The US currency does not give up and at the end of the week in the markets the dollar is strengthening to most of the major G10 currencies. What important happened in the last hours and what will rivet the attention of investors during the day today? About this below:

The US currency does not give up and at the end of the week in the markets the dollar is strengthening to most of the major G10 currencies. What important happened in the last hours and what will rivet the attention of investors during the day today? About this below:

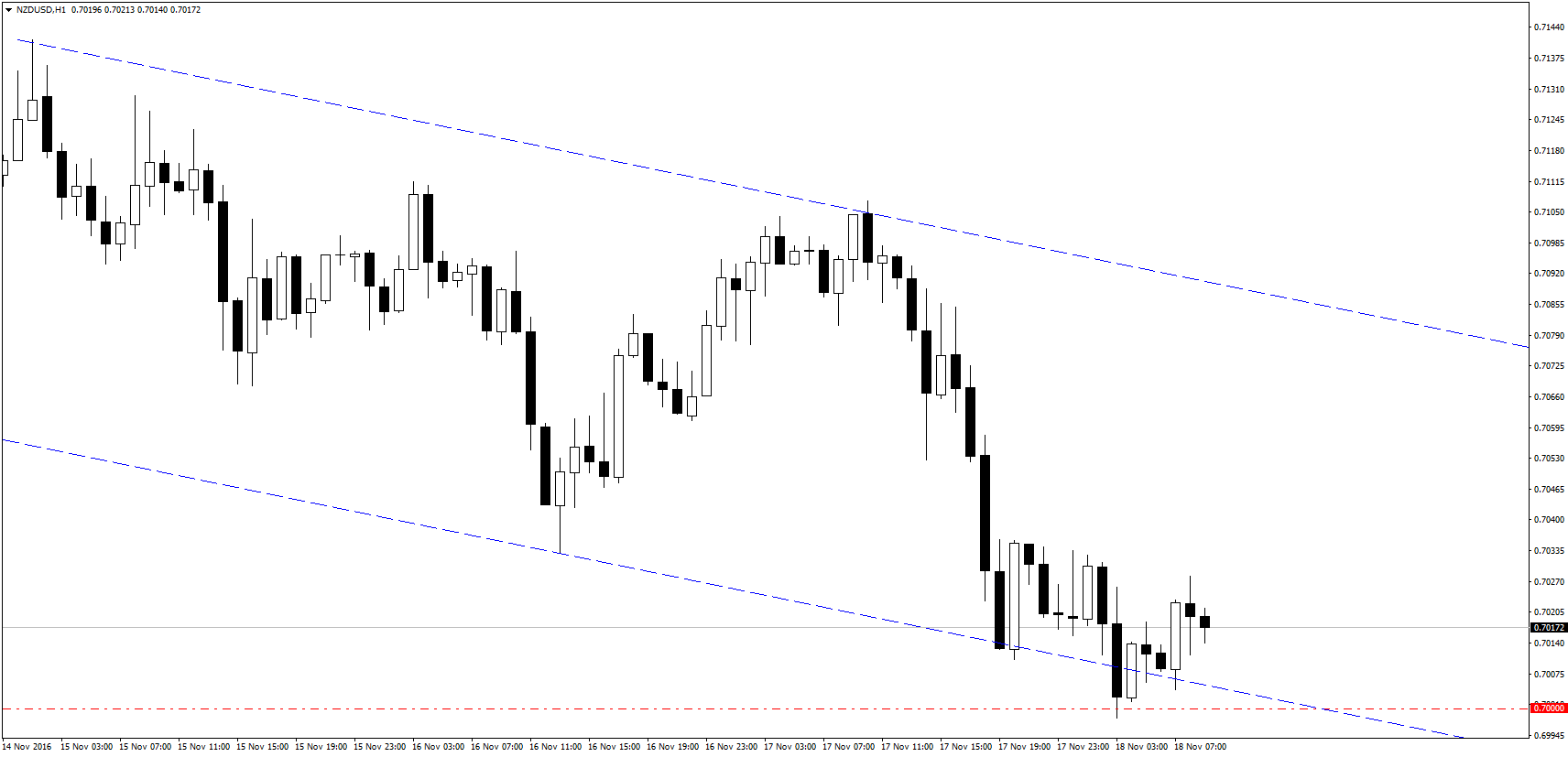

Noteworthy is fact the return of the Statistical Office of New Zealand to the publication of macroeconomic data. In recent days, this small island nation was hit first by earthquake and later with accompanying tsunami. Damages caused by the element are estimated at the moment at the amount of several billion NZD.

Published report on retail sales is not taking into account the inflation rate somewhat saves the image of NZD. Rate in line with expectations fell to 0.9% q/q – much slower than the published value in the last quarter (2.3%). After all NZD/USD still remains above the level of 0.7000:

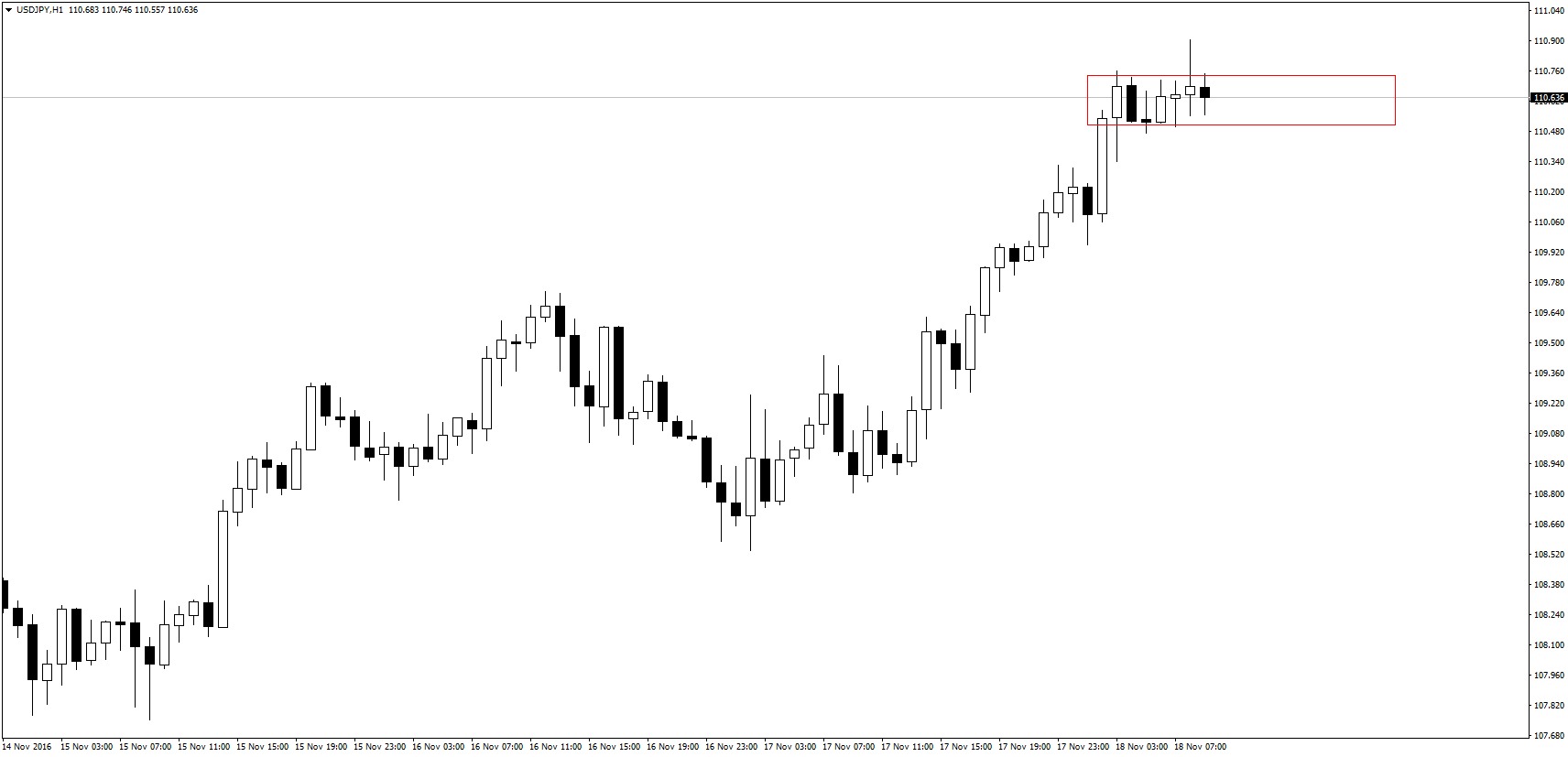

At night we heard the comment from Haruhiko Kuroda in relation to yesterday’s BoJ intervention on the Japanese bond market. The Governor of the Bank of Japan stated that the BoJ will continue to actively work on the stock market of safe bonds and warned against too high level of profitability of these. He recalled, however, that the BoJ is able to buy an unlimited number of assets, but also promised that the yield curve will be maintained at an appropriate level. USD/JPY couldn’t react differently than increases – the pair is now above the level of 110.50:

What are we waiting for?

There are few mportant points in today’s macroeconomic calendar. The first of these will be a morning speech Mario Draghi, which will begin at 9:30.

About 11:30 James Bullard, the head of the Fed in St. Louis will participate in a moderated discussion on monetary policy at the Frankfurt European Banking Congress.

About 14:30 we will track the data from Canada – for an afternoon is planned publication of the report of CPI for the month of October. The base CPI according to the latest estimates should not change (0.2%).

15:30 This is another point in the calendar dedicated to the occurrence of a member of the central bank. Then William Dudley, chief of the New York Fed will take part in a press conference on consumer expectations about inflation, the labor market and access to credit. The day will end in the markets with moderated question and answer session with the participation of head of the Fed in Dallas, Robert Kaplan.