Markets do not give us many potential Price Action signals lastly. Part of them was also negated recently. But – as always – there is a possibility that something interesting will come up. Welcome in today’s PA setups preview. Our analytics team prepared four currency pairs for your – Cable, Kiwi Gold and NZD/JPY.

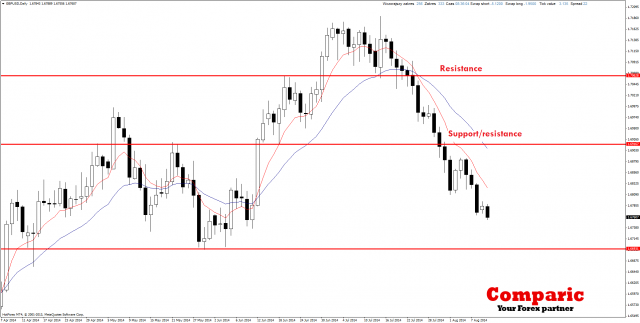

GBP/USD:

Cable still falling in the direction of key support. It will be a really important level, which may stop the price – due to the long term trend which is still clearly upward. It is worth to observe this level and look for PA signals.

NZD/JPY:

New Zealand dollar is weakening. If you do not remember – the sell off swing began after planned rate-hike announcement, which would be rather a strengthening signal for NZD. However, the statement about blocking further hikes disappointed investors. When it comes to the currency pair with Japanese yen on Friday we saw a clear support breakout and pin-bar on the D1. Currently, it was retraced in more than 50% and it may be occasion to open long positions following long term uptrend. However – current momentum is clearly downward, so we have to be careful.

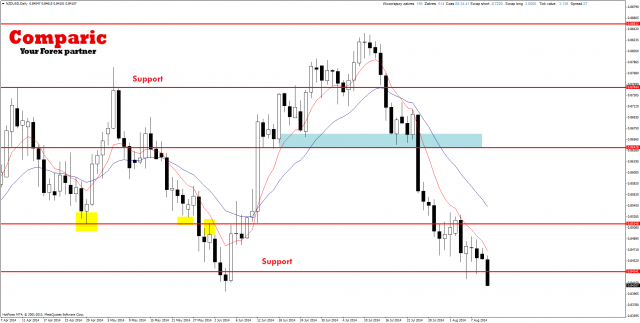

NZD/USD:

Kiwi negated buy signal from last Wednesday. It does not mean of course, that the downward movement will be continued – the last minimum from June was not pierced. If it happens, it will indicate a clear trend pullback and bearish appetite. Then we should seek short positions after support re-test from the bottom.

XAU/USD:

Gold try to defend the support level which can be clearly seen on the H4 chart. Yesterday pin-bar candle occurred, today we can also see active demand which in effect ended with long lower wick candle. It is worth to consider long positioning with small SL – a safe TP should be put on the last maximum, giving great R/R (6-7:1).