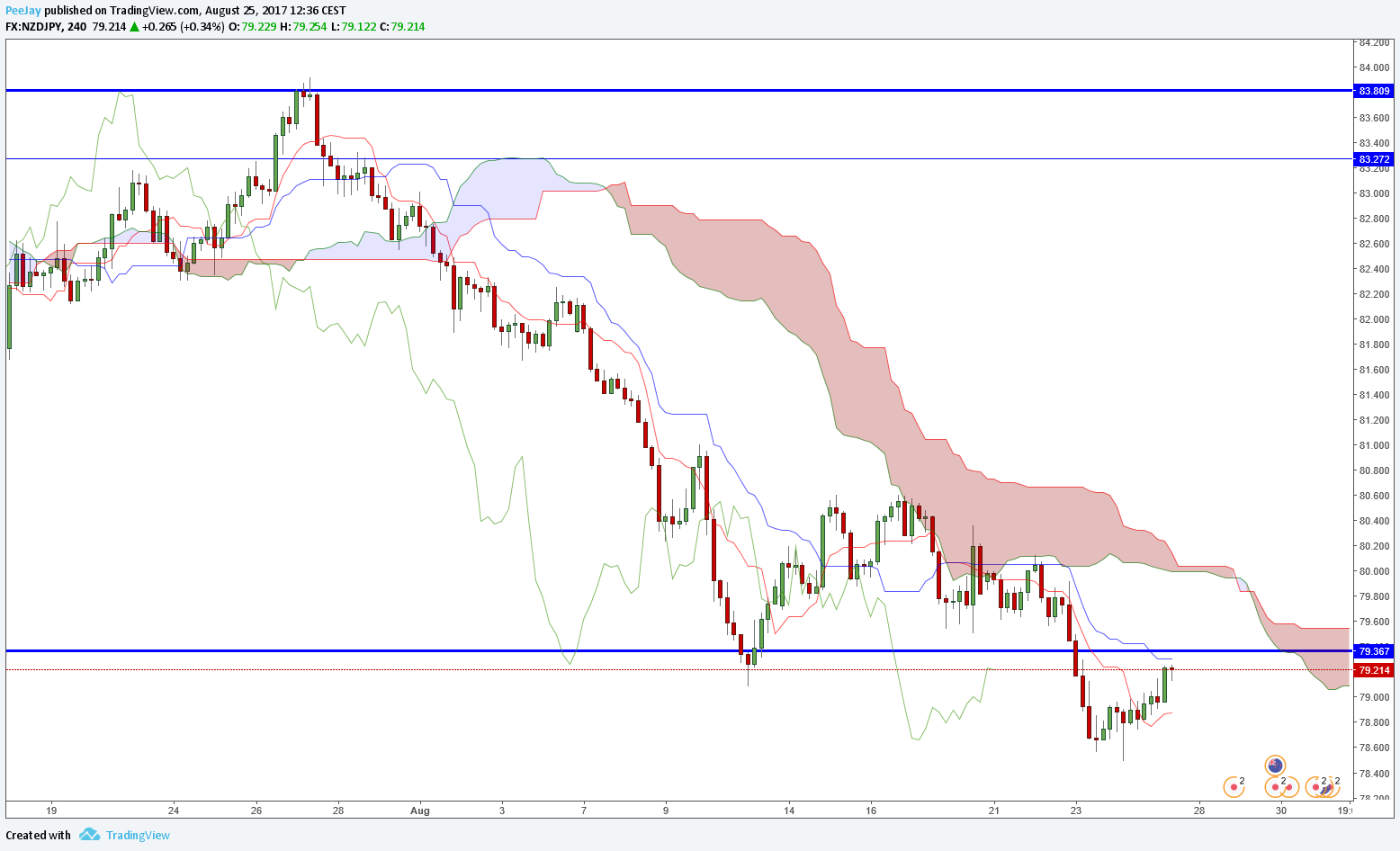

NZDJPY

On the H4 chart of NZDJPY we can see bullish correction of last wave of decreases. Price is getting close to important resistance from the daily chart, which lately was still a support. Kumo cloud is bearish but so far it is really narrow. Tenkan is still below Kijun but the lines will get closer soon. If there will be clear sell signal, we can think about opening short position.