Yesterday, the information about the agreement among the members of the U.S. Federal Reserve on the need of the further economy stimulation, which resulted in the dollar weakening had the greatest impact on the rates. Some of the pairs have reached key levels. However, this trend was not continued during the Asian session. Let’s start today’s Price Action setups review:

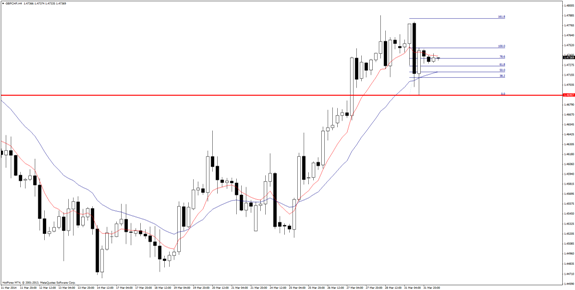

AUD/JPY:

Cross came to a key resistance, which breakout would mean reaching the highest levels since mid-2013. Despite the strong uptrend the downward correction is likely possible near the surroundings of last support at 94.00. Clear Price Action sell signal can be used to play south. But mostly, you should look for buy signals and follow recent, dynamic trend.

GBP/CHF:

Yesterday there was a support (previously resistance) test from the top. A clear demand candle may be treated as a signal one. It can be played in three different ways:

-Buying after breaking the maximum, stop loss below the minimum,

– Buying after breaking the maximum, stop loss below the 50% of candle’s abolition (better profit-to-risk ratio in the first case – where the likelihood of loss was greater),

– Buy Limit on the 50% of candle’s abolition, stop loss below the minimum. Better profit-to-risk ratio than in the first case and safer SL than in the second one. However, there is a risk, that there will not be a correction and we will be out of position, just observing trend development.

NZD/USD:

Currency pair is attacking the April’s 2013 maximum and since the four session it cannot break it permanently. On Friday, a sell signal was created, that regardless of the trading method would be opened. Currently, the price is in the vicinity of 50% candle’s abolition which allows to open short position – of course if you playing against the trend. Target of such position will be a support around 130 pips lower which with 15-18 pips SL gives really nice profit-to-risk ratio. But you have to remember about strong upward trend.

XAU/USD:

Gold falls very rapidly and is approaching the support at 1268.00. Any rebound or growth return should take place from that level.