The main event of Wednesday’s session was the minutes of the FOMC meeting. These did not indicated stronger market movements – but gave more light on what may FED decide in the future. We invite you to morning macroeconomic comment.

Rates should go up “relatively quickly”

Although FOMC minutes did not give a huge amount of guidance about FED movements we learned that at least some members considered “relatively rapid” rate hike. Between the members of the Commission also had place a lively discussion about the timing of rate increases – now we know that winning option is for sure different date than September.

Inside the document we have dovish lookout at the situation of the employment market – protocols pay attention to the slower dynamics of the unemployment rate and broader measures of assessing the situation in the labour market in the current year. This suggest that decisions about monetary policy tightening should be taken with caution.

Today’s data so far

Regarding the Wednesday’s session, we know readings related to the trade balance of China. Dynamics of export falls by 10% per year, while imports by less than 1.9% – the results were far worse than expected. European morning brought publications of the German CPI for September and the HICP index. Results are unchanged compared to the previous month and coincided with the forecasts (CPI YoYat 0.7%, CPI MoM to 0.1%).

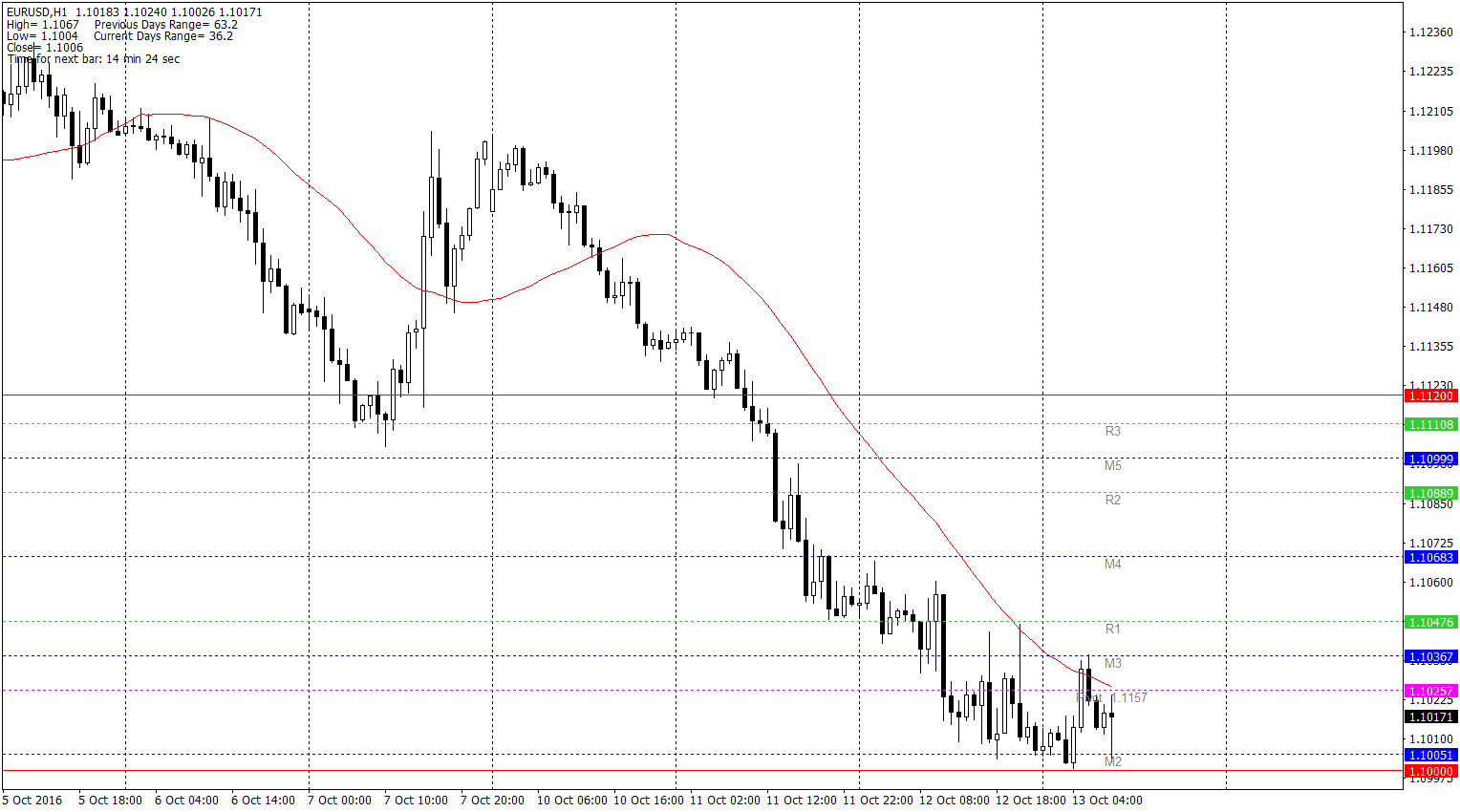

On the EURUSD chart without major changes – the price continues to move in a short distance from the level of 1.1000 – today coincides with the mid-Pivot M2, which can further support range trading:

What data to track in the afternoon?

In the afternoon macro calendar we find some interesting publications and speakers :

- 14:30 – Continuing Jobless Claims

- 16:00 – BOE’s Governor Carney speech

- 17:00 – changes in crude oil inventories

- 18:15 – presentation by a member of the FOMC Harker

Investors have a lot of questions about the changes in inventories of US crude. Last week again brought strong decline to almost 3 million barrels. Forecast in last month strongly differed from the actual publications – question if today will be alike?