Markets were waiting for information from FED and as expected the assets purchase was reduced by $10 billion. This resulted in a strengthening of the US dollar and interesting situation on many currency pair. I recall that yesterday’s conference was translated live for our polish-speaking users.

Let’s start with Price Action Setups for March 20:

CAD/JPY:

Canadian dollar to yen rebounded yesterday from the key support. Today, it again falls slightly, while a clear PA buy signal will allow to open long positions. It must be remembered however, that the trend here is downward.

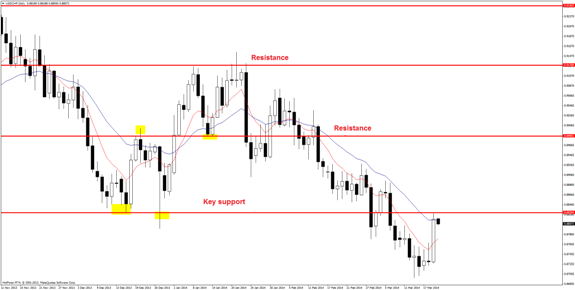

EUR/USD:

Eurodollar fell below key support at 1.38300, but currently it slightly break it. The situation is not clear and to confirm the direction we need a clear signal at this level. If now the price retracts giving a sell signal, the downward momentum will be still important and playing shorts will be the most reasonable. But if the resistance will be break and support will work giving a buy signal near the re-test from the top it will be a sign, that yesterday’s decline was a fake breakout and increases are still in force.

GBP/AUD:

Trend for the cross is downward – but yesterday the currency pair approached the local resistance. You can search here for PA sell signal on the lower TFs and open short positions.

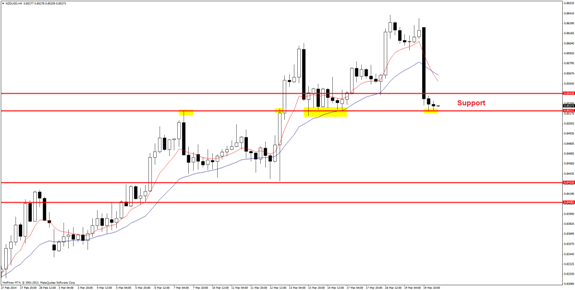

NZD/USD:

Currency pair broke yesterday one of the first supports and stopped on the second one – which is shown on the chart. The long-term trend is still upward, because a possible buy signal will be an opportunity to open longs. Breaking this level should result in a test of the next support – 90 pips lower.

USD/CHF:

USD to CHF also came to a key resistance. The currency pair is in an extremely dynamic downward trend, so it may be an opportunity to open short positions.

XAU/USD:

A clear trend change here. Key support was dynamically broke and now we should look for sell signals in its vicinity.