Gatecoin is very excited to announce that we have listed litecoin (LTC), a major cryptocurrency and one of the first serious alternatives to bitcoin (altcoins) on our exchange.

Clients can now trade LTC with BTC, ETH and EUR.

LTCUSD and LTCHKD pairs are also available, however, USD and HKD transfers are still on hold for several weeks while we work to activate our new payment processing solutions. See last week’s update for details.

What is litecoin?

Like bitcoin, litecoin was designed to be a peer to peer digital currency that enables high speed and low-cost payments between two parties with an internet connection. Also, like bitcoin, litecoin is an open source protocol that is maintained by a decentralized network of miners, nodes and developers. No company or central authority controls litecoin.

But, unlike bitcoin, litecoin facilitates faster transaction confirmation times and better storage efficiency, enabling its network to support higher transaction volumes.

Who created litecoin?

Litecoin was first announced in October 2011, two years after bitcoin’s software had been released. The founder of litecoin, Charlie Lee, is a former Google engineer and up until very recently was the CTO of the major US based bitcoin wallet service Coinbase. He is also the brother of Bobby Lee, the CEO of Chinese crypto exchange BTCC.

Charlie Lee created litecoin not to replace bitcoin, but rather to act as a complementary alternative. Charlie has stated that he believes “even with worldwide adoption of bitcoin, another alternative will be needed to aid in transactions to ensure they are both fast and low cost.”

How does litecoin work?

If you don’t understand how bitcoin works (the blockchain and mining) click here.

Litecoin has the same core principles of bitcoin and is built on blockchain technology. Fundamentally, the blockchain works the same way with both bitcoin and litecoin using the Proof of Work algorithm for mining.

More specifically, bitcoin mining uses the secure hash algorithm 256-bit (SHA 256). Hashing is required for the process of solving a cryptographic math problem or “block”. Gone are the days where an average CPU or GPU could mine bitcoin because the hash rates have increased so significantly that consumer level products can no longer compete.

Bitcoin mining currently requires enormous computational power and the industry uses application-specific integrated circuit (ASIC) chips, which are customized specifically for bitcoin mining, rather than general-purpose functions. ASIC chips are incredibly expensive, which has enabled a small group of bitcoin mining companies (mostly based in China), benefiting from economies of scale to have significant control over the bitcoin network.

Litecoin uses a different algorithm called Scrypt in combination with SHA 256. Scrypt favours large amounts of high-speed RAM, rather than raw processing power alone. Therefore, litecoin can still be mined with consumer-grade technology, such as custom PCs with multiple graphics cards which gives them faster memory.

What are the key differences between litecoin and bitcoin?

1. Speed

One of the most notable differences between the two is that litecoin has 4x faster block confirmations at 2.5 minutes per block compared to bitcoin’s 10 minutes. This means that litecoin is able to process more transactions, which is highly beneficial for usability. The faster transaction or block times also reduces the threat of cyber-attacks and double spending. Litecoin also has four times the supply of bitcoin, with a cap at 84 million litecoin in contrast to bitcoin’s 21 million.

2. Scalability

Litecoin does not suffer the same scaling problem of its older brother bitcoin. Bitcoin blocks are consistently full, which further slows down confirmation and transaction times. Litecoin blocks are not full and are currently not plagued by a scaling problem.

3. Community consensus

Litecoin and bitcoin are both open source protocols, developed and improved by their respective communities. Similar to bitcoin, any change to litecoin requires consensus among the community. However, bitcoin requires a 95% consensus compared to litecoin’s 75%, which means new innovations and ideas can be implemented more rapidly when compared to bitcoin. The failed Segwit2x proposal is a perfect example of the community refusing to agree on a how to develop bitcoin.

4. An active founder

Bitcoin has suffered from this lack of community consensus, through forking, predominantly because people have their own beliefs about what bitcoin should be and of what Satoshi Nakamoto envisioned for bitcoin. Having litecoin’s creator Charlie Lee known and actively involved has created cohesion among the community and ensured that litecoin has a guiding ideology and pragmatic future plan. Charlie Lee has been notoriously outspoken on twitter and even wrote a letter to the litecoin mining community influencing them to integrate Segregated Witness (SegWit).

5. Less spam

Bitcoin has suffered from several spam attacks, which slows transactions and causes frustration for users of the network. Spam transactions are transactions which create extra load on the blockchain network due to not following bitcoin’s best practices, either maliciously or out of ignorance. Litecoin avoids these spam transactions by charging a sender fee for every output. For instance, using bitcoin, someone could send 15 transactions with one fee, but when using litecoin each of the 15 transactions would have their own fee. This makes spam attacks costly and less likely, which helps keep the network scalable and running at optimal speed.

Why did Gatecoin decide to list Litecoin now?

During Charlie Lee’s time at Coinbase, litecoin primarily rode the coattails of bitcoin, developing and advancing alongside the major cryptocurrency. However, recently litecoin has veered in front of bitcoin in terms of development and has been working as a test network for bitcoin.

One such notable test is litecoin’s SegWit integration that fixes transaction malleability and facilitates long-term and secure scaling solutions. Litecoin has also successfully tested other innovative ideas such as atomic swaps and is focused on the future of cryptocurrencies.

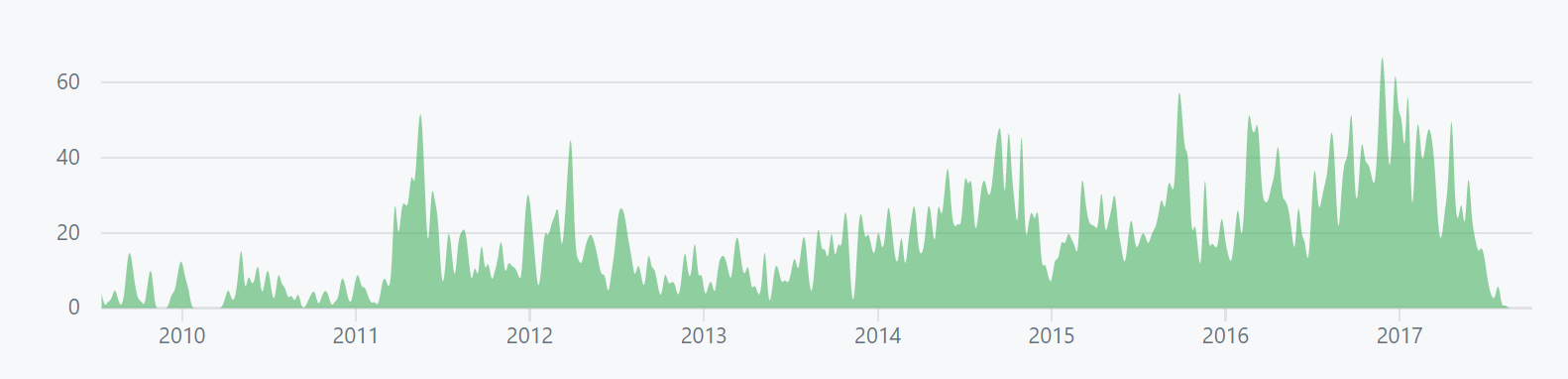

Litecoin has an active development community which is consistently working to improve the network. Click here to view the litecoin developers’ 2017 roadmap and see a list of the development team. Litecoin’s development community on github has made over 14,000 commits, which has seen a steady increase, especially in 2017. In comparison, the bitcoin core development group has made over 15,000 commits to the bitcoin github.

Investors may also see litecoin as a hedge against the potential volatility that will accompany any future bitcoin or ethereum forks.

Gatecoin is always looking to add more cryptocurrencies and tokens to our exchange. Litecoin has proven to be successful in the market and has gained a lot of popularity among traders and merchants.

What hardware wallet providers support Litecoin?

The safest place to keep your litecoin is on a hardware wallet, a device that enables you to store your private key offline. Gatecoin strongly recommends that you keep any crypto-asset funds in a hardware wallet. Litecoin is supported by a few hardware wallet providers such as:

Ledger Nano S: offers wide support for altcoins, including litecoin. The Nano S sells for around USD 65, making it one of the most affordable hardware wallets on the market.

TREZOR: This is one of the oldest hardware crypto wallet providers. Trezor also supports various altcoins, such as litecoin and is priced around USD 100.

KeepKey: a newer hardware wallet provider. It is slightly bigger than both TREZOR and Ledger hardware wallets due to its larger screen. The firm was acquired by Shapeshift in 2016 and its wallet also sells for around USD 100.

Hardware wallet best practices:

Find a hardware wallet that best suits you and your needs. Gatecoin is not liable for the performance of these hardware wallets.

Please conduct your own research and due diligence before making a purchase. Customer reviews can be an excellent source of information.

We suggest making test transactions with small amounts before conducting larger transactions to make sure the funds are successfully transferred to the wallet address.

While hardware wallets keep your keys safe offline, if you forget or misplace your pin or code then you can lose access to your cryptocurrencies and tokens. Therefore always remember your PIN code.

You should also write your backup seed key on a piece of paper and keep it safe. We recommend you make 2–3 copies of this key and keep all copies in separate safe places.

Where can I find out more about Litecoin?

- The source code for Litecoin Core and related projects are available on GitHub

- Litecoin Forums

- Litecoin Telegram

- Reddit Litecoin

- Search for Users on Twitter

- IRC FreeNode network channels #litecoin (for general users) and #litecoin-dev(for developers).

![Reltex Group Reviews: Explore business opportunities by Trading [reltexg.com]](https://comparic.com/wp-content/uploads/2023/12/image001-218x150.jpg)

![Mayrsson TG Reviews: Why Choose Crypto-Trading with Them? [mayrssontg.com]](https://comparic.com/wp-content/uploads/2023/12/image1-218x150.jpg)

![Bitogrand Opinion: Leveraging Trade Indices [bitogrand.com]](https://comparic.com/wp-content/uploads/2023/09/bitogrand-218x150.png)