After yesterday’s publication of the FOMC minutes US dollar falls – because markets expected a clearer guidance regarding the timing of another interest rate hike. Today, however, we face two officials of the Federal Reserve, which in case of any mentioning interest rates hikes can also affect USD.

After yesterday’s publication of the FOMC minutes US dollar falls – because markets expected a clearer guidance regarding the timing of another interest rate hike. Today, however, we face two officials of the Federal Reserve, which in case of any mentioning interest rates hikes can also affect USD.

Lockhart and Kaplan at the microphone

On Feb. 23 are provided two public speeches of presidents of regional branches of the Fed – first before 15:00 our time Dennis Lockhart will give a speech summarizing his ten-year career at the Fed chair commander in Atlanta (slowly preparing to retire).

Exactly at 19:00 his speech should begin Robert Kaplan of the Fed in Dallas – will be a guest of conference organized by the banking association Tarrant County, Texas. In the course of the speech, the audience will be able to ask questions, so surely some of them will concern future of interest rate hikes.

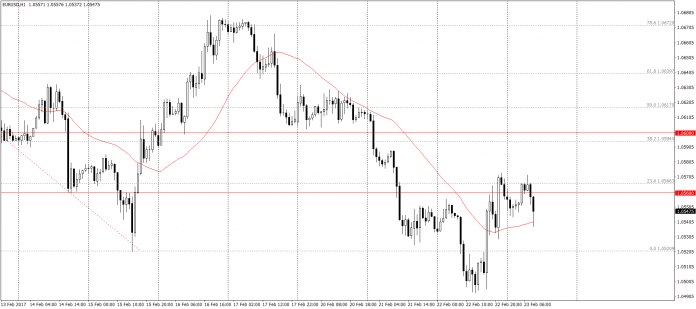

EUR/USD after yesterday’s FOMC finally tested the level of 1.0570, but quickly returned to the zone defined by resistance 1.0560 and the 23.6% Fibonacci retracement after testing this zone in the course of this morning:

4 interest rate hike in the next two years?

As stated at Wednesday BNPP updated its economic forecasts for the US and expects up to 7 interest rate hikes until December 2018. The projections of Barclays are much more cautious and bank predicts 4 increases – two in two consecutive years:

- Monetary policy will remain very tight fit to the fiscal policy and response to the changes

- Fiscal policy should provide a short-term increase in economic activity and inflation

- Trump may impose additional charges on Mexico and China, however, reducing the negative economic effects with strong tax cuts.

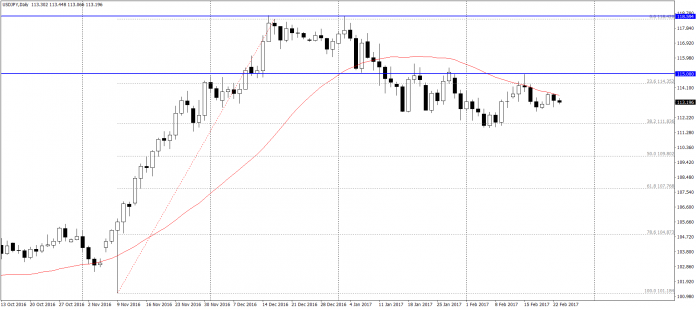

As a result, on the USD/JPY we should see appreciation in medium term. First, it is necessary to overcome resistance at a height of 115.00 (the February peaks), and then peaks at the turn of the year just below 118.60:

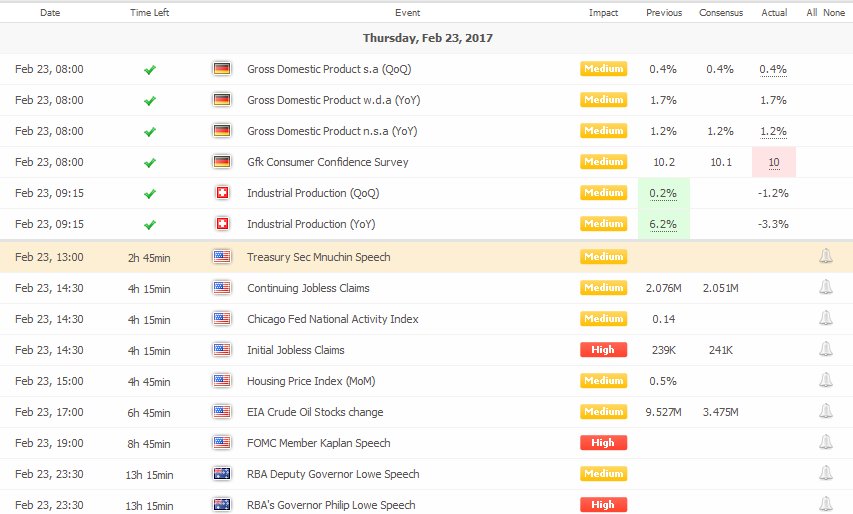

What to look for in today’s session? Calendar macro

About 08:00, the markets got to know another reading of German GDP for Q4 – which are in alignment with the expectations and fall out at 0.4% annualized q/q, but on an annual basis (y/o/y) growth rate did not meet analysts’ expectations (1.6% ) and then moves to 1,2%.

As we can see in the above calendar, today we should not expect excessive macroeconomic publications. In the morning we are interested only in Polish unemployment rate, then at 14:30 the standard scores of jobless Claims and finally crude oil inventories EIA 17:00.