A review of the most interesting investment opportunities is a daily cycle of analyses created under the auspices of the Tickmill broker, in which every day we present the most interesting possible investment setups using Price Action techniques.

A review of the most interesting investment opportunities is a daily cycle of analyses created under the auspices of the Tickmill broker, in which every day we present the most interesting possible investment setups using Price Action techniques.

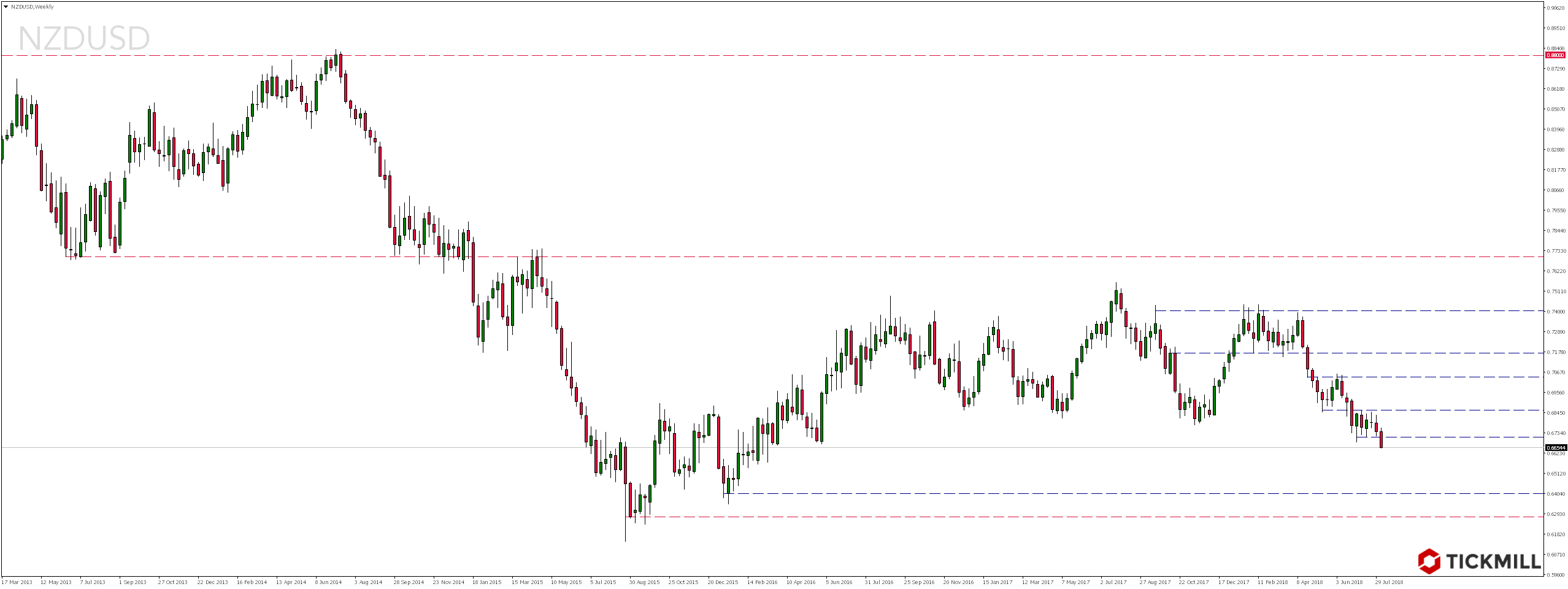

NZDUSD

Yesterday, late evening, we got to know the monetary decision of the RBNZ. Just as keeping the interest rate at the current level of 1.75% did not make any impression on anyone, the lowering of forecasts for the next year was very negatively received by the markets, as a result of which the New Zealand dollar depreciated significantly.

As a result of these drops, the currency pair NZDUSD overcame further technical support and broke down from consolidation lasting for 1.5 months, which could technically open the way to further depreciation.

As a result of these drops, the currency pair NZDUSD overcame further technical support and broke down from consolidation lasting for 1.5 months, which could technically open the way to further depreciation.

Looking at the weekly interval, we notice that if there is no strong demand reaction in the near future that could negate this breakdown, potential drops could reach even level around 0.64 or 0.6280.

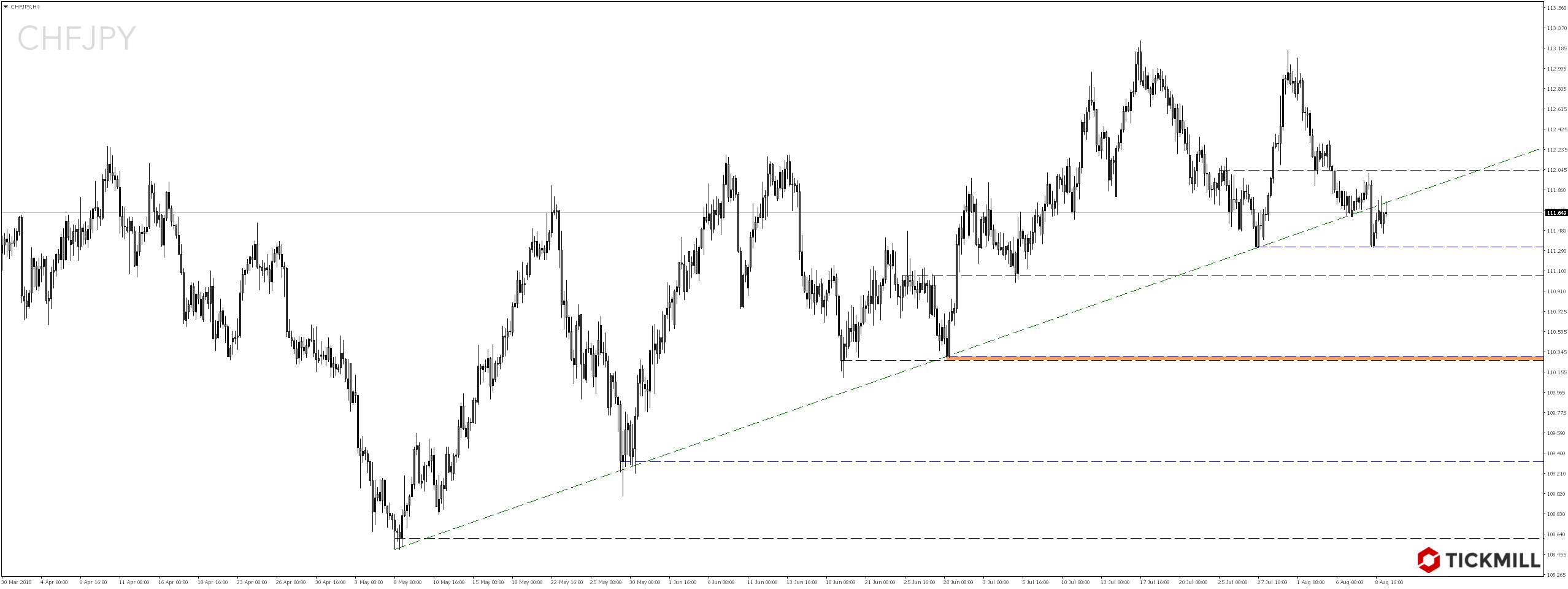

CHFJPY

CHFJPY

The current situation on the CHFJPY is also bearish, where the market is re-testing the yesterday’s uptrend line. If this resistance is permanently rejected, we would expect further declines, for which possible range is around 111.30, 111.05 or even 110.30.

Tickmill is authorised and regulated in the UK by the Financial Conduct Authority (FCA), one of the most respected financial supervisors. Access a wide range of markets, including the Forex market, Stock Exchange Indices, Raw Materials and Bonds. Use some of the lowest spreads on the market. Experience trading at its best with an international broker and gain the advantage of exceptional trading conditions. Open a real account or try a demo account.

Tickmill is authorised and regulated in the UK by the Financial Conduct Authority (FCA), one of the most respected financial supervisors. Access a wide range of markets, including the Forex market, Stock Exchange Indices, Raw Materials and Bonds. Use some of the lowest spreads on the market. Experience trading at its best with an international broker and gain the advantage of exceptional trading conditions. Open a real account or try a demo account.