Not sure if you heard yet but apparently the world’s greatest toy store may soon be closed for business.

Toys R Us is a privately held company so they don’t have any stocks. However, they have borrowed money from time to time and now hold about $400 Million worth of outstanding corporate bonds. Those bonds are now crashing as the bid has apparently gone from $97 to $22 in just two and a half weeks.

Looks like Geoffery Girrafe and all of the Toys R Us kids just got Amazoned.

@MatiGreenspan

eToro, Senior Market Analyst

Today’s Highlights

- In The Game (Cont)

- UN Assembly Today

- The Only Thing That Matters

Please note: All data, figures & graphs are valid as of September 19th. All trading carries risk. Only risk capital you can afford to lose.

In the Game

Not only are people finding it easier, cheaper, and quieter (no crying kids) to shop at Amazon these days, it seems that advances in technology may be playing a big role in this game as well.

The Lego company has also been going through a period of reduced sales and has recently been forced to take evasive action by firing about 1,400 employees.

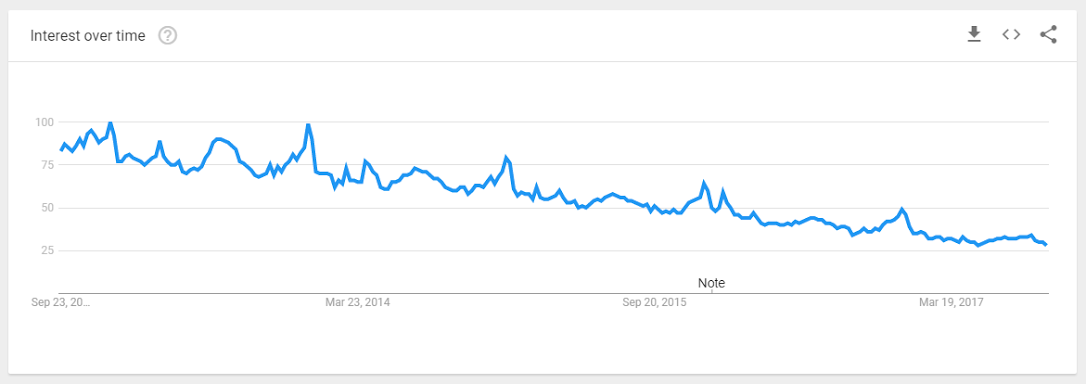

In this world of smartphones and LCD screens, even Barbie is having trouble competing for popularity. This graph from Google Trends shows searches for Mattel’s favorite blond over the past 5 years.

Not that kids are playing less. On the contrary, they’re playing more. They’ve just discovered different types of games. Games that are more interactive and more exciting.

The Video Gaming industry has morphed from $9.5 Billion in 2007 to a monstrous estimated $108 Billion in 2017.

The @InTheGame CopyFund that we set up in mid-2016 has shown our clients a gain of 54% in the past 12 months making it one of the strongest holdings at eToro in this level of risk.

Today we’ll be holding a one of a kind webinar to showcase the gamer’s favorite CopyFund as well as some of our other best performing assets. Feel free to join our very own Matthew Newton at 4:00 PM London time.

Register Now at —> https://etoro.tw/2fgy4tr

Market Overview

Another hurricane is currently battering the Caribbean islands. Catagory 5 Hurricane Maria has just ripped through the Island of Dominica. Hurricane Jose on the other hand will most likely remain seabound and aside from a few floods in Long Island will probably do little damage.

Today the markets are focused on a different type of storm, one that is expected at the United Nations as President Donald Trump delivers his first address to the general assembly.

Trump is expected to lobby his international counterparts to create a joint force against North Korea and Iran. After months of being president and an entire election campaign that revolved around these two nations not getting nuclear weapons, Trump is eager to show that he is not playing games.

Also, at the meeting will be both Theresa May and her wayward party member Boris Johnson, who will be meeting today for the first time since their recent spat created national headlines.

May will also be eager to show Great Britain that she is in control.

Just Fun & Games

Of course, the geopolitical games mentioned above are only just a bit of dramatic roleplay for our benefit. While it’s important to keep track of the players, their words are not having much impact on the markets lately.

Through all the fuss between the Prime Minister of England and her Secretary of State, even at this critical late hour of Brexit Negotiations, the British Pound is surging to new highs.

Why?

Those of you who have been paying attention to my daily updates surely know. 🙂

Politicians, investors, and even major financial institutions no longer control the “free market.”

These days, the markets are controlled by the central banks. The Bank of England signaled last Thursday that they are likely to raise their interest rates within the next few months and the Pound Sterling has been flying ever since.

Tomorrow, we’ll hear from the Federal Reserve Bank in the United States, the single biggest player in the financial markets of this decade and possibly the biggest player in any financial market in the history of the world.

The US Dollar has lost more than 10% of its value against other major currencies since the beginning of the year and has lost 400% of its value against Bitcoin in the same timeframe.

On the one hand, the weak US Dollar is part of Donald Trump’s strategy to make America great again. On the other hand, the value has fallen so much lately that it threatens to undermine the stability of the global economy.

Fed Chair Janet Yellen is going to need to walk a very fine line tomorrow if she wants to be renominated in February. However, some unique players know when to sacrifice their role for the good of the team. Is Yellen one of them?

![Reltex Group Reviews: Explore business opportunities by Trading [reltexg.com]](https://comparic.com/wp-content/uploads/2023/12/image001-218x150.jpg)

![Mayrsson TG Reviews: Why Choose Crypto-Trading with Them? [mayrssontg.com]](https://comparic.com/wp-content/uploads/2023/12/image1-218x150.jpg)

![Bitogrand Opinion: Leveraging Trade Indices [bitogrand.com]](https://comparic.com/wp-content/uploads/2023/09/bitogrand-218x150.png)