We can see a clear dollar strengthening on the markets. It may be a beginning of a larger trend, because USA still waits for rates hike and assets purchase program tapering. Of course we cannot be sure when in how it will take place, but betting on dollar versus weaker currencies sounds like an A+ plan. Let’s start today preview of potential PA setups.

We can see a clear dollar strengthening on the markets. It may be a beginning of a larger trend, because USA still waits for rates hike and assets purchase program tapering. Of course we cannot be sure when in how it will take place, but betting on dollar versus weaker currencies sounds like an A+ plan. Let’s start today preview of potential PA setups.

GBP/JPY:

Pound vs yen still in consolidation above the support. Price falls to 50% retracement of Thursday’s candle which we described as a pin-bar (doji). It allowed to open long position (even yesterday).

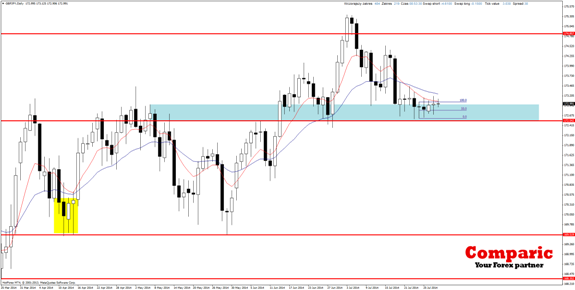

GBP/USD:

Cable approaches support area which may give an opportunity to open long positions. Dollar is getting stronger, but British pound is in long-term upward trend and it is too early to talk about it retracement. If the support breaks, it will change the pair’s momentum to the downward one. It will be worth then to look for sell signals (after 1.6920 re-test).

NZD/USD:

Kiwi still falls and broke key support, closing the daily candle below. However, the breakout may be to small to give robust signals and allow to open shorts with LS slightly above 0.8515. From the other site, if clear sell signal occurs in this area, we should revise short positioning.

USD/CAD:

Loonie break above the resistance with great dynamics. It is worth to wait for a correction, which will test the previous resistance and confirm upward USD/CAD trend.

USD/JPY:

Ninja approaches higher consolidation band. Lately playing short on this level and then long near lower band is really a profit-maker. Now it is too early to talk about opening shorts. Firstly we need to see resistance challenge and sell signal.