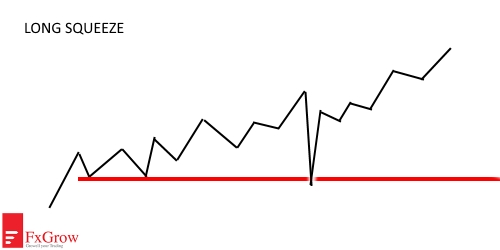

A LONG SQUEEZE occurs when a sudden drop in price of a single asset incites further selling. Investors protecting themselves against a rapid fall close long positions or sell shares.

A characteristic feature is a new, deep low which results from many traders exiting their positions. This sharp drop without a fundamental basis may be caused by an event, news or media rumour. After discounting this news, the lower price will be treated buy experienced traders as a but signal since fundamentally nothing has changed.

There are several ways to avoid this situation:

• Avoid illiquid markets, where a long squeeze can be very deep. Although recognizing a long squeeze quickly can mean you can sell and buy back at a lower level.

• Use a broader Stop Loss orders on liquid markets. This could mean a bigger loss but means that if you are fundamentally right you will be protected

• Fast reopen the position after orientation that the market return to uptrend.

On this chart, there is an example of a long squeeze on the DAX futures contract. The index moved in an upward trend for several days until there was a dynamic drop that exceeded the lows of the past 5 days. This chart is the M30, and the trap for the bulls lasted only from 1:30 PM until 4:30 PM (6 candles). After breaking a few support levels, index quickly returned to the upward trend and reached a new high.