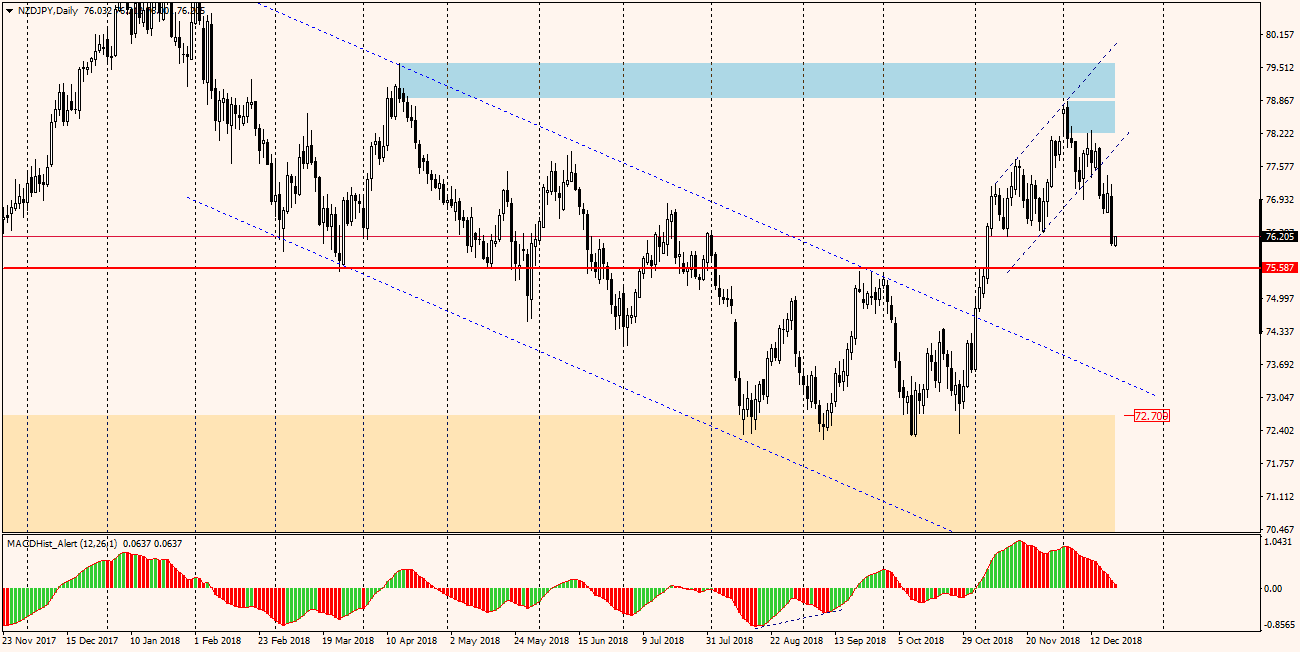

NZDJPY – from the beginning of the year, for 10 months, the pair moved in the downward channel. At the beginning of November, the quotations dynamically overcome the resistance of the channel and continued to move north until 78.90, where the resistance created in mid-April this year is located.

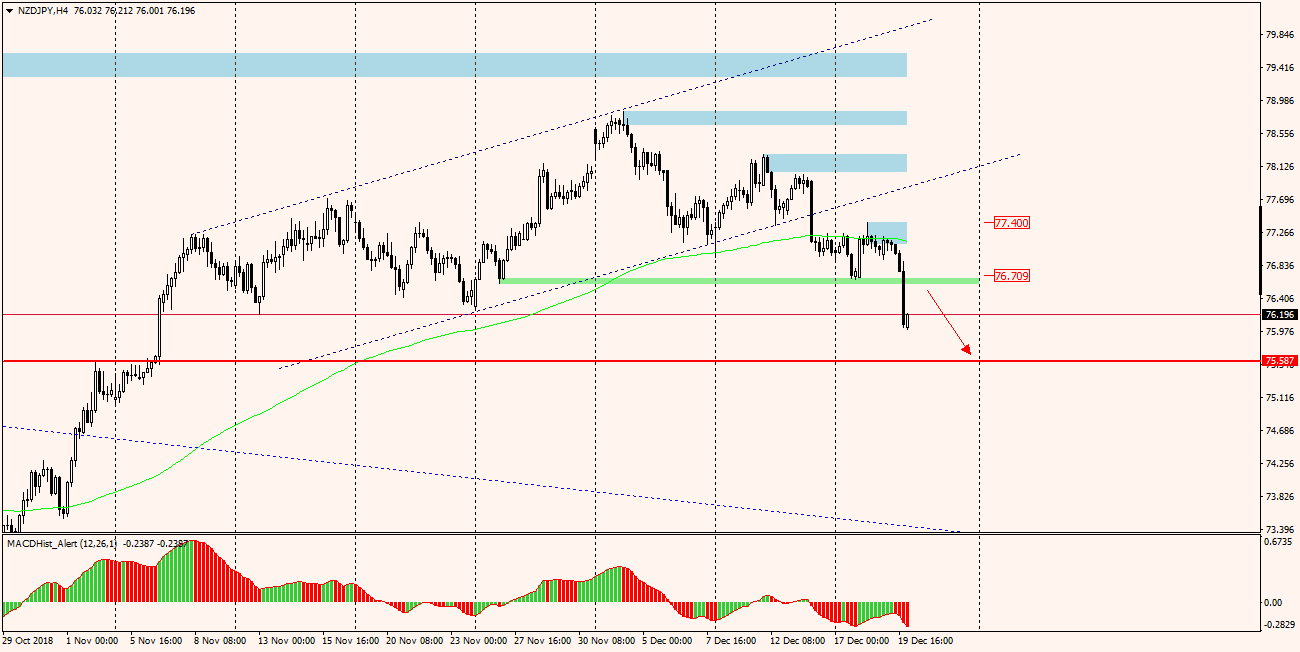

Today, FED has raised interest rates to 2.5%, resulting in further falls on Wall Street. Usually, the falls on the stock exchange strengthen the Japanese Yen. Additionally, New Zealand data announced overnight indicates a decline in GDP from 2.8 to 2.6% per annum, which is unfavourable for the national currency.

The current macroeconomic situation indicates that falls in the NZDJPY pair may continue, especially as they are supported by the ongoing bearish divergence on D1.

The nearest resistance level of 75.60 may be the sellers’ target. It is currently at a distance of 50 pips, which gives a weak Risk/Reward < 1 because SL would have to be above 76.70 which is more than the potential profit.

When planning a Sell order, it is probably worth waiting for a possible upward correction in the direction of the green zone and only in its vicinity to look for opportunities to enter the market. It should also be borne in mind that the Christmas period is approaching and the market is moving at a slow pace during this period, which may affect the sluggish implementation of this scenario.