I think everyone is already counting days to the upcoming Christmas. Despite fact that the trading week has begun for good, there is a lack of planned publication of macroeconomic data. In the first part of today’s review – as usual – we will discuss the most important events of past hours, while the second will identify the key events of today worth noting.

I think everyone is already counting days to the upcoming Christmas. Despite fact that the trading week has begun for good, there is a lack of planned publication of macroeconomic data. In the first part of today’s review – as usual – we will discuss the most important events of past hours, while the second will identify the key events of today worth noting.

Yesterday late evening was particularly important for oil investors. In the evening API published its latest calculations of changes in the level of oil stocks in United States. This time weekly publication surprised market reporting an unexpected decline in stocks. Nobody expected decline to as much as 4.15 million barrels (forecasted was decline of only 2.5 million), and the fact that it was the fourth consecutive report talking about inventory declines further strengthened the tone of the publication.

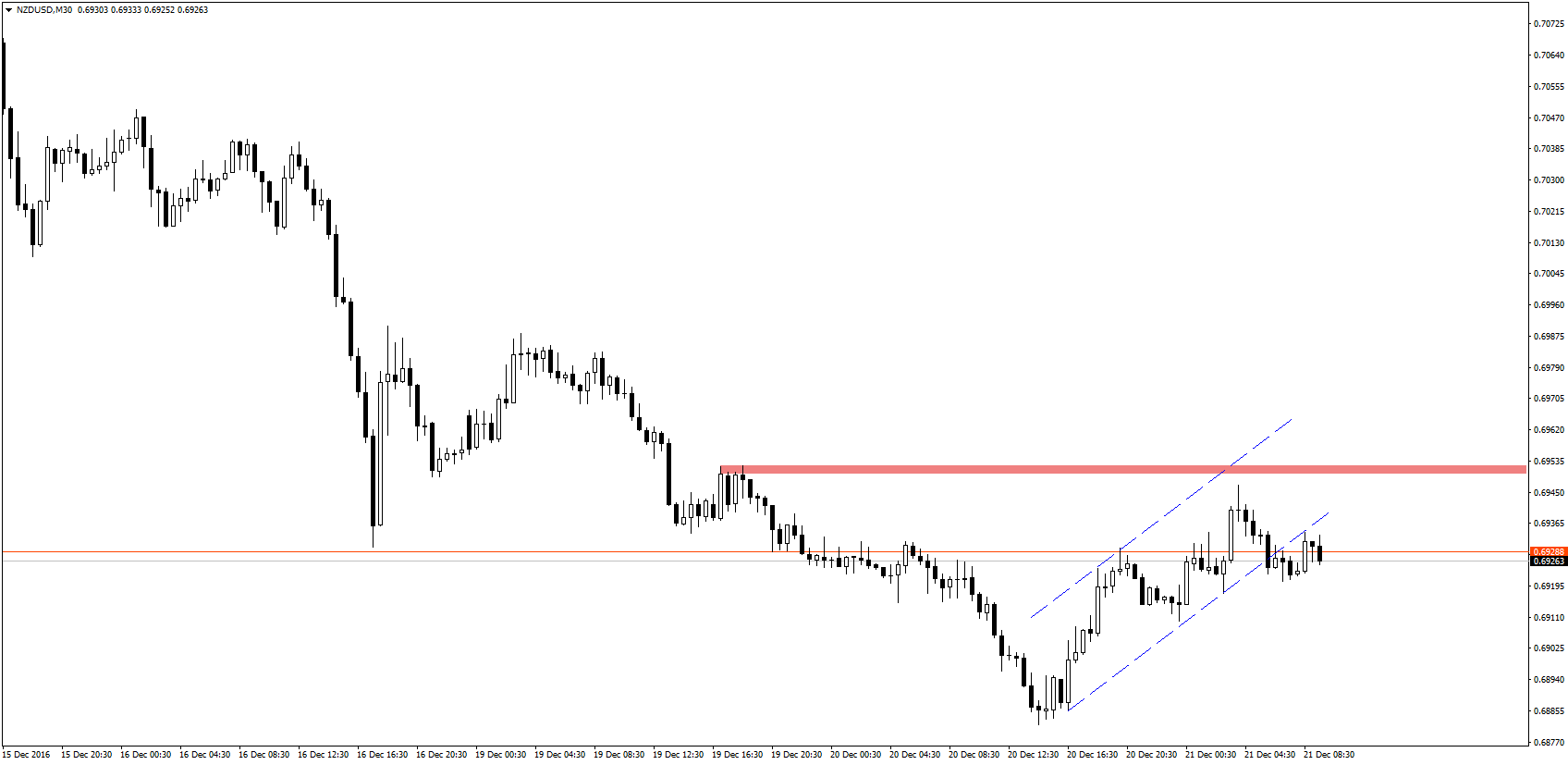

Interesting also proved to be data from New Zealand. Unfortunately, in case of balance of trade, investing in the NZD were disappointed when November amounted to -705 million instead of the projected NZD -500 million. This is still a better result than the previous (-864 million). However the NZD/USD during the Asian session was slowly growing but didn’t reach resistance zone in the region of 0.6950. Pair apparently defeated the selected growth channel and breaking the last low would mean return to the downward trend:

What else in the calendar?

Before noon there is a lack of important macroeconomic data. About 9:30 we will know the recent monetary decision of the Swedish Riksbank. Exactly an hour later, we will keep track on publications on the size of loans to the public sector.

The main point of the day will be scheduled for hour 16:00 publication of the American report on of existing home sales. On a monthly basis, the forecast is a slight decrease in percentage of sales volume.

Half an hour later, we will watch oil market and scheduled for 16:30 US EIA weekly publication. Again, this time officially will be announced size of US inventories of this raw material.

Important data are scheduled for late evening. Fifteen minutes before 23:00 we will know the latest and final calculation of changes in GDP on a quarterly and annual basis. Forecasts indicate a slight improvement (in annual terms).