Pivotal mood change

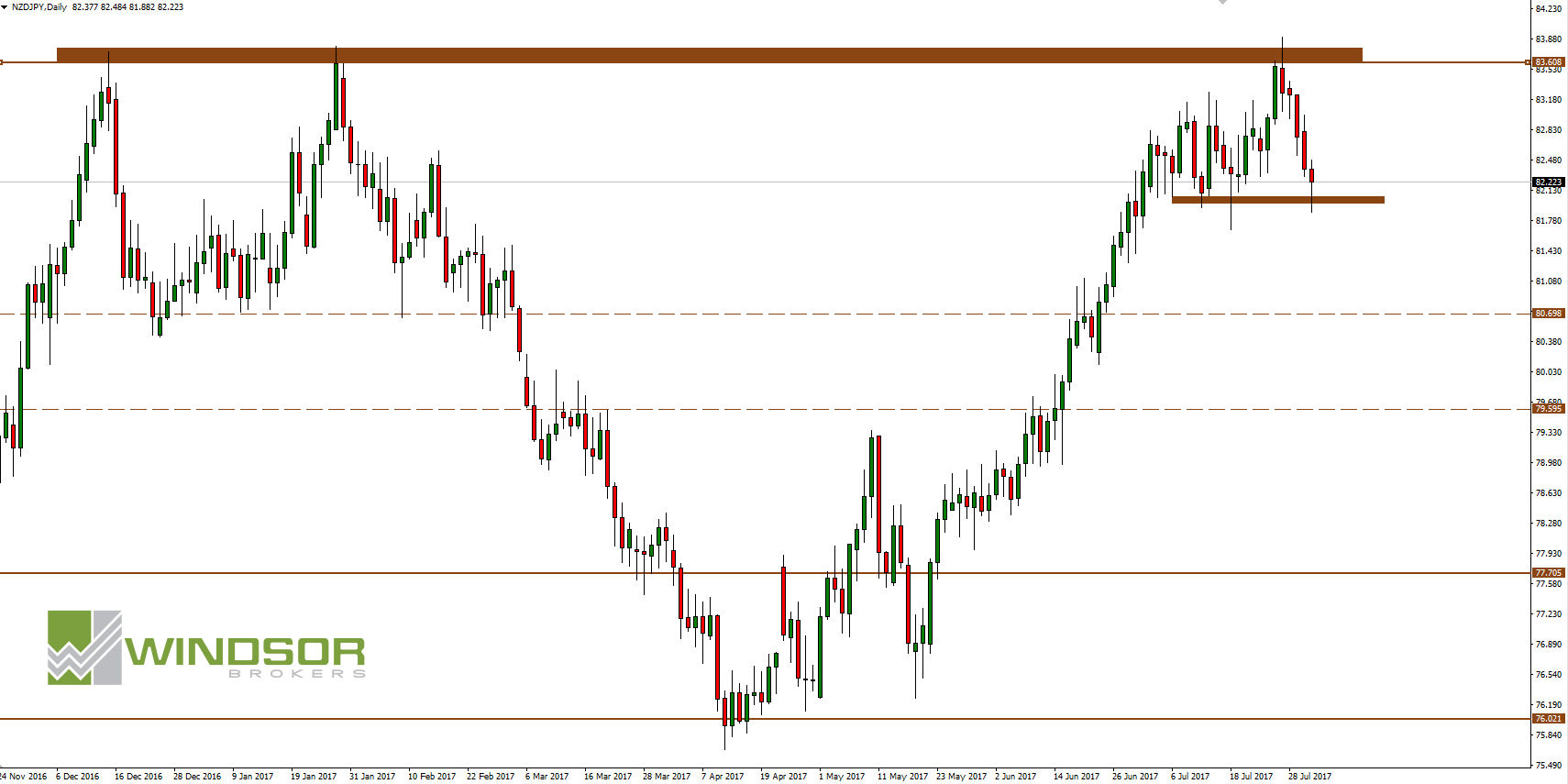

Last week NZDJPY reached highest level since June 2015 but in this week sentiment completely changed. Demand once again failed to break resistance at 83.60. As a result, probably today on D1 graph will appear fifth consecutive bearish candle.

So far, bulls managed to defend local support at 82.00. As long as this level is defended, we can expect another attempt to set new high at any time. However, if supply is going to win and area 82.00 will be broken then further targets for declines are at levels: 80.70, 79.60, 77.70, and finally the 9-month minimum at 76.00.

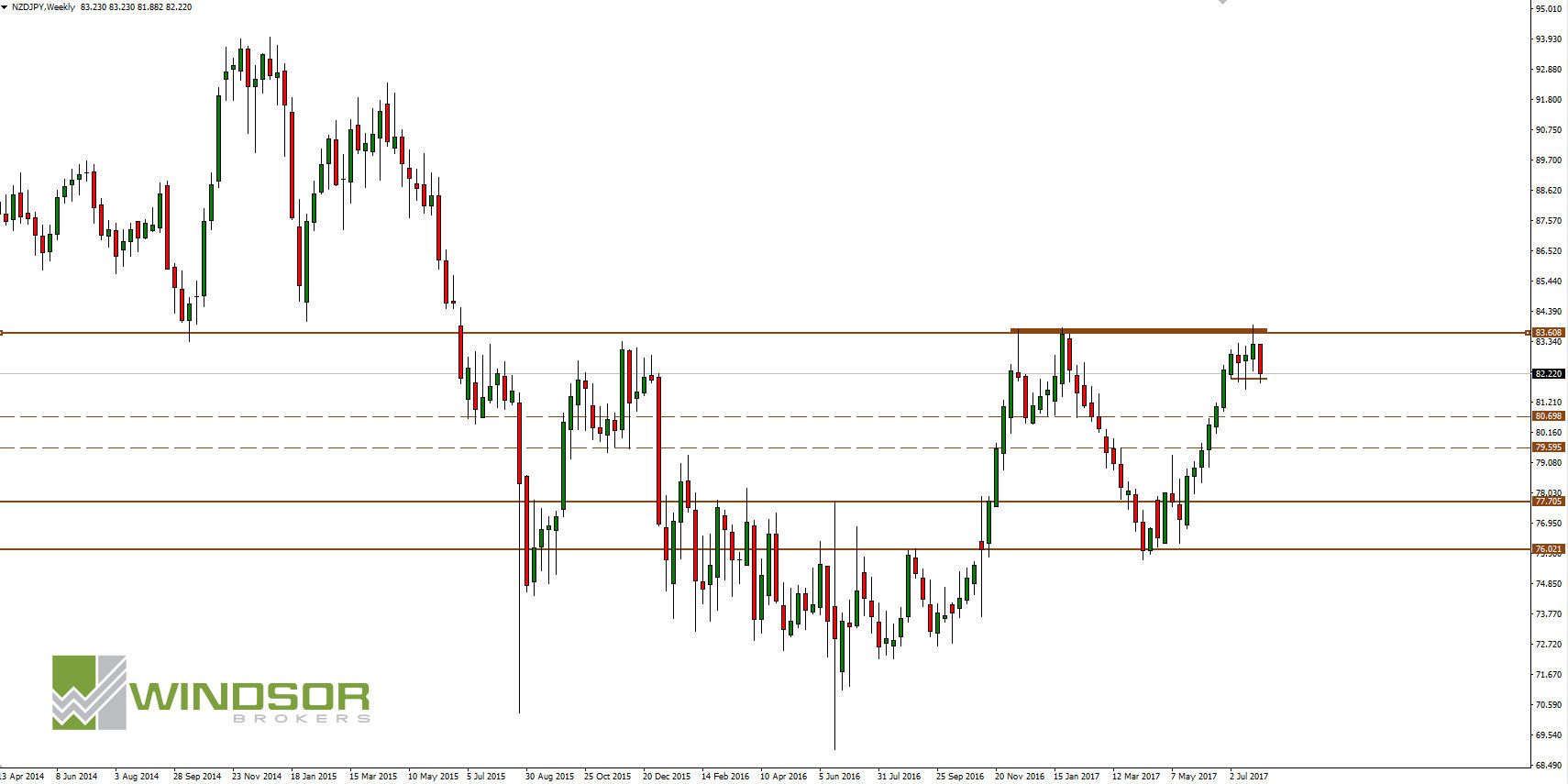

Key resistance for NZDJPY – 83.60

How important is level 83.60 you can see on weekly chart below. If demand can beat it, it will mean that NZDJPY will be on a 26-month maximum. Breaking this key level will let the pair continue growth in medium term where target may be even at 91.60.

Currently it seems more likely that pair will decline from 83.60 and move towards 76.00. So it is worthwhile to observe price behavior in the area of 82.00 – 83.60 at this moment. Breaking one of these levels will be a significant signal that will indicate a further direction of movement.