About 13:30 markets will get informed what are the results of the US jobs report published by the Bureau of Labor Statistics (BLS). The report provides important data as unemployment, labour cost inflation and change in non-farm payrolls (NFP). Will the results positively surprise the markets and give the Fed reason to hike in December? Welcome to the morning market overview!

RBA monetary policy statement

About 01:30 our time Reserve Bank of Australia (RBA) published SoMP – a Statement on Monetary Policy, which appears quarterly. The most important headers can be found in the following paragraphs:

- RBA sees a real chance of achieving sustainable economic growth

- Stable inflation in the short term, should increase to 2% by the end of 2018 years

- The appreciation of the AUD may hinder the development of the economy

- Minor changes in forecasts of GDP and inflation

- RBA cuts growth forecasts for the labor market

- “Underemployment” on high levels are responsible for this situation – the phenomenon could be defined as making part-time work involuntarily, in the face of the impossibility of finding a full-size work

- Short-term economic risk related to the situation in China begins to fade

- Higher prices in the commodity market adversely affect global inflation

The document has not found too many changes, forecasts were only slightly adjusted. Analysts at Westpac in theirs commentary SoMP claim that the RBA looks too pessimistic on the labor market – until 2018 expects a significant improvement of the current situation.

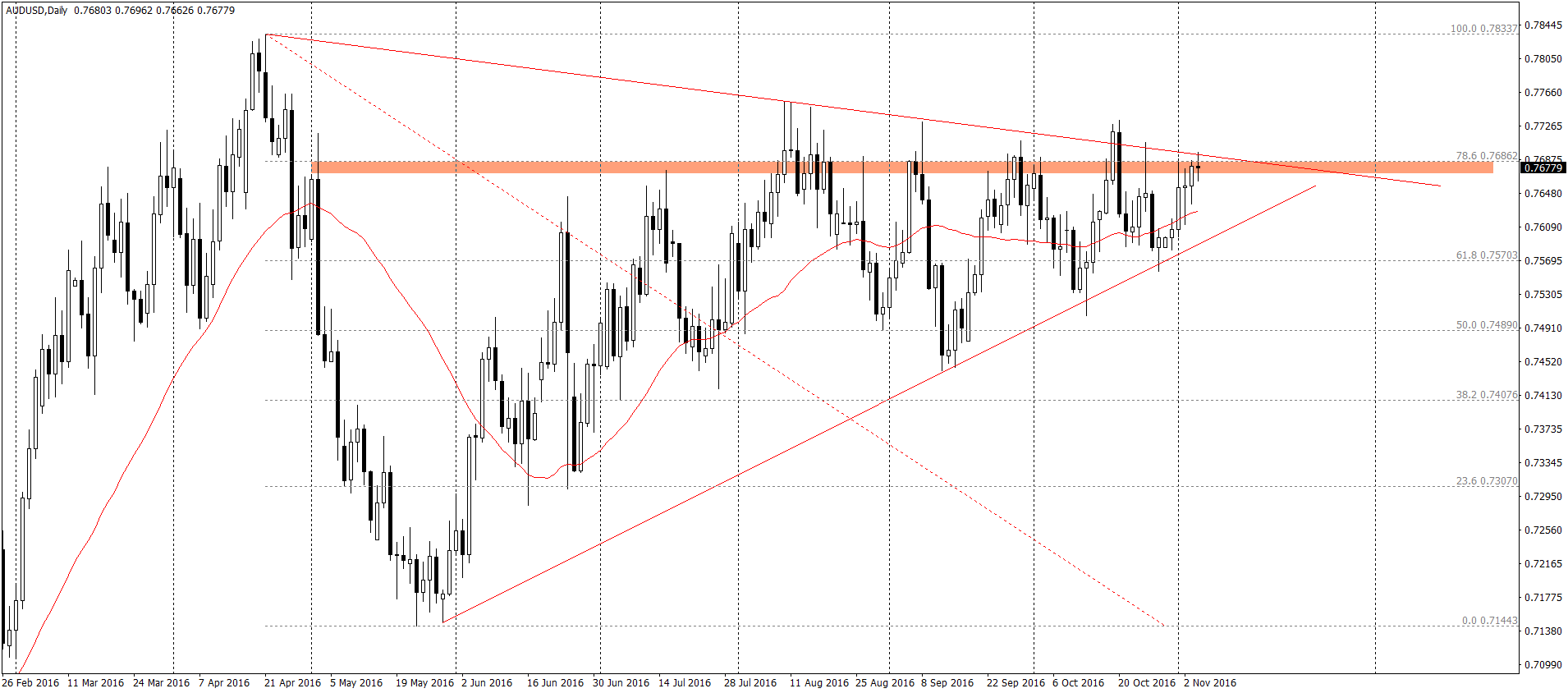

The report did not specifically cause strong movements on the AUD/USD – as it did not present any new information, it seems to be fully understood:

Friday calendar macro – NFP- the icing on the cake!

In the morning, the markets will learn a few minor publications from the Euro zone on the Markit PMI service and Producer Price Index. “Fun and excitement” will begin at 13:30 when both Canada and the US will share their reports from the labor market:

10:00 – Markit PMI services for EuroZone

11:00 – PPI for EuroZone

13:30 – US jobs report and NFP

13:30 – Report from the Canadian labor market

15:00 – according to the Canadian Ivey PMI

Due to the one week difference in the time changing from summer to standard between Europe and the USA, this week’s readings from USA are popping up an hour earlier (we wrote about recently). However, the situation will return to normal next week.

Forecasts Goldman Sachs before NFP

According to analysts from GS, the value of NFP in October will increase by 185,000 jobs, the unemployment rate will return to the level of 4.9%, and the growth of hourly earnings compared to September improve by 0.3%.

Compared to the consensus resulting from the Bloomberg survey results are very similar. Bloomberg, however, provide a projection of NFP in the amount of 173,000 (it is worth recalling that in September non-farm payrolls were at the level of 156 thousand). Each reading above this value should be received positively by the markets.

Follow the results of NFP with the Markets Live portal Comparic.pl!

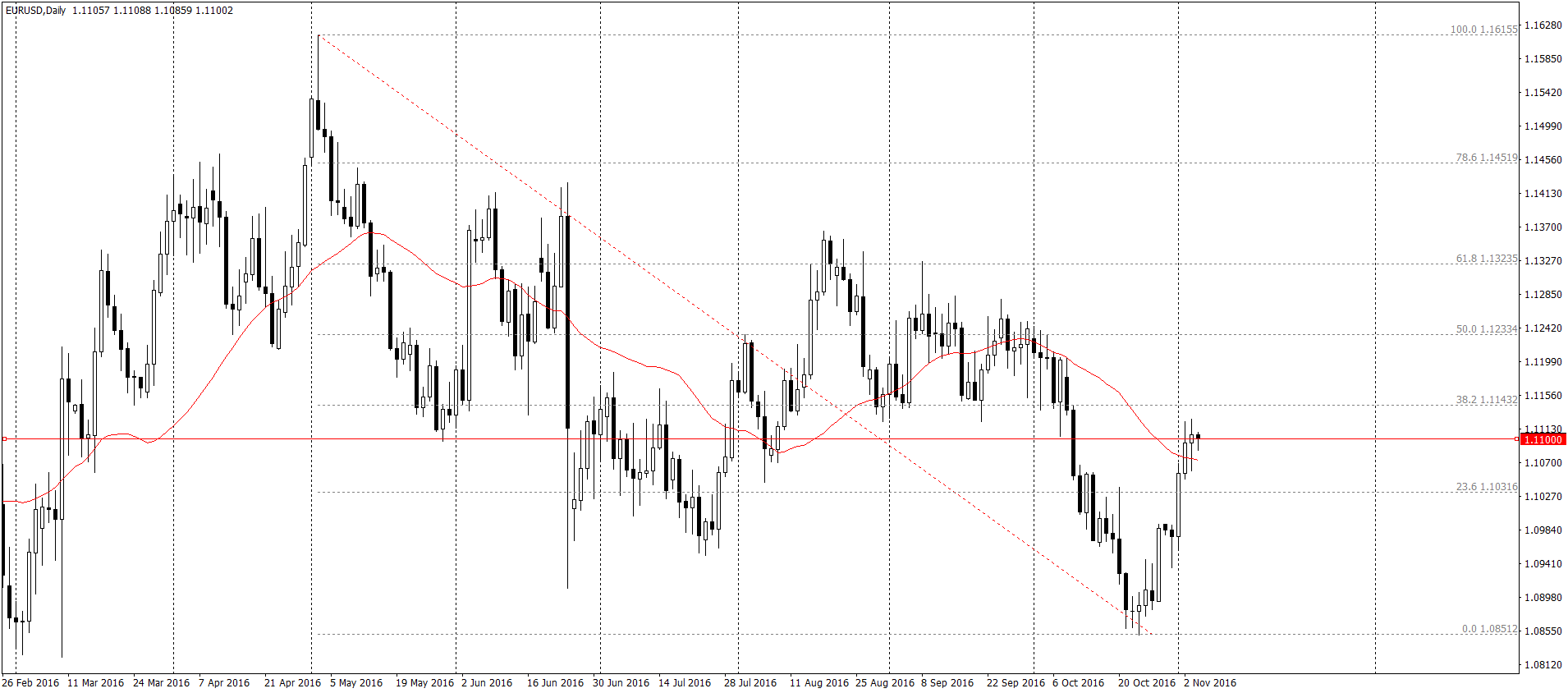

In the morning on EuroDollar we do not see more dynamic movements, price corrects increases from this week working on the height level of 1.1100. Additional volatility caused by the NFP should help you determine if the level becomes the new support or will act as a resistance :

: