From Investor to Scalper is a cycle of analysis in which we take one financial instrument and the analysis includes a detailed look at the value from the monthly/weekly chart to the H1/M15.

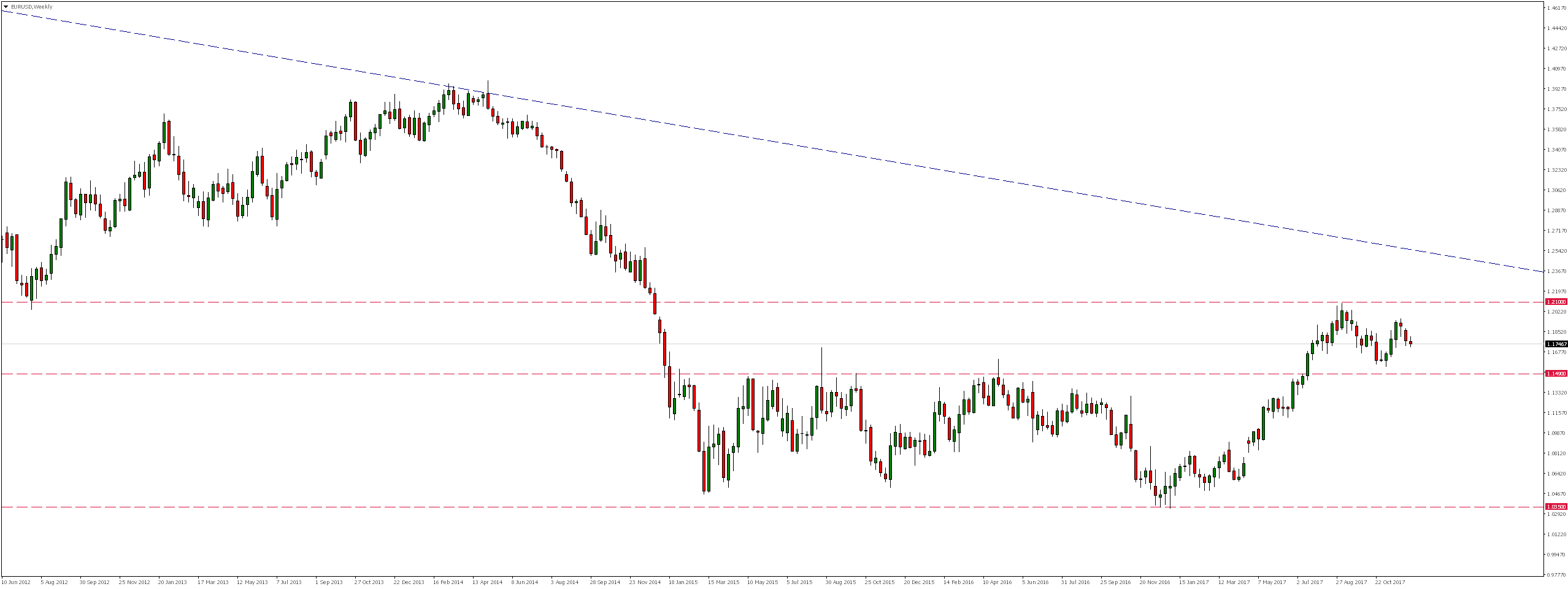

As a result of increases of EURUSD, that lasted almost continuously since mid-December last year, in July this year broke the top of lasting over 2.5 years consolidation and reached vicinity of 1.2100. It is also worth noting that although this level was already defeated in December 2014, it was only its first re-test. Also noteworthy is the fact that the market has not yet tested (as a support) the upper limit of the consolidation mentioned above.

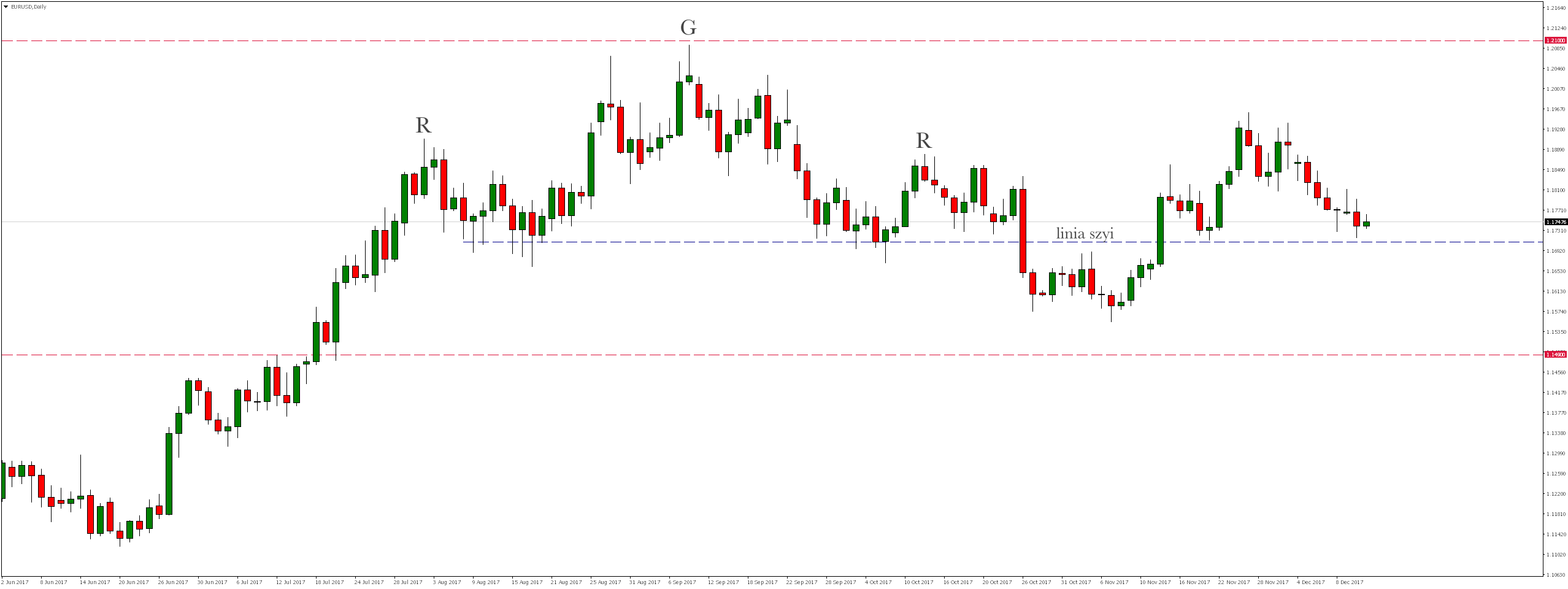

However, that the bearish formation of head and shoulders was created on the daily chart, the later declines did not even reach the level of 1.1490 . Eventually, this formation was negated and now the price is slightly above the neckline of this formation.

Looking at the H4 interval, we notice that there are still about 60 pips to thoroughly test this support. From a technical point of view, the rejection of this zone could be a signal for further increases.

In practice, however, it should be remembered about scheduled at 20:00 FOMC decision on interest rates.

According to Goldman Sachs analysts, the market almost in 100% prices the December increase in the federal funds rate, which will be the third this year. Therefore, the focus will be primarily on the forecasts of further actions in 2018 and subsequent years – the FED’s reaction to the latest tax reform, which should finally come into force, may also be of great importance.

Error, group does not exist! Check your syntax! (ID: 4)

Although in theory the interest rate hike should strengthen the US dollar, it is worth recalling the situation from last year, when the increase was also almost certain. At that time, the market paid much more attention to the forecasts of further movements on rates as a result of which we observed a strong depreciation of the USD. How will it be this time? We’ll find out in the evening.

However, it may turn out that the market will not even reach this support and will immediately start to increase, or that USD appreciation will be so strong that the course will easily overcome this zone.

Nevertheless, it should be remembered that (at least from the point of view of the H1 interval) a downward trend continues. Considering that decisions regarding interest rates are one of the most important publications in the whole month, I would be cautious today with opening any positions on currency pairs and instruments correlated with the US dollar (USD).