Hi Everyone,

A terrorist attack in Paris last night makes the threat of outsiders very real for the people of France who will be going to the polls this Sunday to vote in an election that could have massive implications not just for France, but for the entire world.

The attack was clearly designed by ISIS to disrupt the elections but how will it sway voters?

-Mati

Election Highlights

- Timing is key

- Affected Markets

- Odds on Results

Please note: All data, figures & graphs are valid as of April 21st. All trading carries risk. Only risk capital you’re prepared to lose.

On the seventh day he rested

By law, starting at midnight tonight all candidates must stop campaigning and pollsters need to take a break. This will give the French people some much needed quiet time to sort things out before going to the polls on Sunday.

Most markets are closed for the weekend and will open late on Sunday evening. By the French clock, currency trading opens at 23:00 and commodities at midnight. For specific times on various markets, click here.

Traditionally, the results of the first round are televised in France at 20:00. However, this year the polls are closing a bit later. Voting in rural areas will close at 19:00 and in the big cities at 20:00.

That gives us a three-hour window from the time voting closes to the time the Forex markets open, which should be plenty of time to give us a pretty clear indication of the winner, especially if the outcome is clear. However, if it is a tight race we could be looking to get the final results only after the markets are open.

WARNING: As the initial results will certainly be known before the markets open it is likely that we will see some large gaps in the market depending on the outcome.

Which Markets will be Affected?

The market is currently pricing in the most likely outcome from the latest polls… A Le Pen Vs Macron runoff with France uniting behind Macron in the second round in order to block the extremist.

As we explained in this video, and as we saw clearly in both the Brexit Referendum and the Trump Election, the biggest market moves come when the unexpected thing happens.

So, if the above scenario happens we could get through this with fairly little panic and start focusing directly on the UK snap elections. However, any other outcome is likely to have a large impact.

For the purposes of simplicity, we can break down most assets into risk on and risk off, or in this case Pro-Europe or Anti-Europe.

Safe havens include Gold, Yen, Swiss Franc, and possibly the US Dollar.

Risk assets are Stock Indices (especially Fra40 and Ger30) and the Euro.

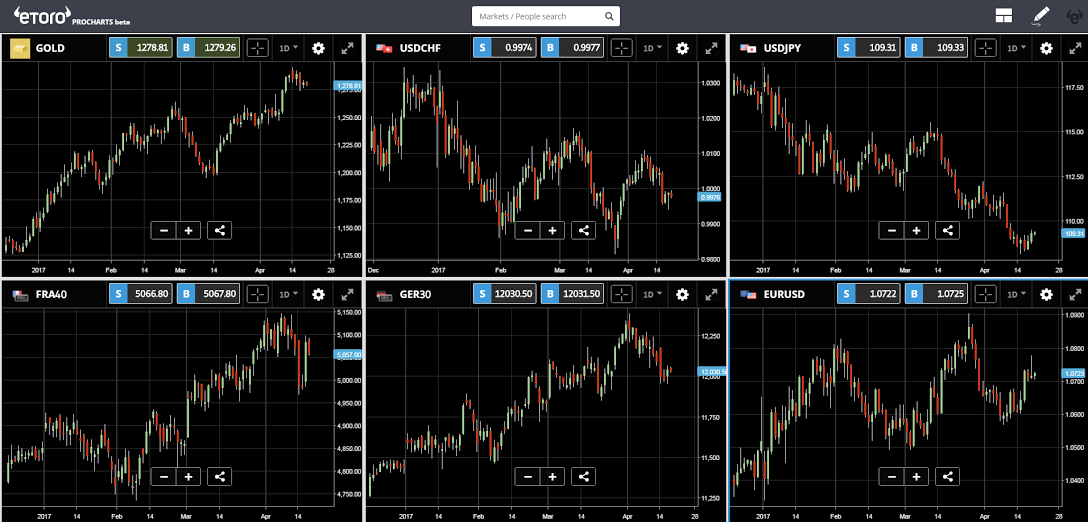

Using the new eToro ProCharts tool, we can see them all in a single glance.

Notice: how the risk assets on the bottom have been rising steadily over the past few weeks. European markets are clearly pricing in the above-outlined scenario with an eventual Macron win.

Yet, the global safe havens on the top have been gaining recently as well, which could be due to other geopolitical factors as well.

Clients in eToro have been short on all stock indexes over the past year. On the Ger30 we currently stand at about 75% short by volume.

For the EURUSD, it’s very interesting, as we have very large positions in both directions. At the moment, the shorts are slightly greater but that could certainly change by this evening.

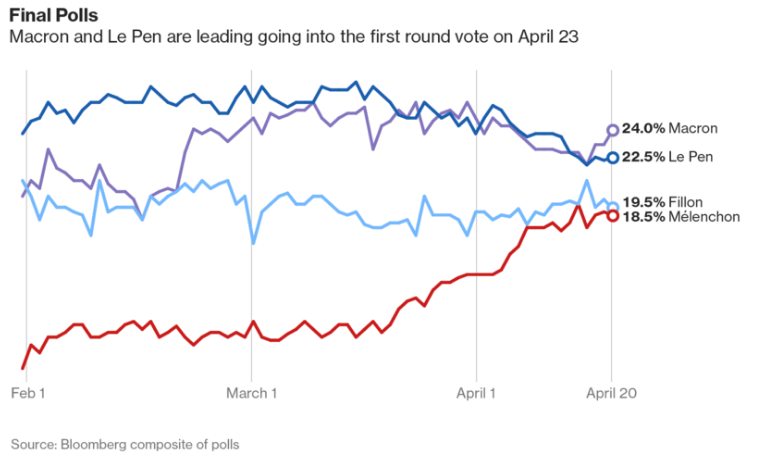

The latest polls

Here it is…

But really? Who cares about polls at this point? I want to know the odds.

Currently, there’s about a 5% spread between the frontrunner and the fourth place, that’s well within the margin of error. So let’s break it down statistically.

For the first round, there are six possible outcomes. So the probability of any outcome is about 16.6%. Here is how analysts are currently viewing each of the outcomes.

- Le Pen / Macron: Normal. This is what the market is expecting. We could see little or no movement. Possible move out of the safe haven assets.

- Le Pen / Fillion: Less than normal. Fillion is a weaker candidate than Macron and it will be harder for him to win against Le Pen.

- Le Pen / Melenchon: This is the big risk one and most likely to see wild swings. Both of these candidates are for leaving the EU.

- Macron / Fillion: The EU dodges a bullet. Most stable for the markets. Very good for risk assets.

- Macron / Melenchon: Should be an easy win for Macron.

- Fillion / Melenchon: This is the most unlikely scenario by the polls but nevertheless a possibility. Two weak candidates. Things could get a bit weird.

Huge disclaimer on this one. Analysts, myself included, don’t always get it right.

Remember how everyone was saying the stocks would fall if Trump won in the USA? Well, they did for the first few hours as the votes were being counted, but the subsequent days and weeks saw one of the biggest bull markets in history.

Always keep in mind the current direction of the market as sentiment can sway very quickly.

What’s next?

Whatever happens on Sunday, things over the next two weeks are likely to get very volatile as supporters of the nine candidates that don’t make it to the runoff will need to quickly reassess how and if they will vote in round two.

Any of the above scenarios that involve Le Pen or Melenchon winning the first round could cause further stress as people come to the same realization that Tom Hanks did in The Terminal…

If you don’t remember, here’s the clip: https://www.youtube.com/watch?v=ozCUzbewRRk

Wishing you an amazing weekend. Always feel free to contact me directly with any questions comments or feedback. @MatiGreenspan

Best regards,

Mati Greenspan

Senior Market Analyst

![Reltex Group Reviews: Explore business opportunities by Trading [reltexg.com]](https://comparic.com/wp-content/uploads/2023/12/image001-218x150.jpg)

![Mayrsson TG Reviews: Why Choose Crypto-Trading with Them? [mayrssontg.com]](https://comparic.com/wp-content/uploads/2023/12/image1-218x150.jpg)